-

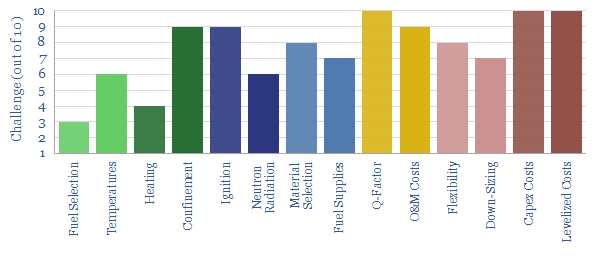

Nuclear fusion: what are the challenges?

Nuclear fusion could provide a limitless supply of zero-carbon energy from the 2030s onwards. The goal of this 20-page note is simply to understand the challenges for fusion reactors, especially deuterium-tritium tokamaks. Innovations need to improve EROI, stability, longevity and costs.

-

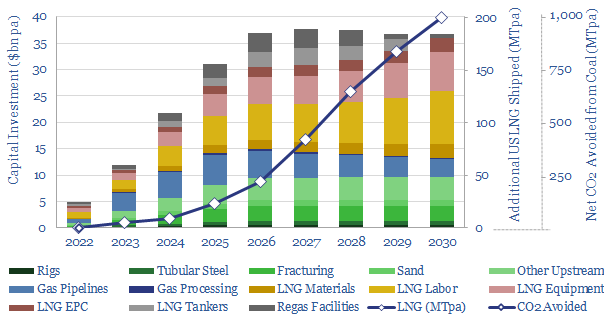

US LNG: new perceptions?

Perceptions in the energy transition are likely to change in 2022, amidst energy shortages, inflation and geopolitical discord. The biggest change will be a re-prioritization of US LNG. At $7.5/mcf, there is 200MTpa of upside by 2030, which could also abate 1GTpa of CO2. This 15 page note outlines our conclusions.

-

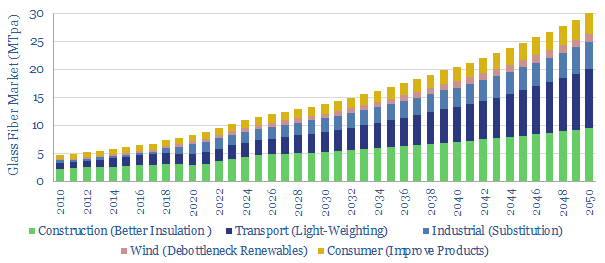

Glass fiber: what upside in the energy transition?

Glass fiber makes up 50% of a wind turbine blade, lightens vehicles and insulates homes for 30-70% energy savings. Hence we see demand rising 3.5x in the energy transition. To appraise the opportunity, this 13-page note assesses the market, costs, CO2 intensity and leading companies.

-

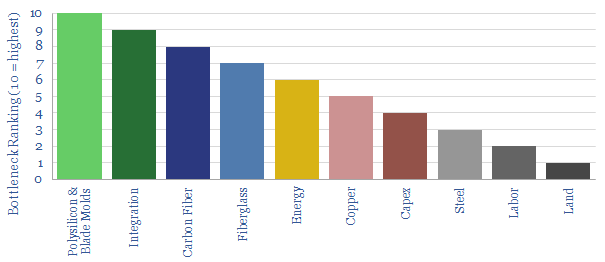

Renewables: can they ramp up faster?

How fast can wind and solar accelerate, especially if energy shortages persist? This 11-page note reviews the top ten bottlenecks. Seven value chains will tighten enormously in the coming years. Paradoxically, however, ramping renewables could exacerbate near-term energy shortages.

-

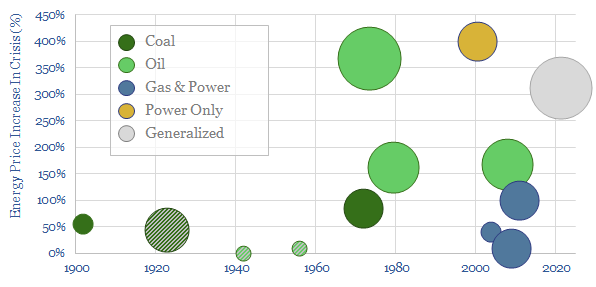

Energy crisis: ten themes for 2022?

We are all hoping for ‘normalization’ in 2022. But what if the world is instead entering a full-blown energy crisis, as severe and persistent as the first ‘oil shock’? This 21-page note lays out ten hypotheses, drawing on history. Everything we know about energy transition may change this year.

