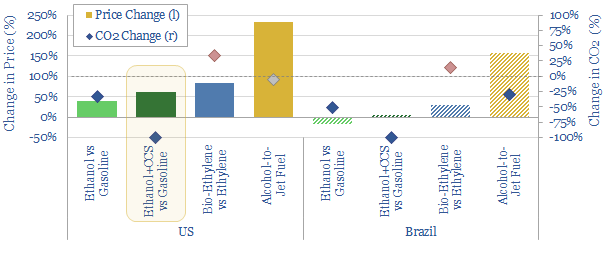

Could new technologies reinvigorate corn-based ethanol? This 12-page note assesses three options. We are constructive on combining CCS or CO2-EOR with an ethanol plant, which yields a carbon-negative fuel. But costs and CO2 credentials look more challenging for bio-plastics or alcohol-to-jet fuels.

Challenges for the bio-ethanol industry are re-capped on pages 2-3, building off of our recent research. Hence how could new technologies fix the economics and carbon credentials of corn-based ethanol?

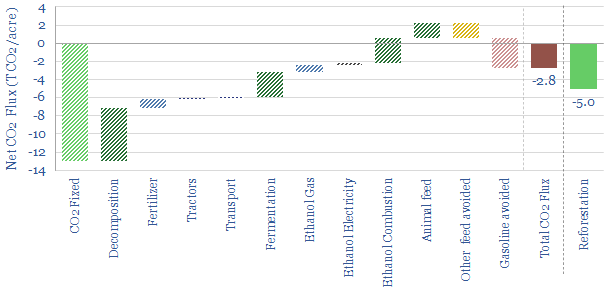

Our constructive outlook on ethanol + CCS is presented on pages 4-6. Ethanol plants have the unique advantage of a nearly pure CO2 stream from fermentation, allowing them to by-pass the costly and energy intensive amine process. The resultant fuel can be considered carbon negative. White Energy and Oxy are pursuing a project.

Our outlook for bio-plastics is presented on pages 7-10. Costs of bio-ethylene will likely be 2x higher than conventional ethylene, mainly due to running ethanol as a feedstock. Although encouragingly, ethanol dehydration could be 70% less energy intensive than ethane cracking.

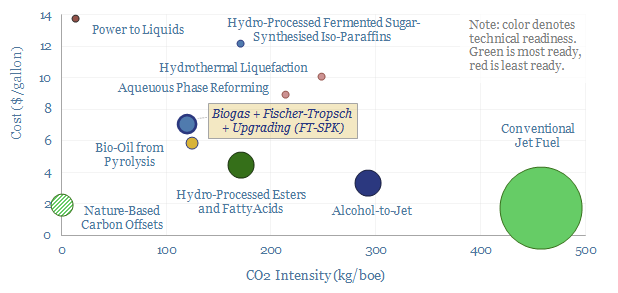

Our outlook for alcohol-to-jet fuel is presented on pages 11-12. If our numbers are correct, some projects could result in 3-4x higher costs compared to conventional jet, despite minimal CO2 savings. Thus companies in this space are pursuing more novel pathways.