Could renewables increase hydrocarbon realizations? Or possibly even double the value in flexible LNG portfolios? Our reasoning includes rising regional arbitrages, and growing volatility amidst lognormal price distributions (i.e., prices deviate more to the upside than the downside). This 14-page note explores the upside for energy trading in the energy transition. What implications and who benefits?

Global energy markets are growing increasingly volatile, as argued in our January-2024 quantification of energy market volatility. Key reasons are the volatility of wind and solar, which are gaining share in the global energy system, as re-capped on pages 2-3.

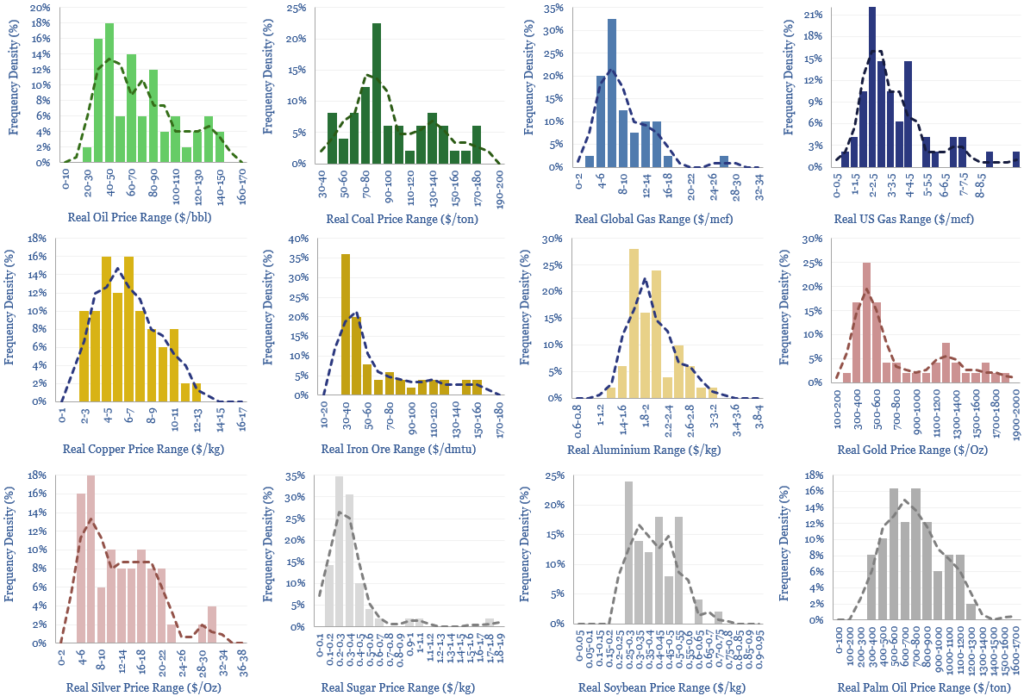

In order to assess commodity price volatility, we have tabulated the statistical distributions of commodity prices, for a dozen major commodities, over the past 50-years. More volatile commodities generally have higher mean average prices, as shown on pages 4-5.

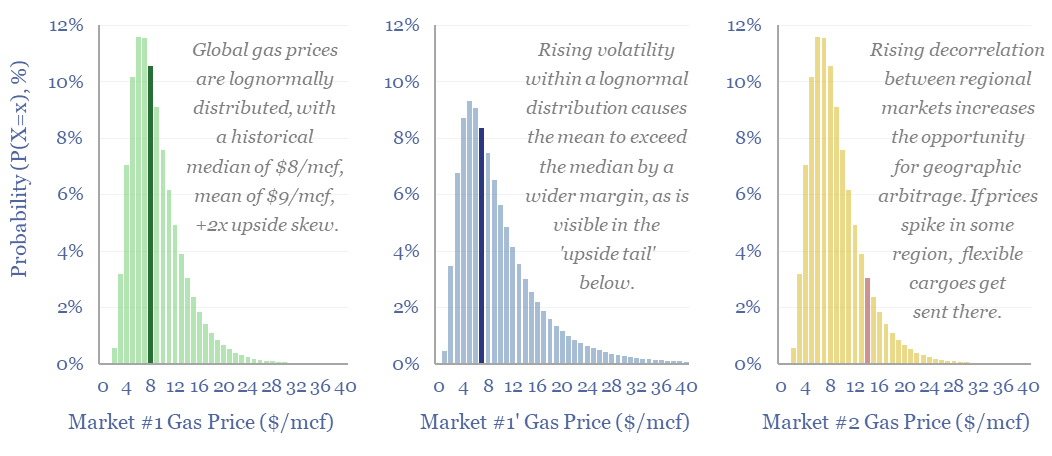

In order to model the impacts of rising volatility upon commodity prices, we need to fit a statistical distribution onto the commodity prices. Lognormal distributions provide a beautiful fit. Our confidence intervals for oil prices, gas prices and coal prices are outlined on pages 6-7.

How are commodity price realizations impacted by rising volatility? Mean outcomes exceed median-basis forecasts by a wider margin! The impacts of rising volatility on gas prices, coal prices and oil prices are quantified on pages 8-9.

How are the commodity price realizations available to energy trading businesses impacted by rising regional volatility? We argue that arbitrage potential will widen most in global LNG markets. Energy trading profits are often treated as one-offs. But they are one-offs that will tend to recur every quarter. We have quantified the growing value of diverting flexible LNG contracts to higher value markets on pages 10-13.

LNG portfolios are most likely to benefit from rising volatility in the global energy system, as price spikes become more frequent, and higher prices are also required to mobilize a limited number of truly flexible LNG cargoes. 25 companies’ LNG portfolios are assessed on page 14.

We think this report should be required reading for anyone with commodity-exposed interests. Commodities are volatile. But as the energy transition progresses, there is value in volatility.