LNG trucking is more expensive than diesel trucking in the developed world. But Asian trucking markets are different, especially China, where exponentially accelerating LNG trucks will displace 150kbpd of oil demand in 2024. This 8-page note explores the costs of LNG trucking and sees 45MTpa of LNG displacing 1Mbpd of diesel?

When we have evaluated LNG trucks in Western markets, such as the US or Europe, they are 20% more expensive than diesel trucks, per our models of truck costs.

What has surprised us is how different Asian trucking is from Western trucking, after tabulating the prices for 100 new trucks, with different fuels, and on sale in different geographies (see page 3).

Hence the costs of trucking are compared in Western markets and Asian markets, especially for China and India, on page 4.

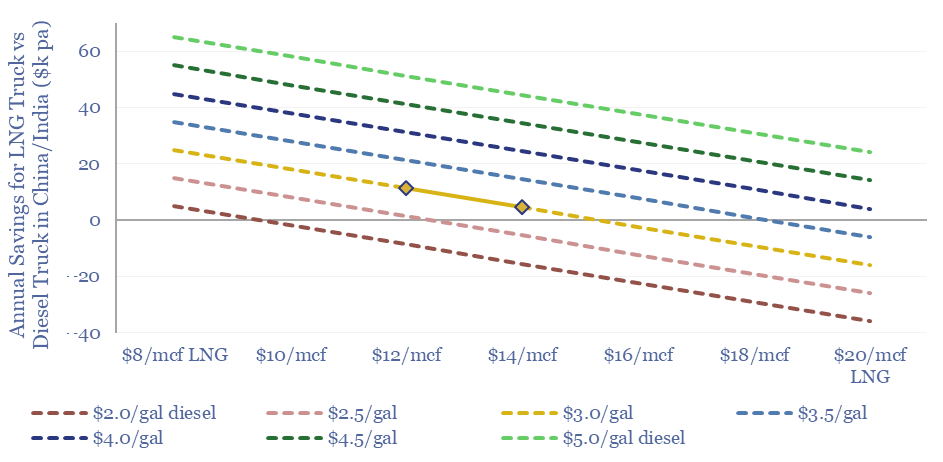

Another key difference is that while the costs of LNG trucking are higher in the US or Europe, they are lower in China or India. A sensitivity analysis is given on page 5.

Other advantages for gas-powered trucks are spurring adoption in China in 2024. Some observations on the advantages are on page 6.

What impacts on global oil markets and global LNG markets, if gas-powered trucking continues accelerating in China and India? We can see 1Mbpd of oil being displaced, and substituted for 45MTpa of LNG, impacting our oil demand models and LNG models.

The other angle that excites us in energy commodities is rising volatility, linked to geopolitics, and the ramp of volatile wind and solar, whose regional output varies +/- 10% per year, and whose global output varies +/- 5% per year. This creates volatility in demand for backups – e.g., LNG – and greater regional arbitrage potential. LNG trucks play into this theme. Companies and opportunities are noted on page 8.

Underlying calculations behind this report, and data into truck costs by geography, can be found in our overview of trucking costs.