We have assessed over 100 markets in energy, materials, manufacturing and decarbonization across our research. More concentrated industries achieve higher margins across the cycle. But not always. This 10-page report draws out seven rules of thumb around market concentration to help decision-makers.

The usual format of a TSE research note is to explore a particular topic that matters for the energy transition: How does it work? What does it cost? What supply-demand outlook? What are the key technology challenges? And who are the leading companies? This means we now have a library of almost 100 company screens.

What can we conclude about profitability and concentration, by reviewing these screens? We want to derive some conclusions to improve our future research, and help decision-makers appraise opportunities in the energy transition.

The concentration metrics that we find most helpful are the ‘top five market share’ and the ‘Herfindahl Hirschman Index’, which are explained on pages 2-3, including examples from our database, such as industrial gases and the recent consolidation in US E&P.

What is the typical concentration of industries across energy, metals, materials, semiconductors and capital goods sectors? The Herfindahl Hirschman Index and top five market share are on page 4.

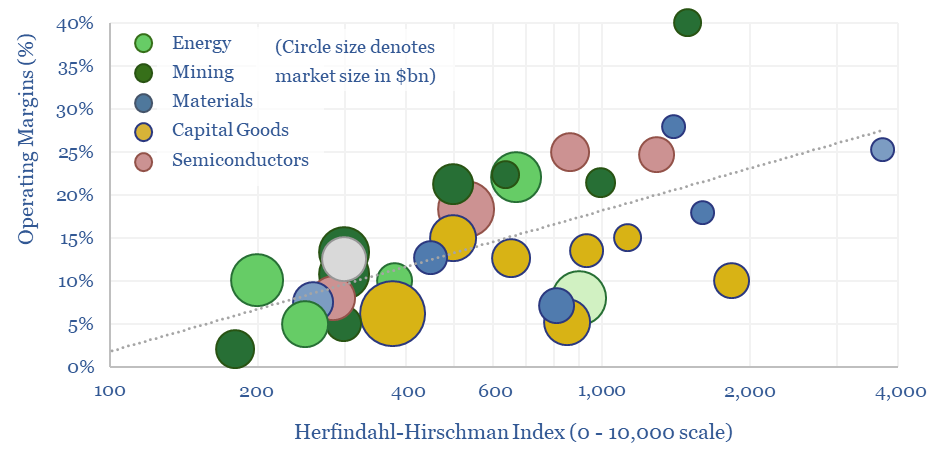

Do more concentrated industries generate higher margins? The answer appears to be ‘yes’, across the board, with a correlation coefficient of 50%. From this, we can also predict likely operating margins from market concentration metrics, per page 5.

But not always. 75% of the variance in different industries’ margins is explained by industry conditions and across the market cycle. This underscored the opportunity for active managers in the energy transition. We look at why lithium miners will tend to over-earn and wind turbine manufacturers will tend to under-earn (pages 6-8).

There is value in niches. Smaller markets are inherently less concentrated and higher margin. Sometimes we get feedback from our readers asking why we look at so many ‘niche industries’. This is the reason. Indeed, the epitome of a potentially low-competition and high-margin niche is in breakthrough technologies (page 9).

Mean reversion? Some industries have recently generated higher or lower margins than might be expected from their concentration. Hence which industries stand out as potentially ‘reverting to the trend line’ and what opportunities for decision-makers? (page 10).

This turned out to be one of our favorite research notes of 2023, and we think it adds useful context for investors in public markets, private equity and VC; across energy, materials, capital goods and emerging clean-tech.