-

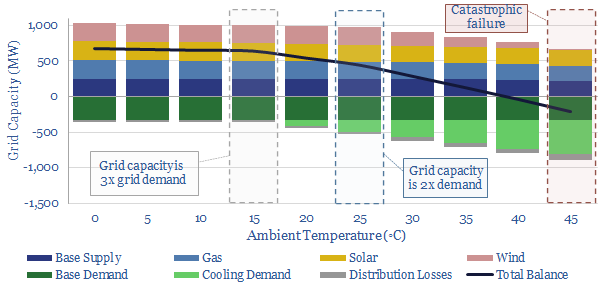

Power grids: hell is a hot, still summer’s day?

Ramping renewables to 50% of power grids is a growing aspiration. But in some markets, it may result in devastating blackouts during summer heatwaves, as power demand doubles exactly when wind, solar, gas, transmission losses and disruptions all deteriorate. This 15-page note assesses the implications.

-

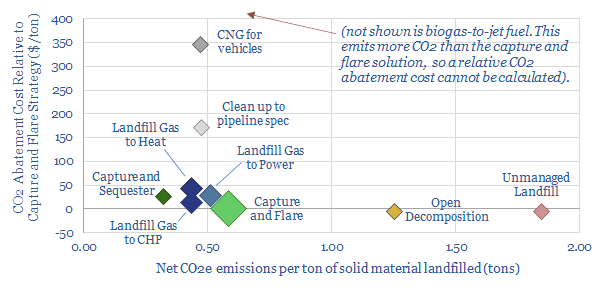

Landfill gas: rags to riches?

Methane emissions from landfills account for 2% of global CO2e. c70% of these emissions could easily be abated for c$5/ton, simply by capturing and flaring the methane. Going further, low cost uses of landfill gas in heat and power can also make good sense. But vast subsidies for landfill gas upgrading, RNG vehicles and biogas-to-jet…

-

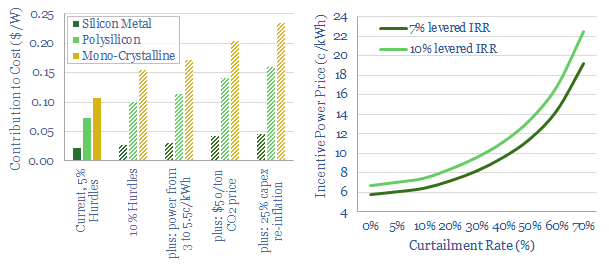

Solar costs: four horsemen?

Solar costs have deflated by an incredible 90% in the past decade to 4-7c/kWh. Some commentators now hope for 2c/kWh by 2050. Further innovations are doubtless. But there are four challenges, which could stifle future deflation or even re-inflate solar. Most debilitating would be a re-doubling of CO2-intensive PV-silicon?

-

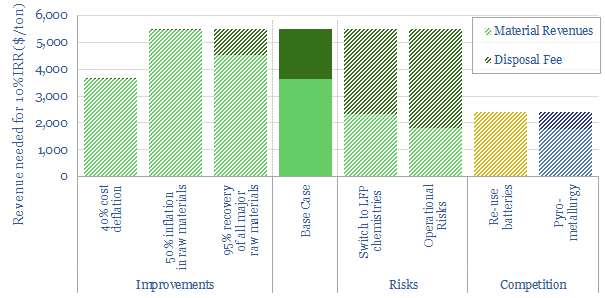

Battery recycling: long division?

Recycling lithium batteries could be worth $100bn per year by 2040 while supporting electric vehicles’ ascent. Hence new companies are emerging to recapture 95% of spent materials with environmentally sound methods. Our 15-page note explores what it would take for battery-recycling to become both practical and compelling.

-

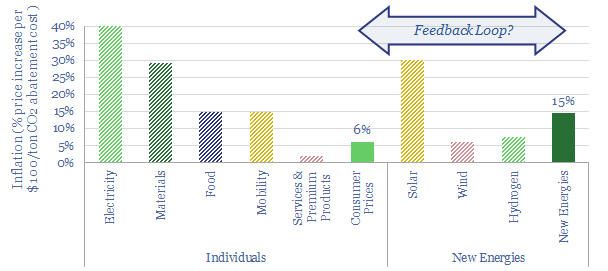

Inflation: will it de-rail the energy transition?

New energy policies will exacerbate inflation in the developed world, raising price levels by 20-30%. Or more, due to feedback loops. We find this inflation could also cause new energies costs to rise over time, not fall. As inflation concerns accelerate, policymakers may need to choose between delaying decarbonization or lower-cost transition pathways.

