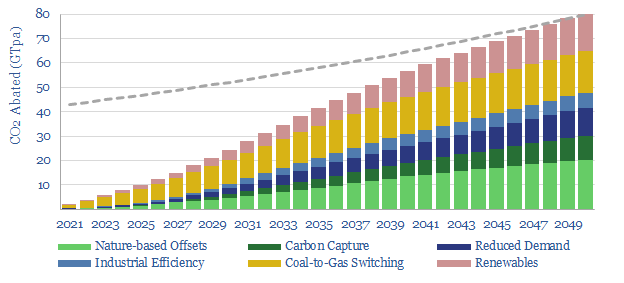

This 26-page report aggregates all of our work in 2020 and presents the best route to reach ‘net zero’ CO2. The global energy system can be fully decarbonized by 2050, for an average CO2 cost of $42/ton. Remarkably, this is almost half the cost foreseen one year ago. 85Mbpd of oil and 375TCF pa of gas are still required in this 2050 energy system, together with efficiency technologies, carbon capture and offsets.

Important note: our latest roadmap to net zero is from 2022, published here. But this note remains on our website, for transparency into our views at the end of 2020.

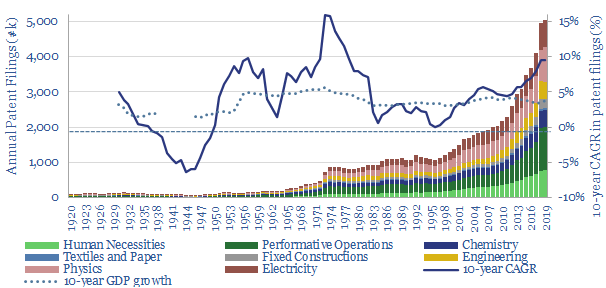

Our modelling framework for the decarbonization of global energy is explained on pages 2-6, looking across 90 thematic research reports and 270 models, which have featured in our work to-date. The aim is to find the lowest-cost route to meeting global energy demand, while removing all of the CO2.

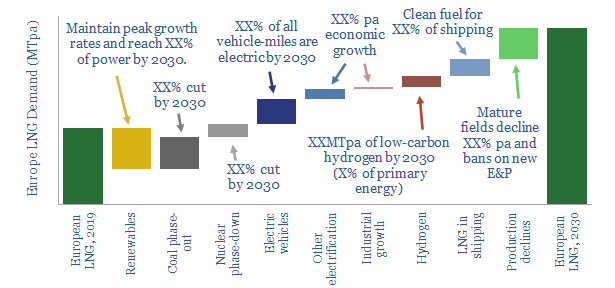

The framework joins up with our models of supply-demand models of global energy, oil, LNG, European gas, the total US economy and the climate system. Supply shortages are noted in many of these markets on pages 7-8.

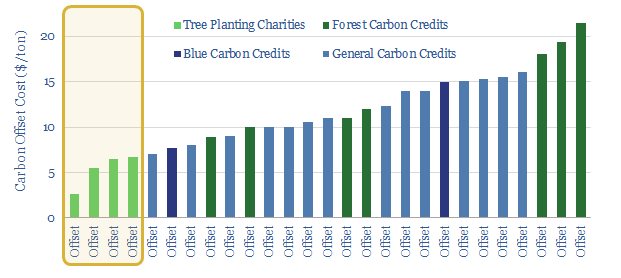

How can this be a decarbonized energy system if there is still 85Mbpd of oil and 375TCF of gas? Our bridge includes carbon capture and carbon offset, as shown on page 9.

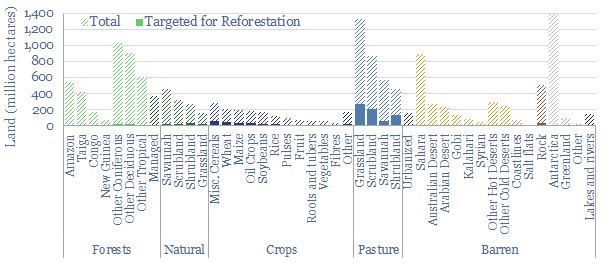

Nature based solutions are profiled in detail on pages 10-14. This includes data into the CO uptake rates in reforestation and soil carbon projects, and quantification of the land that is available for both.

