-

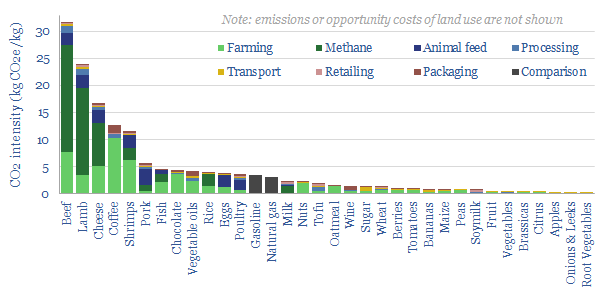

Diet and climate: should energy transition include agriculture?

Feeding the world explains 20% of global CO2e emissions, across 12bn acres of land, whose reforestation could theoretically decarbonize the entire planet. Kilo for kilo, many meat products have 1-10x more embedded CO2 emissions than fossil fuels. This short article is to present our top ten conclusions.

-

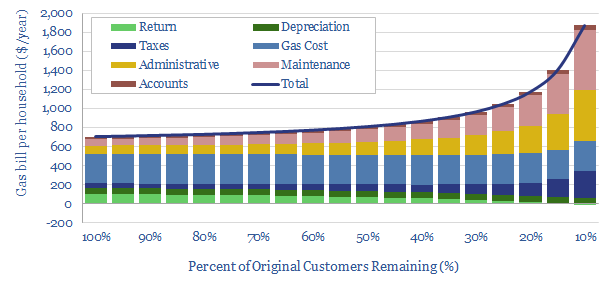

Phasing out gas: five hidden consequences?

Phasing out gas is likely to be a policy choice made by some cities or States, as part of the energy transition. The purpose of this short note is simply to examine possible consequences. Which could be stark.

-

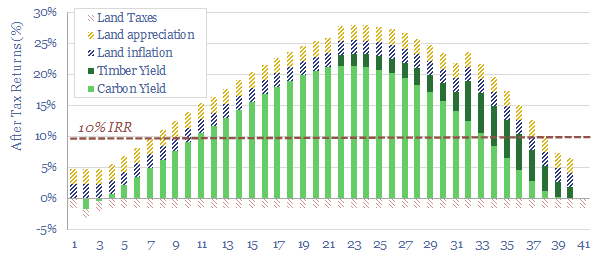

Reforestation: a real-life roadmap?

This 12-page note sets out an early-stage ambition for Thunder Said Energy to reforest former farmland in Estonia, producing high-quality CO2 credits in a biodiverse forest. The primary purpose would be to stress-test nature-based carbon removals in our roadmap to net zero, and understand the bottlenecks.

-

Carbon markets: a thought experiment?

This short video is a thinly-veiled critique of carbon markets. To do this, we use an analogy from the banking sector, followed by some observations on carbon prices and carbon offsets.

-

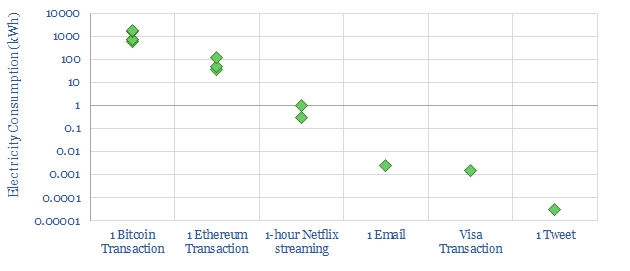

Blockchain: why so energy intensive?

A single Bitcoin transaction currently uses c1,000kWh of electricity, 1 million times more than a traditional payment. Hence this note aims to explain how blockchain works, why it has been so energy intensive in the past, and how the energy multiplier could be reduced to maybe 100 – 1,000x.

-

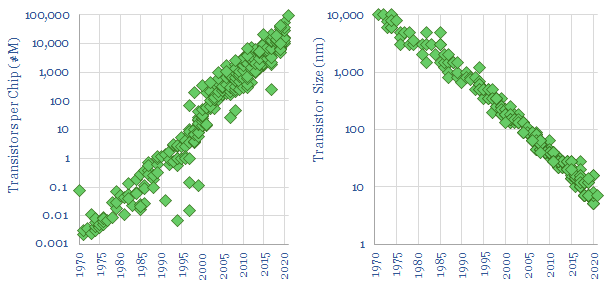

Moore’s law: causes and new energies conclusions?

Moore’s law entails that computing performance doubles every 18-months. Which has held true since 1965. This exponential progress has been driven by three positive feedback loops. Can these same feedback loops unlock a similar trajectory for new energies costs? We find mixed evidence.

-

Energy transition: conclusions from 6-months on the road?

This video contains my top five conclusions from some eye-opening real world experiences. Specifically, for the better part of the past six months, my wife and I have been working ‘nomadically’. I made it to 44 US States in total. This has changed my views on transition costs, mobility and nature.

-

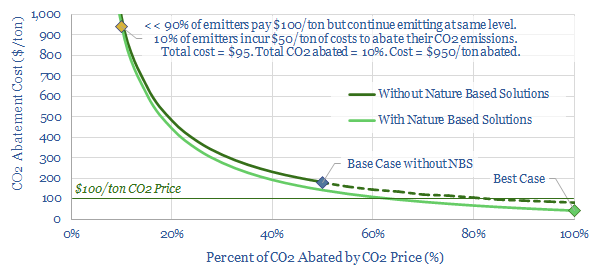

CO2 prices: re-thinking the costs?

CO2 prices and CO2 abatement costs are very different numbers. The CO2 prices are incurred by remaining emitters. But the abatement costs depend on how much CO2 is reduced. These abatement costs can actually be astronomical if CO2 does not fall much. We argue CO2 prices are only effective if nature-based offsets are incorporated.

-

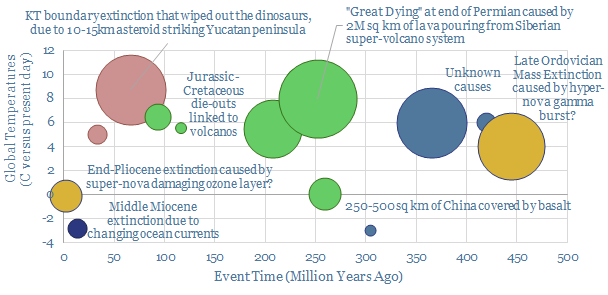

Mass extinctions: insights into systemic risk?

We have reviewed 14 mass extinctions over the past 500M years. This short note contains our top five solutions. Current policies may be short-sighted around systemic risks. Improved technologies and nature-based solutions fare better.

-

Video: how to risk early stage technologies?

We are starting a new strand of research, evaluating the specific energy technologies of specific early-stage companies, to help drive the energy transition. This video lays out our rationale, and our methodology, which draws on two years of patent learnings.

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (831)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (351)