-

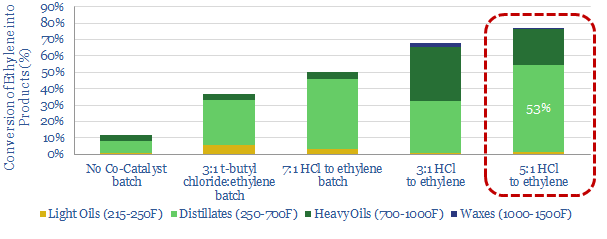

Shale: restoring downstream balance? New opportunities in ethylene and diesel.

Shale’s light mix is often criticised for distorting oil product markets. But distortions create opportunities for Integrateds. This note explores one opportunity, patented by Chevron, to convert ethylene into diesel.

-

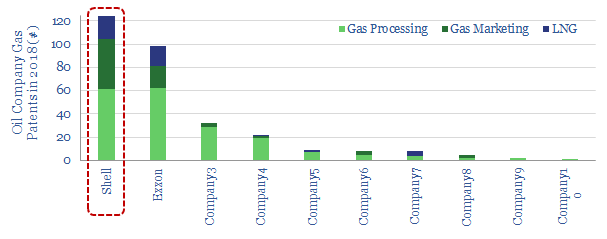

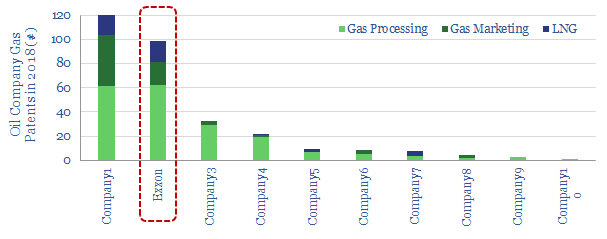

Shell drives LNG in transport?

Shell is the most active Major in driving new LNG demand. In 2019, it patented a new sub-cooler to improve the ascent of LNG in transportation. Our note explains the challenges of boil-off and gas-weathering, how they are addressed by Shell’s new technology, and eight resulting advantages.

-

Greenfield LNG: Does Exxon have an edge?

ExxonMobil has developed industry-leading technology for greenfield LNG cosntruction, particularly in remote geographies. This conclusion follows from reviewing 3,000 patents. We analyse its edge the and resultant opportunities, as new projects progress in Mozambique, PNG and on the US Gulf Coast.

-

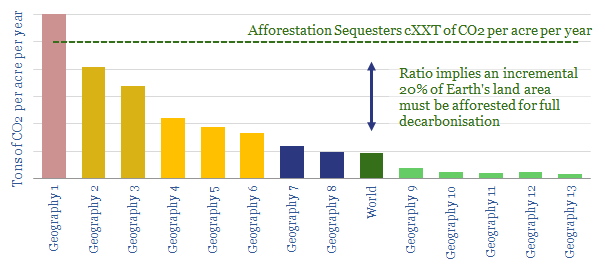

Lost in the Forest?

In 2019, Shell pledged $300M of new investment into forestry. TOTAL, BP and Eni are also pursuing similar schemes. But can they move the needle for CO2? In order to answer this question, we have tabulated our ‘top five’ facts about forestry. We think Oil Majors may drive the energy transition most effectively via developing…

-

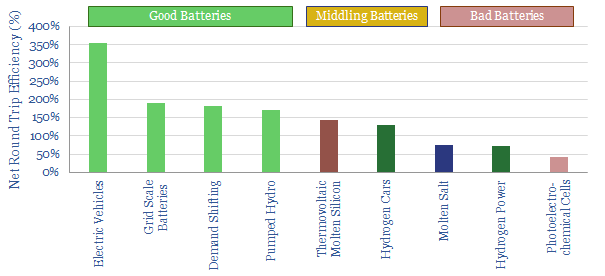

Good Batteries vs Bad Batteries?

A “good battery” enhances the efficiency of the total energy system. A “bad battery” diminishes it. Hence we have quantified battery quality, ranging from 3.5x efficiency gains for EVs to c30% efficiency losses for grid-scale hydrogen. This distinction must not be overlooked in the world’s quest for cleaner energy.

