-

Electric motors: state of flux?

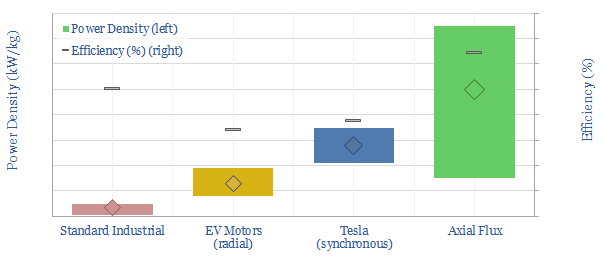

This 15-page note explores whether axial flux motors could come to dominate in the future of transportation. They promise 2-3x higher power densities, even versus Tesla’s world-leading PMSRMs; and 10-15x higher than clunky industrial AC induction units; while also surpassing c96% efficiencies.

-

Small-scale CCS: transport liquid CO2?

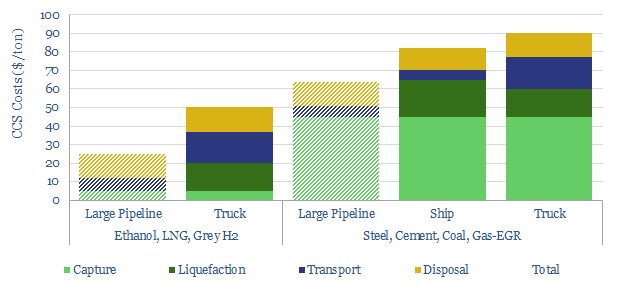

CO2 has unusual physical properties, which make small-scale liquefaction and transport much more viable than we had expected. The energy burden is 70% less than other industrial gases. Total CCS costs are $50-90/ton for leading examples. This 15-page note outlines the opportunity.

-

Electric motors: variable star?

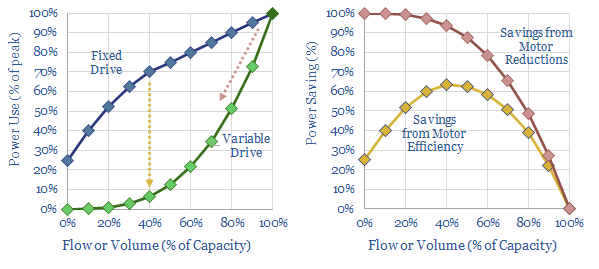

Variable frequency drives precisely control motors. Amazingly they could reduce global electricity demand by c10%. We expect a sharp acceleration due to sustained energy shortages, increasingly renewable-heavy grids and excellent 20-50% IRRs. Hence this 14-page note reviews the opportunity and who benefits.

-

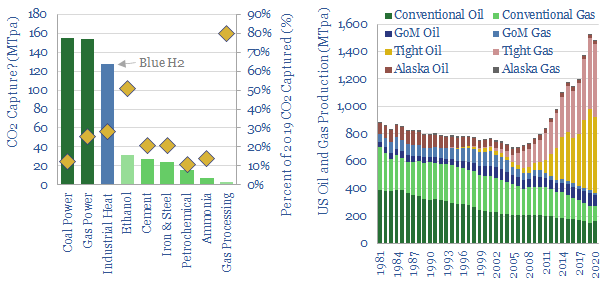

Carbon capture: how big is the opportunity?

This 13-page note quantifies the upside case for CCS in the United States, using top-down and bottom-up calculations. Our conclusion is that a clear, $100/ton incentive could help CCS scale by c25x, accelerating over 500MTpa of projects in the next decade, cutting US CO2 by 10%.

-

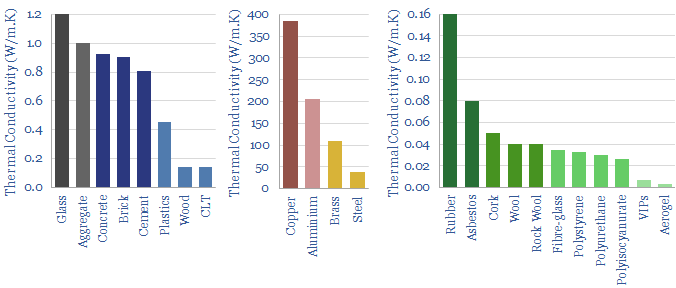

Insulating materials: deliver us from gas shortages?

