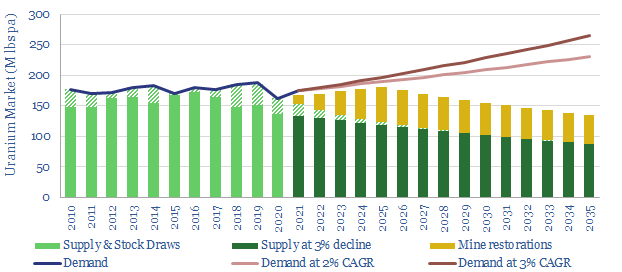

Uranium markets could be 50-75M lbs under-supplied by 2030. This deficit is deeper than other commodities in our roadmap to net zero. Demand is driven by China, constructing reactors for 50-70% less than the West, yielding zero carbon power at 6-8c/kWh. This 18-page note presents the outlook for nuclear in the energy transition and screens uranium miners.

An overview of the nuclear power industry is outlined on pages 2-5, in order to understand the market, its sub-components, and the energy-economics of nuclear power generation.

Capex costs have held back nuclear growth in the West, as heavy investments and devastating delays can kill IRRs and require 16c/kWh levelized costs (pages 6-7).

China is different, constructing new reactors for 50-70% less than the West, yielding passable economics at 6-8c/kwh, while generating clean baseload power (pages 8-9).

China drives our demand forecasts, underpinning 75% of future global demand on our ‘roadmap to net zero’, with stark upside as a diversification to under-supplied LNG markets, if China exports its technology and as new start-ups require inventory builds (pages 10-13).

Impacts on the uranium market are quantified on page 14. We are bridging to 50-75M lbs of under-supply by 2030, with risks skewed to the upside.

Uranium prices must re-inflate, from sub-$30/lb to $60-90/lb marginal costs (page 15).

Uranium miners are screened on pages 16-18, including profiles of ten public companies, from incumbents to early-stage developers. Rare Earth metals are a common by-product of uranium mining and also relevant to the energy transition.