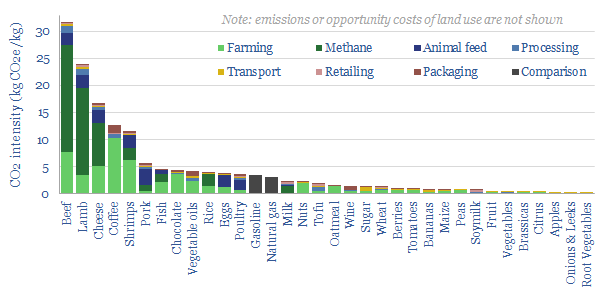

Feeding the world explains 20% of global CO2e, across 12bn acres of land, whose reforestation could theoretically decarbonize the entire planet. Kilo for kilo, many meat products have 1-10x more embedded CO2 emissions than fossil fuels. Thus with dietary changes a typical developed world inhabitant could cut their total CO2 footprint by 50-70%. The purpose of this short article is to present our top ten facts and observations.

(1) Food is a form of energy. The average person needs to ingest around 2,000 calories (kcal) per day to maintain their weight. The energy content of 2,000 calories is equivalent to 2.3 kWh. In power terms, this is c100W, or a similar electrical draw as a desktop computer. Hence nourishing 8bn people globally is equivalent to supplying 7,000 TWH per annum of energy, or c10% of all global energy. For comparison, the useful energy harnessed from 40Mbpd of oil by the world’s fleet of 1.7bn passenger vehicles is around 5,000 TWH per annum. Energy demand per capita and across different household appliance are captured in our data-files below, to enable further comparisons. But how efficiently do we supply this food energy onto our plates?

(2) Crop yields can be very high per acre. The average yield for an acre of corn in the US is 175 bushels (explored in detail in our biofuels research below). 1 bushel of corn contains 88k kcal of food energy. Hence 1 acre of corn yields 15M calories per year of energy and could theoretically nourish 20 people (although they would get very sick of eating corn). Numbers can be similar for potatoes. Calorific yields fall to c11-13M calories/acre for rice, 4-6M for wheat, 2-6M for soybeans.

(3) Animal agriculture has >85% lower yields per overall acre. Producing 1 calorie of eggs or dairy products requires feeding 6 calories to chickens and cows. While producing 1 calorie of poultry, pork or beef, respectively, requires feeding 9, 12 or 37 calories to chickens, pigs or cows. Even further land is needed to rear these animals too.

(4) Macro land use. Animal agriculture therefore takes up c80% of all agricultural land to produce c20% of the calories. Specifically, the Earth contains 37bn acres of land. Of this 37bn acres, 12bn acres are barren (deserts and Antarctic wilderness) and 25bn acres can support life. Of this 25bn acres, 10bn acres remain as forests. 8bn acres are used to graze animals, and 4bn acres are used to raise crops. Of these crops, c55% are fed to humans, c35% are fed to animals and c10% are used for biofuels. These data are drawn from our research below.

(5) Micro land use. It takes 2.5 acres of land to support the average UK person’s diet, consuming 75g per day of protein, which is 50% above the recommended daily intake, and c40% derived from meat and meat products. The US average land requirement has been estimated between 2.6 – 3.3 acres, as the average American eats 200lbs of meat per annum, 3x the global average. By contrast, the average Chinese and Indian diets currently require 1.7 acres and 0.8 acres of land. Finally, to re-iterate, the minimum possible land footprint to sustain a human being today is around 0.05 acres.

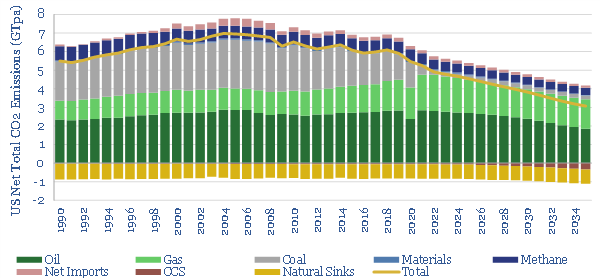

(6) Agricultural land has a climate cost. 5bn acres have been deforested by mankind, releasing one-third of all anthropogenic CO2-equivalents. Forest cover in different countries with Western diets is as low as c10%, across the UK, Netherlands, Ireland, Denmark; and generally around c30% in countries such as the US, Germany, France, Italy and Central Europe more broadly. We have cleared 50-70% of our forests in these European countries, over the past several centuries. The world is still shedding 25M acres per year of forest land globally, of which 75% is driven by animal agriculture, and half may be for rearing beef. Thus deforestation remains the largest source of anthropogenic CO2 emissions on the planet (chart below).