-

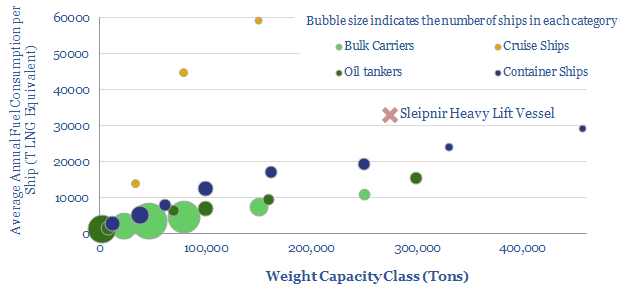

LNG Ships: a new record-setter?

Multiple records have just been broken for an LNG-powered ship, as construction completed at Heerema’s “Sleipnir” crane-lift vessel. It is a remarkable, LNG-powered machine, substantiating the 40-60MTpa upside we see for LNG demand, from fuel-intensive ships, after IMO 2020.

-

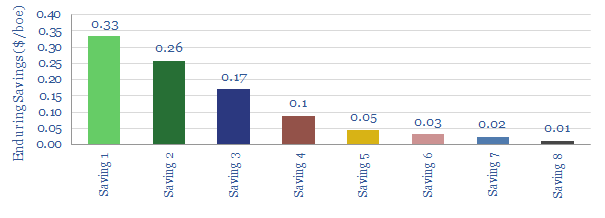

Digital Deflation: How Hard to Save $1/boe?

A typical operator can readily save $1/boe via continued, digital deflation. Our numbers are derived from a new case study from Cognite, which is among the leaders in oilfield digitization, collaborating with cutting-edge E&Ps. Digitization remains the most promising opportunity to improve offshore economics.

-

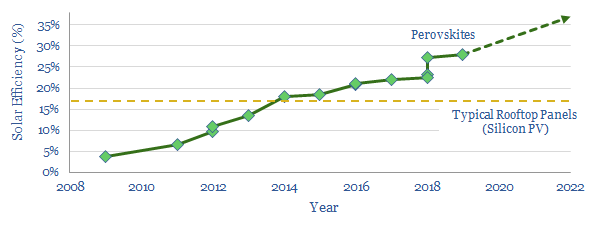

Perovskites: Lord of Light?

Perovskites are the fastest-improving innovation in solar. The best test-cells hit a new record of 28% efficiency last year, with line-of-sight to the mid-30s, i.e., 2x more efficient than today’s silicon photovoltaics. We review the opportunities and challenges. A Major is at the cutting edge.

-

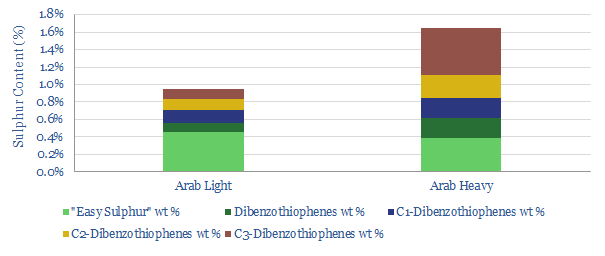

IMO 2020. Fast Resolution or Slow Resolution?

The downstream industry is debating whether IMO 2020 sulphur regulations will be resolved quickly or slowly. We think the market-distortions may be prolonged by under-appreciated technology challenges, which mandate large, increasingly hard-to-finance refinery overhauls.

-

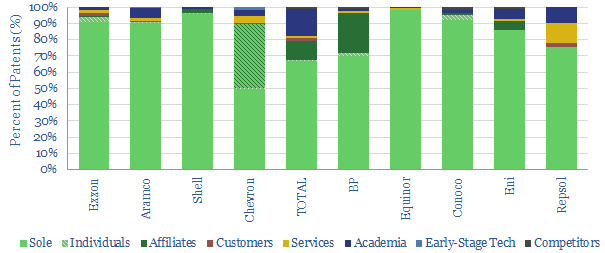

Patent Partners: Pairing Up?

This note contains our ‘Top Five’ conclusions about the Oil Majors’ research partnerships, drawing off our database of 3,000 oil company patents. Different companies have importantly different approaches. We can quantify this, by looking at the number of patents co-filed with partners (chart above). (1) Working with Academia. TOTAL stands out as collaborating most closely…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)