For the first time, in November-2021, a moderate-sized company has gone public with a mandate to generate CPI + 5% returns, by investing in forestry and nature-based afforestation projects. This short article summarizes the key points from the 216-page prospectus. We remain excited by the theme. The fine-details are informative.

Foresight Sustainable Forestry Company PLC (FSFC) went public in November-2021, listing in London and raising £130M in its IPO. This makes FSFC the second listed afforestation company in our screen that will be commercializing CO2 removals, and the only one of moderate size (below). The notes below are our highlights from the prospectus.

The Ambition of the group is to generate a total return of CPI + 5% by creating a balanced portfolio of sustainable timber and afforestation assets, while protecting nature and enhancing biodiversity.

Revenues. “The group’s revenues will primarily be generated by the sale of harvested timber and, in due course, the sale of Carbon Credits”. But harvested timber is “the primary revenue stream”.

Why forestry? Forestry investment returns are quoted at 12-16% pa over the past decade.

Timber. Global demand for timber is predicted to rise 4x from 2012 to 2050, by which year the market is seen being 4.5bn m3 pa under-supplied, increasing timber prices. UK timber prices have risen at 2% pa in the last 30-years and 5.6% pa in the last 20-years.

Future timber upside is seen from new wood products, with excellent carbon credentials, including mass timber, packaging and biochar. We would agree here, notes below. In the UK, upside is seen from the government’s plan to construct 300,000 new homes, increasingly sustainably, as well as practically and cost-effectively.

The harvest paradox. The prospectus addresses the paradox that timber harvesting might be seen to worsen natural carbon stocks. Academic research is cited showing that planting (or re-planting) conifers can mitigate 3x more emissions than conserving pre-existing broadleaf forest. Again we would agree (notes below) 65% of harvested tonnage is seen being used as sawlog, for lumber, with structural use and a long life. 25% will be small roundwood (particle board, fiber board, packaging, paper) and 10% is wood fuel.

Sustainable Timber standards. All projects will meet or exceed UKFS standards. The company notes it must obtain certifications from the FSC or PEFC, in order to sell its forest products.

Afforestation. “The Company will seek to make a direct contribution in the fight against climate change through forestry and Afforestation carbon sequestration initiatives.” Afforestation assets may comprise up to 50% of gross asset value. This matters in the UK, where forest cover is cited at 13%, one-third the level of other European countries.

Policy support is cited. In March-2020, the UK committed to reforest 30,000 hectares per year. In May-2021, plans were laid out to treble tree-planting rates in England, with grants from the £500M Nature for Climate fund. Scotland aims to plant 10-15k hectares per year and has a grant scheme, which tends to average £4k per hectare. Most recently, COP26 has explicitly encouraged the protection and restoration of forests.

Carbon Credit standards. The company plans to meet the criteria for creating carbon credits under the UK’s Woodland Carbon Code. This is encouraging, as we have generally found prior projects in the WCC to be high-quality (data below).

Carbon removals from the IPO are ascribed potential to enable 4MT of additional CO2 removals.

CO2 attribution. The company states “regardless of who ultimately acquires and/or retires the CO2 Credits, investors in the Initial Issue will always reserve the right to the claim they provided the original enabling capital to get the additional Afforestation and natural capital projects into action”.

Ancillary Revenues. Where appropriate, additional revenues may be generated by leasing the land for sporting, eco-tourism, renewable energy, telecommunications towers. Wind farms are noted in particular, as newer, taller turbines can now be ‘key-holed’ into forestry areas without impacting wind resources. This looks interesting to us.

Biodiversity. “The Company will seek to preserve and proactively enhance natural capital and biodiversity”. In addition, biodiversity credits will be commercialized “if a future market develops”. Some reports suggest legislation is progressing that will market worth hundreds of millions pa. Biodiversity can also be its own benefit (see below).

Other co-benefits cited are stabilizing soils from erosion, preventing flooding and landslides, supporting rural jobs, active engagement, education and health benefits for local communities.

Land ownership could be either on a freehold or leasehold basis.

Diversification. The company is using a portfolio approach, across a mixture of assets, asset types, geographies (although at least 90% will be in the UK), age classes, harvesting profiles and off-takers. No single asset is to represent more than 15% of the firm’s gross asset value.

Control. Assets will typically be owned 100%.

Gearing may be used to enhance returns but will not exceed 30% of gross asset value. One reason noted is that forestry assets are inherently illiquid.

