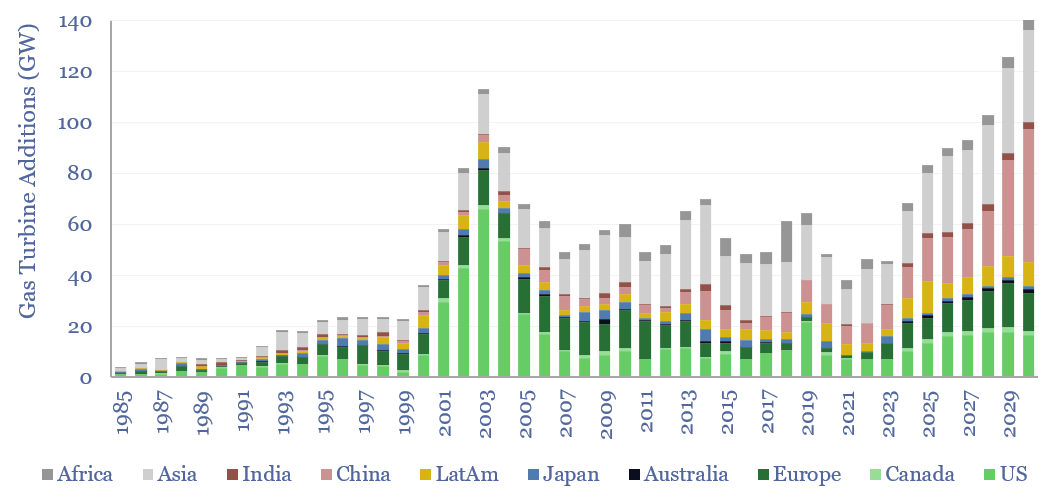

Gas turbines should be considered a key workhorse for a cleaner and more efficient global energy system. Installations will double to 100GW pa in 2024-30, and reach 140GW in 2030, surpassing their prior peak from 2003. This 16-page report outlines four key drivers in our gas turbine outlook, and their implications.

25% of global electricity came from burning 150bcfd of natural gas in 2023, generating 6,750 TWH of electricity from a fleet of 1.9 TW of gas turbines. The basic functioning, cost and efficiency of a typical gas turbine are described on pages 2-3.

Our goal in this report is to forecast the market for gas turbines through 2030. To predict the future, however, it is first necessary to predict the past and present, estimating the total market for gas turbines from 1985 to 2023. Our methodology and conclusions are on pages 4-6.

The first reason we think gas turbines will continue gaining share in the global power mix is that they are genuinely a better technology, in thermodynamics terms, than thermal generation via Rankine steam engines, which makes up 50% of global electricity today. This is why the CO2 intensity of a gas CCGT can be 65% below coal-fired power.

There are four key drivers that will accelerate demand in our gas turbine outlook. They are linked to the rise of AI, energy policy in China, the rise of renewables lowering utilization rates across the global generation fleet and pushing baseload facilities to run more like peakers, and rising retirement rates from early-2000s installations. These ideas are discussed on pages 9-13.

Our outlook above suggests a sharp acceleration should be underway in gas turbine orders. Interestingly, we can find evidence that this is occurring, based on the leading indicators discussed on pages 14-15.

Another attribute of the gas turbine market is its high market concentration. Leading companies in gas turbines are noted on page 16.