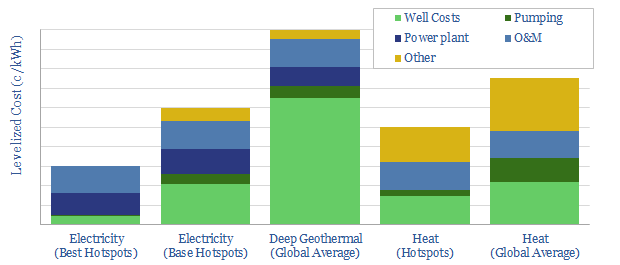

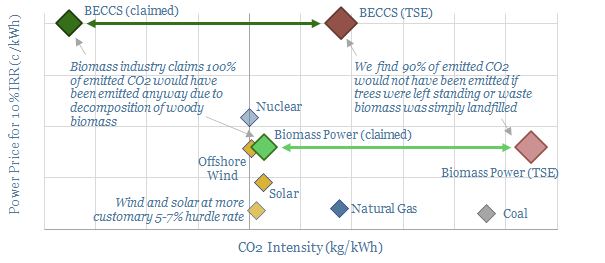

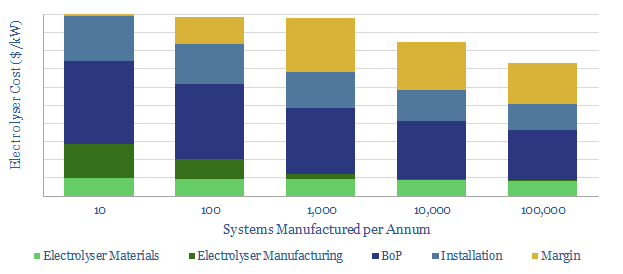

Carbon capture technologies are profiled in detail on pages 15-18. This is not simple CCS, but an array of 35GTpa potential, spanning a dozen themes, evaluated in our work.

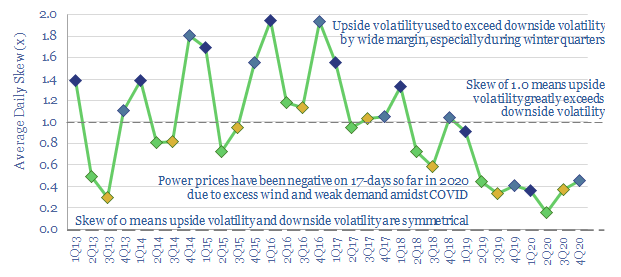

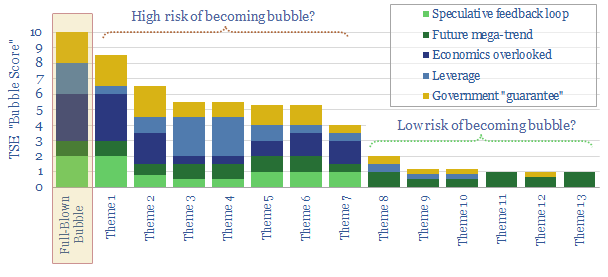

Why not rely more on renewables in the roadmap? Our work already assumes the ascent of wind and solar will double in speed, and reach 17% of total global energy by 2050. This would be a monumental achievement. But it is challenging to do more, as outlined on pages 19-24.

The best demand-side and efficiency technologies are presented briefly on page 25, including links to detailed research reports, underlying each theme.

What has changed? The report closes by comparing our latest decarbonization roadmap, in December-2020, with the roadmap we laid out in December-2019. The outlook has improved most for nature-based solutions, efficiency technologies and backing up renewables’ volatility.