This data-file estimates the labor costs of coal production, as a function of labor productivities and salaries, by region and over time. Across 3M global coal mine employees in the file, labor productivity runs at 2,500 tons of coal per employee per year, average salary is $14k pp pa, and thus labor costs are $6/ton. The data covers Europe’s phase-backs of lignite and hard coal, the US/Australia’s staggering productivity, China’s rising wage rates, and India/Indonesia’s low costs.

$60/ton hard coal offers up thermal energy at 1c/kWh, near the bottom of the global energy cost curve. Hence it might seem like dialing back coal is inevitably going to be inflationary? Or that Europe might rationally consider ramping back its coal production, which has halved in the last decade, as competitiveness and defense overtake decarbonization as priorities.

However, the costs of coal production can be opaque, due to variations in different coal grades. We have built up data-files in the reported cost from Chinese public coal miners, and US public coal miners. But there is a lack of disclosure from the constellation of private companies in Europe (of course they went private, as the divestment movement has sought to clobber public ownership of coal stocks).

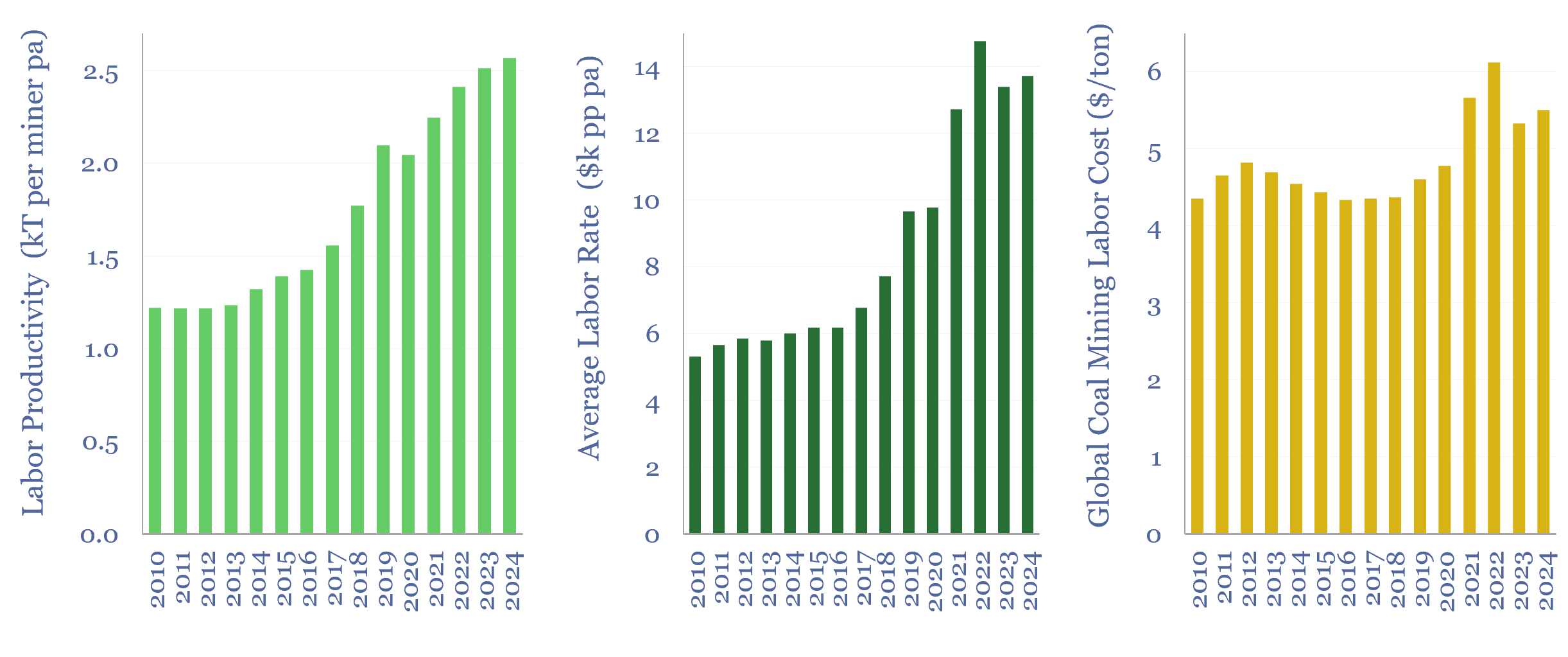

This data-file covers the labor productivity of coal production, labor rates, and thus the labor costs of coal production, across the US, Europe, China, India, Australia and Indonesia. As a global average, across the 3M global coal mine employees captured in the data-file, labor productivity runs at 2,500 tons of output per employee per year, average salary is $14k pp pa, and thus labor costs are $6/ton.

Labor productivity of global coal production has increased over time, mainly due to the mechanization of coal mining in emerging world countries, such as China, India and Indonesia. Conversely, in the US, Europe and Australia, labor productivity correlates inversely with coal prices, as higher prices unlock more challenging resources.

Germany closed down its hard coal production in 2018, but this was not just a function of going green. Our data suggest that labor costs alone on German hard coal production were running above $90/ton, due to high salaries (>$60k pp pa) and very low productivity (<700T pp pa).

However lignite production in Europe has very low costs, ranging from $4-13/ton in Germany, Turkey, Poland, and the Czech Republic. Labor costs are still high, but Germany and Poland achieve labor productivities of 7-8kT pp pa. As a rule of thumb, labor is 20-50% of the total cash costs of coal production.

The US and Australia retain phenomenal coal productivities above 10kT pp pa, hence even with $110-120k salaries for coal miners, labor costs only run to c$10/ton. Our outlooks for these countries’ evolving energy systems are modeled separately for the US and for Australia.

In China, over the past decade, labor productivity has doubled, yet average coal mining salaries have quintupled, and hence the direct labor costs of coal mining have more than doubled to $5-6/ton. Indonesia and India may have the lowest direct labor cost in the world for coal mining at $1-2/ton. Our outlook for Chinese coal is covered here.