-

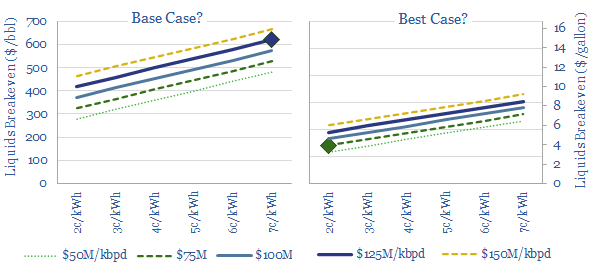

Electro-fuels: start out as a billionaire?

Electro-fuels are hydrocarbons produced from renewable power, CO2 and water. They are reminiscent of the adage that ‘the fastest way to become a millionaire is to start out as a billionaire then found an airline’. Because all you need for 1boe of these zero-carbon fuels is 2-3 boe of practically free renewable energy.

-

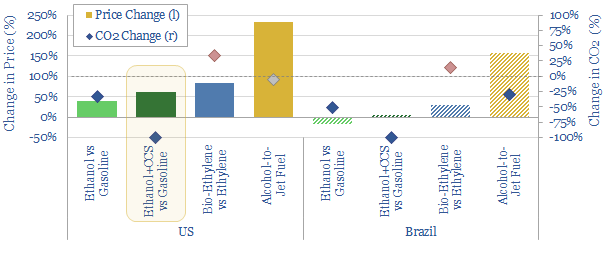

Ethanol: hangover cures?

Could new technologies reinvigorate corn-based ethanol? This 12-page note assesses three options. We are constructive on combining CCS or CO2-EOR with an ethanol plant, which yields a carbon-negative fuel. But costs and CO2 credentials look more challenging for bio-plastics or alcohol-to-jet fuels.

-

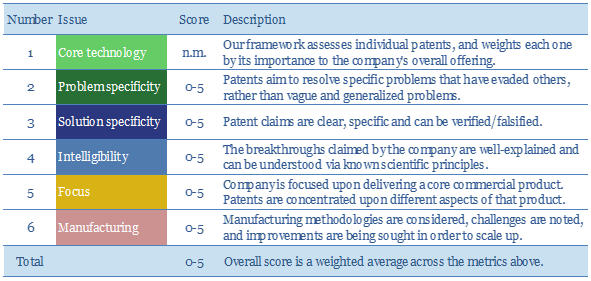

Emerging technologies: can you spot a fraud from patents?

This 11-page note looks back at 175 patents filed by Theranos, which promised a world-changing medical testing technology, but ultimately turned out to be a fraud. The analysis has helped us create a new framework, which we will be using to assess technologies in the energy transition.

-

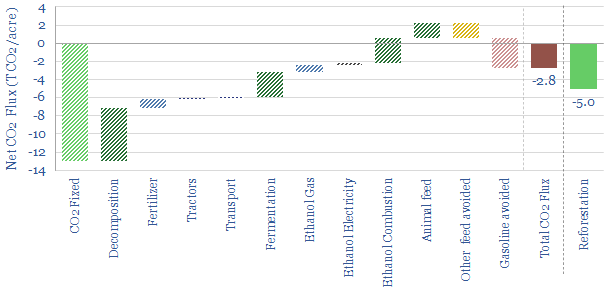

Ethanol: getting wasted?

30M acres of US croplands are used to grow corn for ethanol, with a CO2 abatement cost of $200/ton. However, if these same acres were reforested, they could absorb 2x more CO2, while farmers in the mid-West could have higher earnings. Hence this 15-page note asks could US biofuels be disrupted?

-

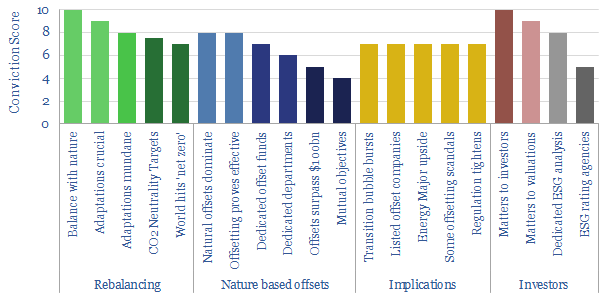

Carbon offset funds: the future of ESG?

Reaching ‘net zero’ is impossible without nature based carbon removals. Hence this 17-page note argues corporations will increasingly create internal groups to procure carbon offsets. We give twenty predictions and an analogy from labor reforms in 1850-1950.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)