Insulating materials slow the flow of heat from a warm house by 30-100x. But 60-90% of today’s housing stock is 30-70% under-insulated. We think renovation rates could treble as gas shortages re-prioritize energy savings. This 12-page note screens who benefits.

-

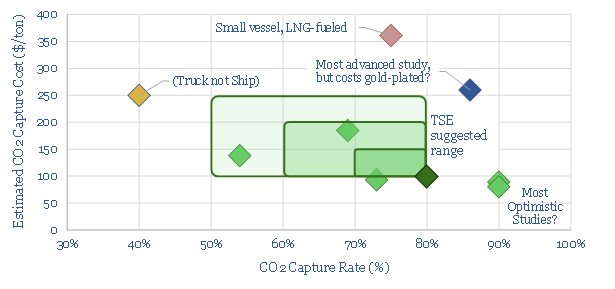

Carbon capture on ships: raising a sail?

CCS is adapting to go to sea. 80% of some ships’ CO2 emissions could be captured for c$100/ton and an energy penalty of just 5%, albeit this is the best case within a broad range. This 15-page note explores the opportunity, challenges, progress and who might benefit.

-

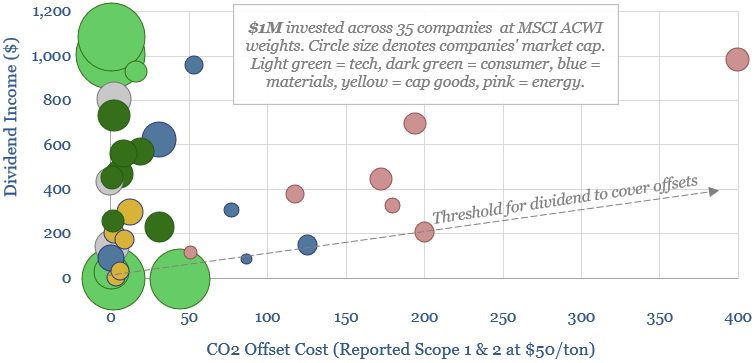

Carbon neutral investing: hedge funds, forest funds?

This 11-page note considers a new model of carbon neutral investing. Look-through emissions of a portfolio are quantified (Scope 1 & 2 basis). Then an allocation is made to high-quality, nature-based CO2 removals. Advantages and practicalities are exciting.

-

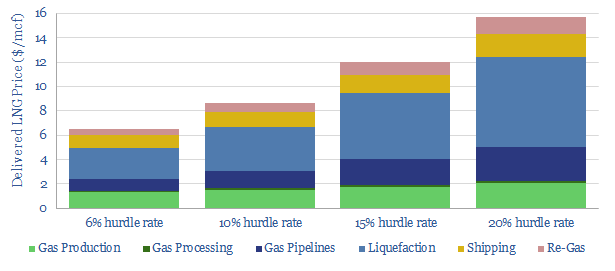

End game: options to cure energy shortages?

This note considers five options to cure emerging gas and power shortages. Unfortunately, the options are mostly absurd. They point to inflation, industrial leakage and slipping global climate goals. But also opportunities in LNG, nuclear and efficiency technologies.

-

Power grids: tenet?

How do power grids work? How will they be re-shaped by renewables? This 20-page note outlines the underpinnings of electricity markets, from theoretical physics through to looming shortages of inertia and reactive power. There are challenges back-stopping renewables and this creates opportunities.

-

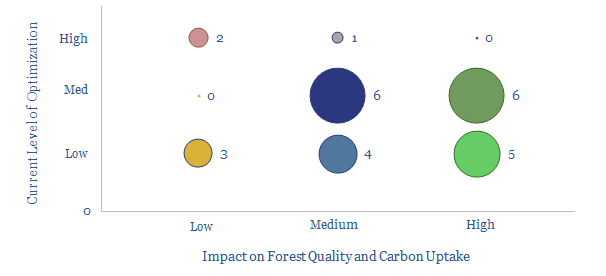

Nature based CO2 removals: theory of evolution?

Learning curves and cost deflation are widely assumed in new energies but overlooked for nature-based CO2 removals. Support for NBS has already stepped up sharply in 2021. This 15-page note finds the CO2 uptake of well-run reforestation projects could double again.

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (831)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (351)