‘Rumors of my death have been greatly exaggerated’. Mark Twain’s quote also applies to global oil consumption. This note aggregates demand data for 8 oil products and 120 countries over the COVID pandemic. We see 3.5Mbpd of pent-up demand ‘upside’, acting as a floor on medium-term oil prices.

We have compiled a database covering the entire global oil market, month by month, product by product, country by country, from 2017 through the end of 2021. We explain our database and some data quality issues on page 2.

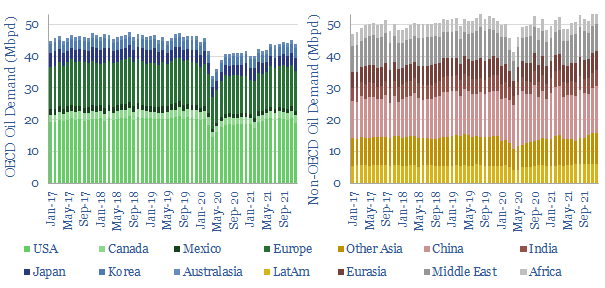

The COVID pandemic is quantified in oil market terms on page 3. Global oil demand fell -22Mbpd at trough in April-2020, -9Mbpd YoY in 2020 as a whole. The declines were about 2x steeper in OECD countries versus non-OECD countries. Although global oil demand had returned above 2019 levels in Nov-Dec 21, there is still 3.5Mbpd of pent up demand.

Jet fuel is the biggest source. This is pretty clear from the charts on page 4.

Low income countries are the second largest source. Again, this is clear from the charts on page 5.

The gasoline market is bifurcating. OECD consumers have not fully resumed travelling, while EM demand is now 1Mbpd above 2019 levels, per page 6.

Another c20Mbpd of other oil products have shown inexorable increases throughout COVID-times, per page 7.

Our conclusions for oil demand during COVID are outlined on pages 8-9. Pent-up demand suggests oil prices must rise to whatever level prevents the demand from coming back.

A final post-script shows that Russia cannot win the war in Ukraine. The analogy from COVID is that OECD countries could displace all Russian exports from the market 1.5x over, if the political will was there for behavioral changes c65% as extreme as during COVID.

To see our calculations for the long-run oil demand to 2050, please see our article here.