Blue hydrogen value chains are gaining momentum. Especially in the US. So this 16-page note contrasts steam-methane reforming (SMR) versus autothermal reforming (ATR). Each of these different hydrogen reformers has different merits and challenges. ATR looks excellent for clean ammonia. While the IRA creates CCS upside for today’s SMR incumbents, across industrial gases, refining and chemicals.

Low carbon hydrogen from natural gas seems to be gaining momentum since the start of 2023. In particular, we have been impressed by the opportunities and momentum in blue ammonia, blue steel, methanol and other chemicals, as re-capped on pages 2-3.

The thermodynamic advantages of producing hydrogen from methane versus water are not well appreciated. If you start with 1 ton of water and 1 ton of methane, then inject the same energy to each one, you could harness 7x more hydrogen from the methane (page 4).

Steam methane reformers are the dominant source of today’s industrial hydrogen market. SMRs derive 75% of their hydrogen from steam, 25% from methane. The seven-step process — along with detailed mass and energy balances at each stage — are on pages 5-6.

Can CO2 be captured from steam methane reformers? 60% of the total CO2 from SMRs is readily captured. But the remainder is mostly from burning PSA tail gas in external fire tubes, and much harder to sequester (page 7).

Autothermal reformers are an emerging reactor design for clean hydrogen, deriving 55% of the hydrogen from methane, 45% from steam. The same seven steps occur in an ATR as in an SMR, but with importantly different gas mixes at each stage, concentrating c90% of the CO2 so that it can readily be captured, as explained on pages 8-9.

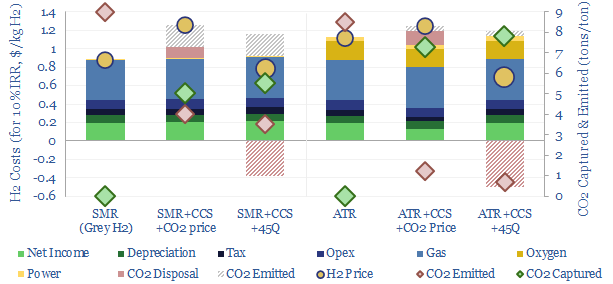

The costs of producing hydrogen are compared for SMRs and ATRs — including for different shades of grey hydrogen and blue hydrogen — on pages 10-11.

ATR has advantages and drawbacks, especially in particular chemicals processes, where oxygen feeds are more available. We think this will become a widely used reactor design for future clean hydrogen production. Please see page 12.

For incumbent SMRs, the US Inflation Reduction Act (IRA) is worded in a way that unlocks upside for industrial gas companies and refiners. We bridge to 20% IRRs for deploying CCS at existing SMRs (page 13).

Who benefits? The US’s 10MTpa hydrogen market is disaggregated here, facility by facility and operator by operator. Possible upside to free cash flow is discussed on page 14.

Leading companies in SMR and ATR reactor designs, including our conclusions from Topsøe’s ATR patents, plus six listed industrial gas and chemicals/engineering companies, are reviewed on pages 15-16.