Could electric vehicles deflate towards cost parity with ICEs in 2025-30, helping to re-accelerate EV adoption? This 12-page report into electric vehicle cost parity contains a granular sum-of-the-parts cost breakdown. Then we consider battery deflation, power train deflation, small urban EVs, tax incentives, and the representativeness of low-cost Chinese EVs.

Electric vehicles may saturate at 15-30% of global vehicle sales in 2025-30, well below consensus forecasts, and even our own forecasts from a year ago which saw EVs reaching 50% of global vehicle sales by 2030. This would strongly impact energy, materials and capital goods.

Sometimes a thesis is so important that it needs to be stress-tested from multiple different angles. Hence the purpose of this 12-page report is to assess whether electric vehicle cost parity could be achievable in 2025-30.

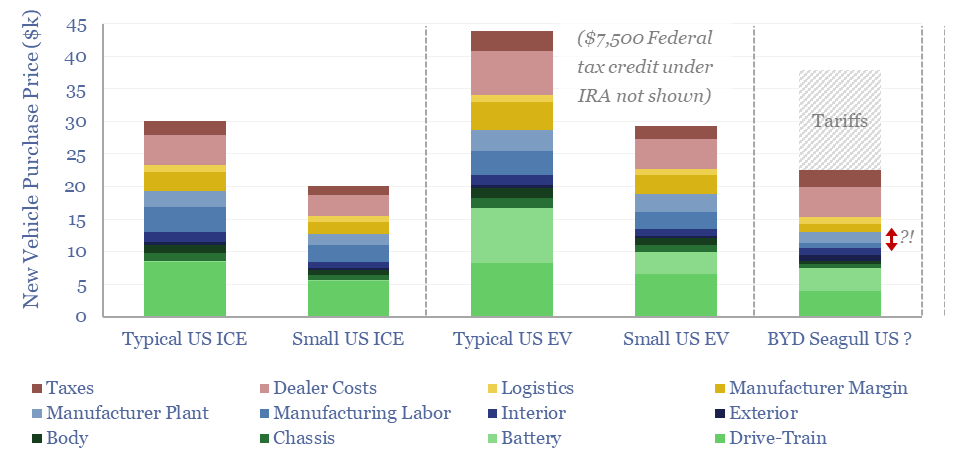

We started by breaking down the costs of EVs and ICEs, across 25 cost lines, via two granular sum-of-the-parts models of vehicle costs.

What is driving the costs of electric vehicles today? How much more expensive are they on an apples-to-apples basis? And is it really fair to call an EV simply an ‘iPad on wheels’? Answers to these questions are discussed in the first half of the report.

Electric vehicle cost parity could be achieved by deflating the different cost lines. But how much running-room is left for battery cost deflation? And if we delve into the supply chain, are Tier 1 and Tier 2 suppliers guiding towards any pricing reductions? Answers are on pages 6-8.

Could smaller electric vehicles emerge, drive down costs, and boost adoption? Or can we draw any deflationary conclusions from BYD‘s famous Seagull EV, on sale in China for the equivalent of $10-14k? We have attempted to answer these questions on pages 9-10.

How do subsidies, incentives and tariffs change the costs of electric vehicles in the developed world? And will this boost adoption from here? This topic is discussed on pages 10-11.

Our outlooks for regional EV adoption and regional oil market evolution are re-visited in light of the new analysis on page 12.