Our 18-page note models the full-cycle economics of a green hydrogen value chain to decarbonize trucks. In Europe, at $6/gallon diesel, hydrogen trucks will be 30% more expensive in the 2020s. They could be cost-competitive by the 2040s. But the numbers are generous and logistical challenges remain. Green hydrogen trucks will most likely find adoption in niche applications, competing with other technologies, rather than as a wholesale shift to a hydrogen economy.

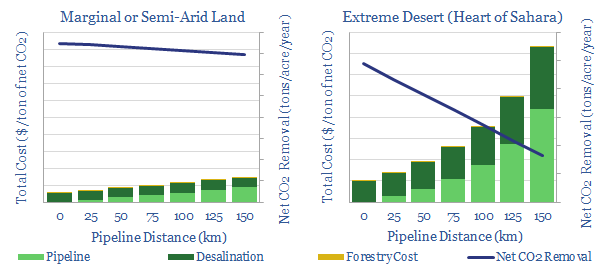

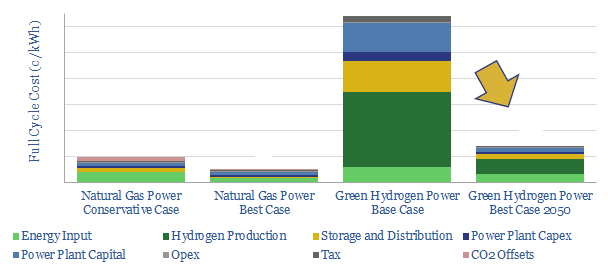

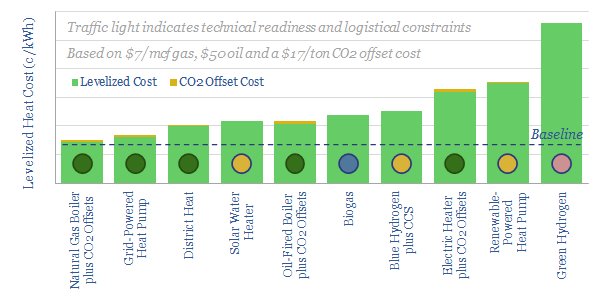

Costs of the green hydrogen value chain are summarized on pages 2-3, re-capping why we are relatively cautious on hydrogen in the power sector (note here).

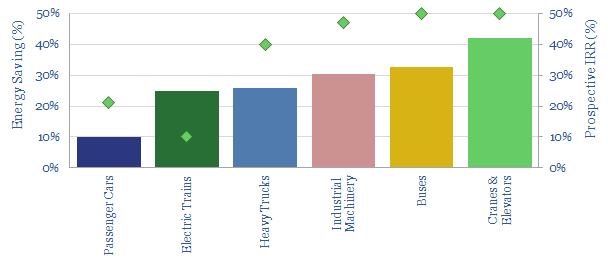

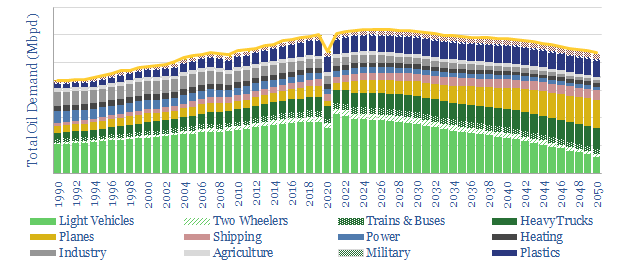

The opportunity in transportation may be much greater, including a lower hurdle for cost competitiveness, and environmental benefits over diesel trucks. (pages 4-5).

The economics of hydrogen fuel retail stations are outlined on pages 6-7, however, we acknowledge our numbers are optimistic for three key reasons.

Hydrogen trucks are compared against diesel trucks on pages 7-11, quantifying the relative differences in costs, ranges, fuelling speeds, functionalities and maintenance costs.

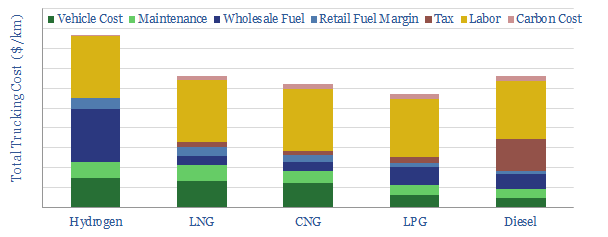

Full-cycle economics are compared on page 12-14, showing the relative costs of hydrogen, LNG, CNG. LPG and diesel; in Europe, in the US, with varying CO2 prices and in the 2040s.

Niche adoption of hydrogen is possible in some contexts, as outlined on page 15, but we think a full-scale shift to green hydrogen trucks is impractical and unlikely.

Technology leaders are profiled on pages 16-18, after reviewing 18,600 patents. We show which companies are commercializing hydrogen vehicles and fuelling stations, and the considerable complexities they are aiming to overcome.