The DRI+EAF steel pathway already underpins 6% of global steel output, with 50% lower CO2 than blast furnaces. But could IRA incentives encourage another boom here? Blue hydrogen can reduce CO2 intensity to 75% below blast furnaces, and unlock 20% IRRs at $550-600/ton steel? This 13-page report explores the opportunity, and who benefits.

A blue process reduces the CO2 intensity of a value chain, usually by over 50%, often over 90%, by pairing it with some form of CCS (page 2).

Most famous are blue hydrogen and blue ammonia. Both currently seem to be booming in the US, following new incentives in the Inflation Reduction Act (IRA). And we think there are five factors underpinning these booms (page 3).

What about blue steel? This 13-page report argues that the same five factors exist for ‘blue steel’ as for blue hydrogen and blue ammonia. The goal of the report is not to assess all 80 different decarbonization pathways for all 500 different types of steel. But to zoom in on a particular pathway that looks particularly interesting to us in the 2020s (page 4).

Existing markets are one of our five factors. Global steel production has risen by 10x since 1950, to 2GTpa by 2022, and demand is still rising at 2.5% per year since 2012. 70% of steel is made in blast furnaces and basic oxygen furnaces, in a pathway that emits over 2 tons of CO2 per ton of finished steel (model here) (page 5).

Technological maturity is another factor. DRI+EAF is an alternate steel-making pathway, which already underpins 120MTpa of global steel production. This is 6% of the world’s steel output (which seems like a small amount, but for comparison, it represents about 5x more production than the world’s entire global supply of copper!) (page 6).

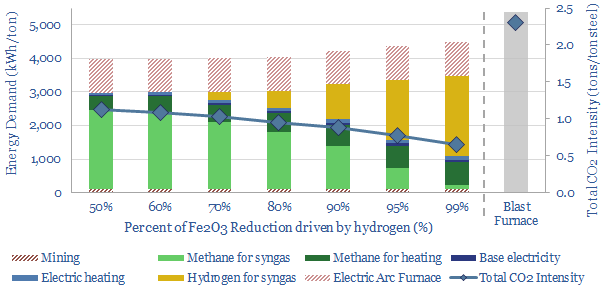

DRI+EAF steel. What are the costs and CO2 intensity factors? We have modeled the DRI pathway converting iron ore (Fe2O3) into direct reduced iron using a syngas of H2 and CO derived from natural gas. The DRI is then flowed through to an electric arc furnace (page 7).

Costs of DRI+EAF steel are competitive with blast furnace steel, but CO2 intensity is 50% lower. The drivers of the varying CO2 intensities are discussed on page 8.

Hydrogen blending. The reducing agents in DRI are mixtures of H2 and CO, formed by reforming natural gas. But the higher the share of hydrogen, the lower the CO2, and thus there is opportunity to add merchant hydrogen to DRIs. Existing DRIs might purchase 20-60kg/ton of merchant blue hydrogen to decarbonize steel (page 9).

Interesting economics? The most important part of the report looks at the economics of DRI+EAF facilities with very heavy levels of hydrogen blending, and thus very low CO2 intensities, around 75% below blast furnace steel. We think that sourcing $1/kg blue hydrogen as a reducing agent is already cost competitive (i.e., before subsidies). But IRA incentives, high energy prices in Europe, and ultimately border taxes uplift these IRRs to around 20% (pages 10-11).

Who benefits? Greater deployment of DRIs fed by blue hydrogen would also expand the market opportunity available to the usual suspects in hydrogen value chains. But we also see interesting wheels in motion in the steel industry. Five companies are discussed on pages 12-13.