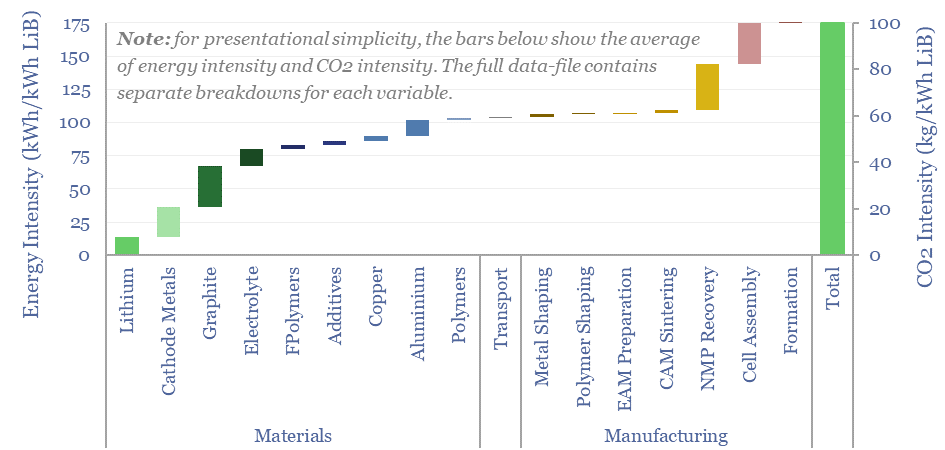

This data-file estimates the energy costs of lithium ion batteries across 17 lines. Our best estimate in 2024 is that manufacturing 1 kWh of lithium ion batteries requires 175 kWh of useful energy and emits 100kg of CO2. When a lithium ion battery is used in an electric vehicle, these up-front energy and CO2 costs should be repaid 10x over.

The energy intensity of lithium ion batteries depends on dozens of variables. We have attempted a full breakdown of the energy costs of lithium ion batteries simply by looking line-by-line, reaching a build-up of 175 kWh/kWh and 100kg/kWh. This means making the 70kWh battery for an electric vehicle will use 12MWH of energy and emit 7 tons of CO2.

Half of the energy use in lithium ion batteries is in materials, such as lithium, nickel, graphite, fluorinated polymers, fluorides, copper, aluminium and other plastics. The other half is in manufacturing, as input materials need to be powdered, shaped, slurried, sintered and dried, and then conditioned.

The energy costs of lithium ion batteries are likely to be repaid around 10-times over, when a lithium ion battery is deployed in an electric vehicle, which achieves 1,500-3,000 charge-discharge cycles over a 10-20 year operating life. Likewise, over its entire life, a lithium ion battery in an electric vehicle will save 10x more CO2 than was emitted in its manufacturing. Calculations are in the data-file.

It is interesting how these numbers have changed, when we updated our calculations in 2024, versus our previous calculations in 2019. Compared to five years ago, we think the energy intensity of lithium ion batteries is 40% lower and the CO2 intensity is 15% lower. This is mainly a function of manufacturing improvements, and a more detailed understanding of the supply chain.

The largest opportunity to reduce the energy intensity of lithium ion batteries further is switching to a dry process for electrode manufacturing. Specifically, today’s cathodes are formed by slurrying active materials in NMP, then evaporating off and recovering the NMP. This process may use as much as 40 kWh/kWh of energy. Some sources say that Tesla acquired Maxwell for its dry manufacturing process (notes in the data-file).

The second largest opportunity to improve the energy intensity of batteries is to switch away from NMC cathodes to LFP cathodes. This could save c10% of the total energy costs. Please see our comparison file for different battery compositions and their costs.

The third largest opportunity is raising the voltage and energy density of batteries. This amortizes the same energy costs over a higher output.