-

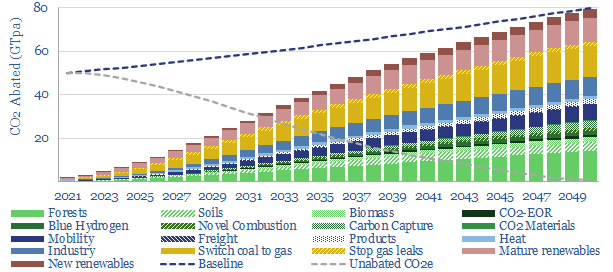

Decarbonizing global energy: the route to net zero?

This 18-page report revises our roadmap for the world to reach ‘net zero’ by 2050. The average cost is still $40/ton of CO2, with an upper bound of $120/ton, but this masks material mix-shifts. New opportunities are largest in efficiency gains, under-supplied commodities, power-electronics, conventional CCUS and nature-based CO2 removals.

-

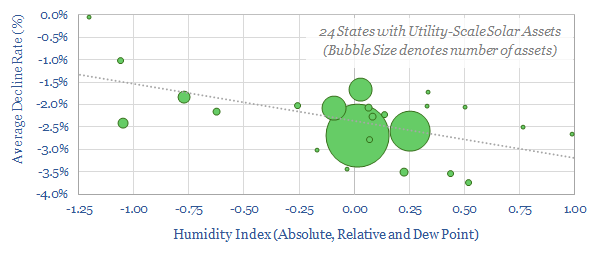

Solar decline rates: causes and solutions?

The average solar asset declines at 2.5% per year. This 14-page note reviews the causes. We find humid climates moderate Potential Induced Degradation, adding a relative headwind in coastal geographies and floating solar. But an exciting way to mitigate declines is emerging via smaller inverters.

-

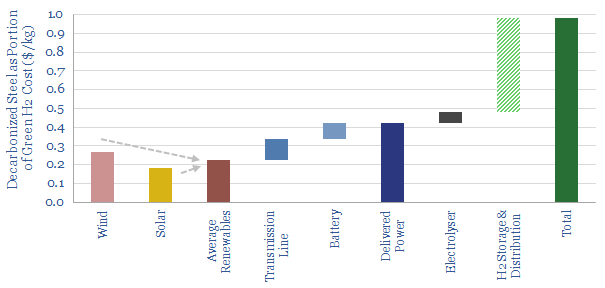

Green steel: circular reference?

Steel explains almost c10% of global CO2. Hence 2021 has seen the world’s first green steel, made using green hydrogen. Yet inflation worries us. At $7.5/kg H2, green steel would cost 2x conventional steel. In turn, doubling the global steel price would re-inflate green H2 costs. This note explores inflationary feedback loops and other options…

-

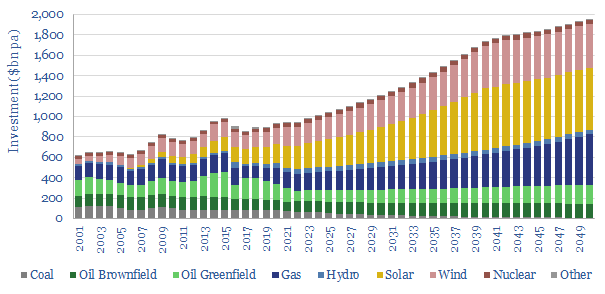

Is the world investing enough in energy?

Global energy investment in 2020-21 has been running 10% below the level needed on our roadmap to net zero. Under-investment is steepest for solar, wind and gas. Under-appreciated is that each $1 dis-invested from fossil fuels must be replaced with $25 in renewables. Future capex needs are vast.

-

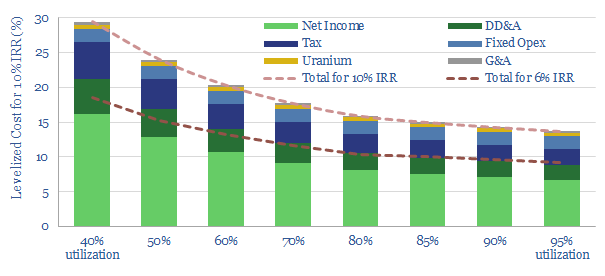

Back-stopping renewables: the nuclear option?

Nuclear power can backstop much volatility in renewables-heavy grids, for costs of 15-25c/kWh. This is at least 70% less costly than large batteries or green hydrogen, but could see less wind and solar developed overall. Our 13-page note reviews the opportunity.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)