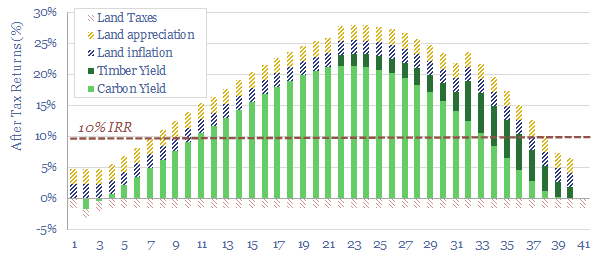

(7) Agricultural land also has an opportunity cost. Reforesting 1 acre of land would be likely to absorb around 5 tons of CO2 per acre per year (below). This is equivalent to 25-35% of the average CO2-equivalent emissions of the average Western citizen. A purely vegetarian diet that requires <0.5 acres of land per year may free up an area large enough to absorb 10 tons of CO2 per year, around 50-70% of the average Western CO2 footprint. To be clear, our existing thesis – on the amazing climate potential of large-scale reforestation – does not require vast numbers of people to give up eating meat. But it would help.

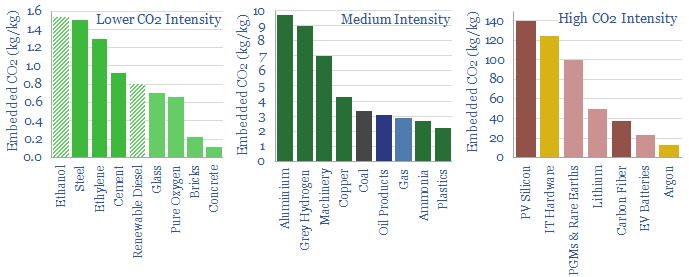

(8) Direct emissions add on top. Methane is responsible for another 25-30% of all anthropogenic warming that is currently occurring on the planet. c40% of mankind’s methane emissions have come from the fossil fuel industry, where vast efforts are needed and underway to reduce leaks (note here). But a similar, c40% of anthropogenic methane has come from agriculture, mainly from methanogenic bacteria, which digest coarse plant material in the fore-stomachs of ruminant animals. 1kg of beef releases 15-50kg of CO2-equivalent methane emissions, as the average cow burps up c100kg of methane per year. Kilo for kilo, this means that 1kg of hamburger is one of the most CO2 intensive materials on the planet, an order of magnitude more than steel or cement (1-2 kg of CO2 per kg of material, chart below). Even further, on top of this, producing different crops will typically require 0.4-2 kg/kg of CO2 emissions, in fertilizers and running agricultural equipment; and 6-40 kg of crop feed is needed to produce 1 kg of meat. Thus ‘what you choose to eat’ has vast CO2 consequences, and certainly much more than ‘where it comes from’ or ‘what form of packaging’ it is sold in (charts below).

(9) Weird subsidies abound. One of the strangest site visits I ever did in my time as an analyst took me to a 4MTpa frac sand mine in Texas. There were a couple of cows standing around on the property. And the manager explained that these cows enabled the facility to claim a legitimate tax exemption available to cattle ranches. In Florida, a similar tax loophole allegedly induces Disneyland to keep cows. Some studies have estimated that the US spends a total of $38bn per annum subsidizing the meat and dairy industries (direct and indirect costs). Meanwhile, the EU has been said to pay €2bn per annum to support livestock farming (direct costs only), providing half of all ‘value add’ in the livestock industry. It makes you wonder whether current climate policies have anything to do with climate at all. For the future, it will be interesting and controversial to see whether emissions taxes will cover agricultural products. If the IEA’s proposal for a $250/ton CO2 tax by 2050 was adopted in the developed world, this would logically be expected to add around $1.65 to the cost of the c$1 quarter-pounder in a typical c$3 fast food hamburger.

(10) An environmentally friendly diet has recently been called the single biggest opportunity for any individual to reduce their CO2-equivalent impact on the planet by a research team at the University of Oxford. Direct CO2 intensities are lowest for root vegetables, nuts, and fruits and vegetables more broadly, which should all have CO2e emissions below 0.5 kg/kg. In addition, this type of annoyingly virtuous vegetarian lifestyle may free up enough land that, if reforested, could realistically offset c50-70% of the CO2 emissions of a typical Western lifestyle. A further practical step would be to minimize food waste, which claims one-third of all food produced globally. Energy efficiency of different cooking techniques is discussed here. Finally, we have recently profiled vertical indoor greenhouses, which may make sense in grids with overbuilt renewables, and certainly a lot more sense than hydrogen (note below).

After-word. The data used in the header image of this report are from an excellent and free resource provided by Our World in Data (Source: Hannah Ritchie and Max Roser (2020) – “Environmental impacts of food production”. Published online at OurWorldInData.org. Retrieved from: ‘https://ourworldindata.org/environmental-impacts-of-food’). Some of these numbers are possibly on the high side, relative to our own numbers. But if they are correct, they imply that consuming 1kg of meat products emits 1 – 10x more CO2 than 1 kg of fossil fuels such as gasoline or natural gas.