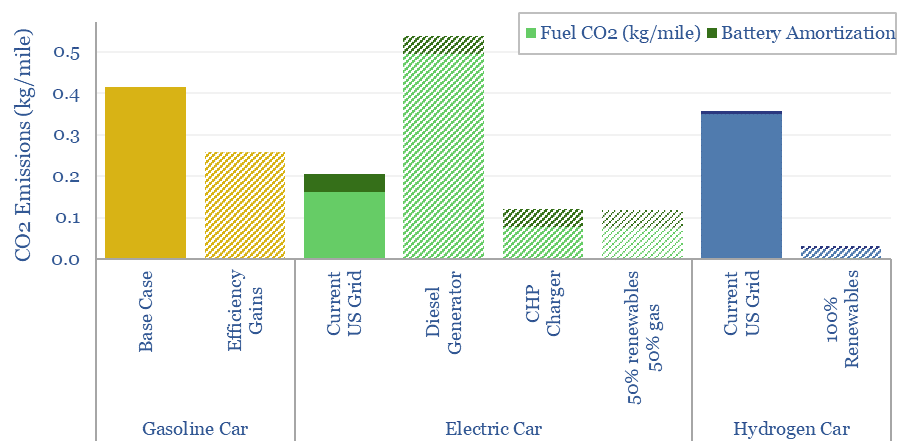

The total CO2 emissions per mile of ICE vehicles, electric vehicles and hydrogen cars are also built up in the data-file. After amortizing the CO2 emissions of producing the battery, the CO2 emissions per mile are 50% lower for an electric vehicle that is charged by the US power grid, compared to a base case ICE. Although an EV is not always cleaner, for example, if it is charged by a small diesel generator! Likewise hydrogen cars are only cleaner than ICEs if powered by low-carbon electricity.

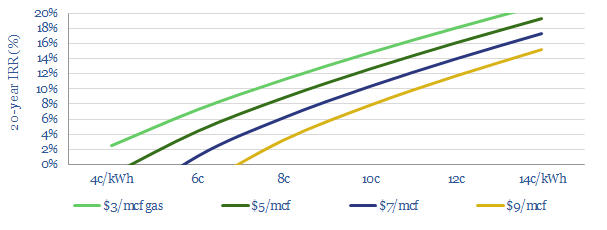

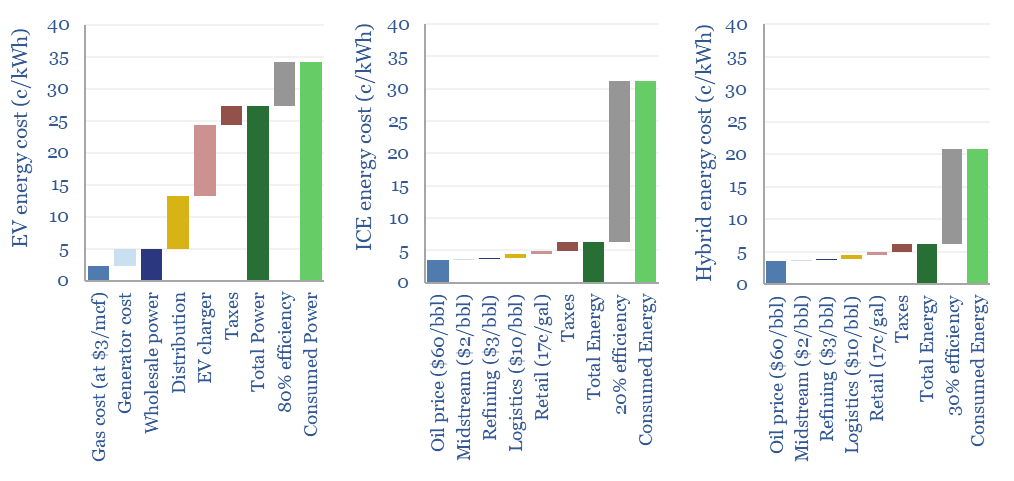

Financial costs of ICEs versus EVs per kWh can also be stress-tested in the data-file. In Europe, EVs are almost 50% cheaper per kWh or per mile. While in the US (charts below), it is not entirely clear that EVs are cheaper on a per kWh or per mile basis, especially compared to hybridization and other efficiency initiatives in combustion vehicles. Numbers can be stress-tested in the data-file.

The full data-file estimates the energy costs of lithium ion batteries across 17 lines, built up line by line, and readily stress-tested. Our best estimate in 2024 is that manufacturing 1 kWh of lithium ion batteries requires 175 kWh of useful energy and emits 100kg of CO2. When a lithium ion battery is used in an electric vehicle, these up-front energy and CO2 costs should be repaid 10x over.