Distribution yield. The company states that it will not retain more than 15% of its income. Distributions will be in the form of dividend (or “interest distributions” for UK tax purposes).

Operating history. Foresight Sustainable Forestry Company PLC is a new entity with “no operating history”.

Capital Raise. The company’s ambition was to raise £200M, of which £4M would comprise initial expenses for setting up and listing. (The IPO amount of £130M seems to be at the lower end).

Speed of capital deployment is cited as a key challenge for meeting earnings and returns targets. We have found this to be a challenge in our own reforestation efforts (see below).

Hence an initial acquisition has been scoped out at the time of the IPO, with a related party, Blackmead Infrastructure Limited. FSFC has the option to acquire 11,000 hectares of standing forests and afforestation assets from Blackmead, based on a third-party valuation, conducted by Savills (at £138M). In return, Blackmead will invest for 30% of the initial IPO.

The Target Asset comprises 34 discrete areas. 85% is in Scotland, 10% in Wales, 5% in England. 59% is mature, 38% are afforestation assets and 3% are mixed. Average age is 19-years. 10 species are used across these sites.

Further land acquisition is cited as another potential risk area. FSFL’s main targets are pasture land and semi-natural grasslands, which comprise 22% and 17% of UK land, respectively. 47,000 hectares of farmland was openly marketed in 2019, a new record low. c£325M of forestable or farm land transacts each year in the UK. Brexit is said to have reduced farmland values by 2% since the Brexit referendum in 2016 and the scale-back of EU subsidies may bring more land to the market. Our own land data are below, comparing the UK to other geographies.

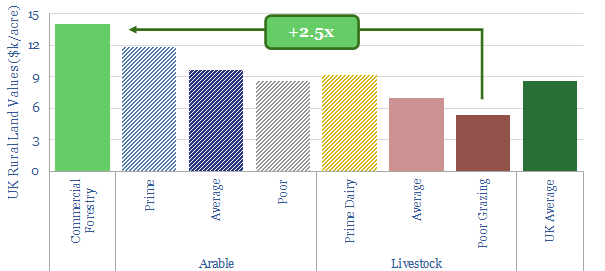

“Converting largely sub-economic grazing land into a commercial forest can increase the value of the asset by 2-3x over an 8-10 year time horizon” (chart below). The rationale also fits within changes in the food system (note below).

Pipeline. The company has identified 324,00 hectares in Scotland, 166,000 hectares in Wales and 68,000 hectares in Northern England that could be suitable for afforestation. The total pipeline is seen to be in excess of £300M per annum.

Due diligence will include legal, financial and other advisory expenses. These expenses may be incurred without necessarily resulting in a successful acquisition.

Land quality matters for carbon credentials. Forests with the best wind-firm soil can achieve up to 80% sawlog, while poorer ground may only achieve c50%.

Rising future competition is also cited as a possible risk. Today “there are a limited number of investment managers… in the UK forestry sector for institutional clients”.

Physical risks are also noted, including possible fires (see below), pest damage, disease, extreme weather. These may lower the value, or delay the timing of harvests.

Environmental laws are noted. For example, the Group could be held liable for historical contamination on land that it acquires, and forced to pay for remediation measures. Other sites in the UK are designated as “Sites of Special Scientific Interest” or “Special Areas of Conservation”. The group would be liable for fines in the event that it damaged or disturbed such designated sites.

Species selection. Conifer species such as Sitka spruce are highlighted for their yield advantages. Such softwoods (pine, fir, spruce, larch) can be harvested after 40-years, whereas broadleaved hardwoods (oak, ash, beech) will take up to 150-years before they reach maturity. Our own data are below.

Modern forestry techniques are “generating accelerated rates of tree growth and higher overall forest timber productivity”. They include decisions into thinning, understory management, species selection, soil management. For our own views on improving forestry techniques, please see the research note linked below.

Relatively early harvesting may be favored. “Once commercial conifers reach maturity they become much more susceptible to damage” from wind, fire or beetle attacks. Again this matches with our data.

Carbon inventories will be run following guidelines from the UK Woodland Carbon Code, using third-party service providers. For our views on measuring forest carbon, please see the research note below.

Overall we like the space of afforestation, as more and more companies seek to compensate for unavoidable and residual CO2 emissions, and truly get to net zero (note below). Please contact us for a more specific discussion on FSFC.