-

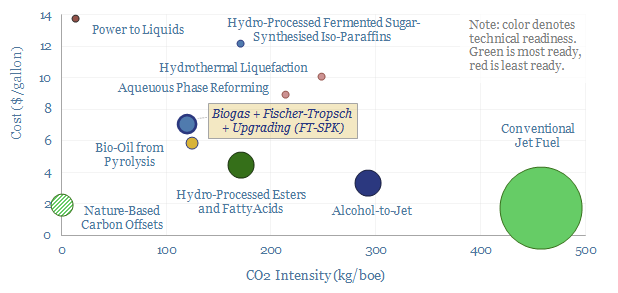

Biogas-to-liquids: decarbonize aviation fuels?

This 15-page report evaluates a pathway for sustainable aviation fuels, feeding biogas into a Fischer-Tropsch reactor. Bio-GTL will likely cost 3x more than conventional jet fuel, for a 75% reduction in CO2, giving an abatement cost of $550/ton. We still prefer nature-based carbon offsets to decarbonize aviation.

-

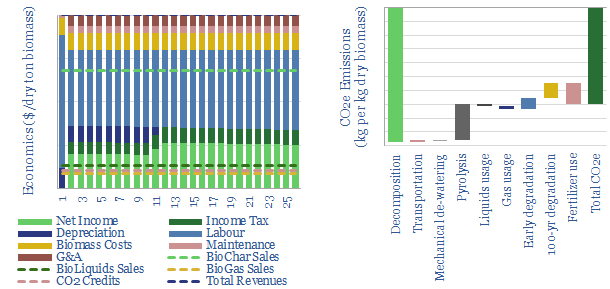

Biochar: burnt offerings?

Biochar is a miraculous material, improving soils, enhancing agricultural yields and avoiding 1.4kg of net CO2 emissions per kg of waste biomass. IRRs surpass 20% without CO2 prices or policy support. Hence this 18-page note outlines the opportunity.

-

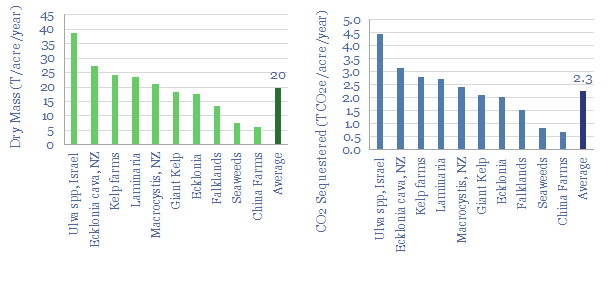

Offshore offsets: nature based solutions in the ocean?

Nature based carbon offsets could migrate offshore in the 2020s, sequestering 3GTpa of CO2 for a price of $20-140/ton. In a more extreme case, if CO2 prices reached $400/ton, oceans could potentially decarbonize the whole world. This 19-page note outlines the opportunity in seaweed and kelp.

-

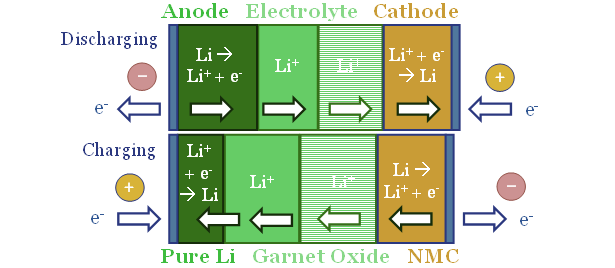

Solid state batteries: will they change the world?

Solid state batteries promise 2x higher energy density than lithium ion, with 3x faster charging and lower risk of fires. They could re-shape global energy, especially heavy trucks. But the industry has been marooned by uncontrollable cell degradation. QuantumScape’s disclosures claim it is light years ahead. But costs may remain high.

-

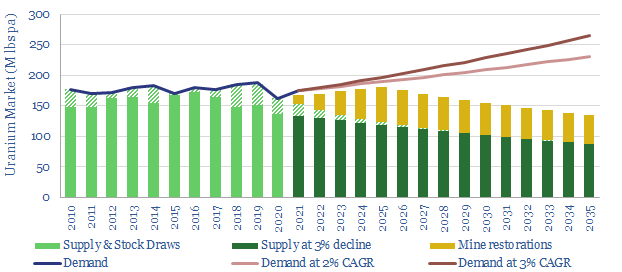

Nuclear power: what role in the energy transition?

Uranium markets could be 50-75M lbs under-supplied by 2030. This deficit is deeper than other commodities in our roadmap to net zero. Demand is driven by China, constructing reactors for 50-70% less than the West, yielding zero carbon power at 6-8c/kWh. This 18-page note presents the outlook and screens uranium miners.

-

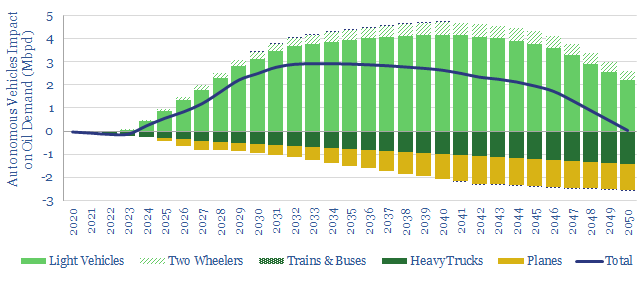

Oil demand: the rise of autonomous vehicles?

We are raising our medium-term oil demand forecasts by 2.5-3.0 Mbpd to reflect the growing reality of autonomous vehicles. AVs improve fuel economy in cars and trucks by 15-35%, and displace 1.2Mbpd of air travel. But their convenience also increases travel. This note outlines the opportunity.

-

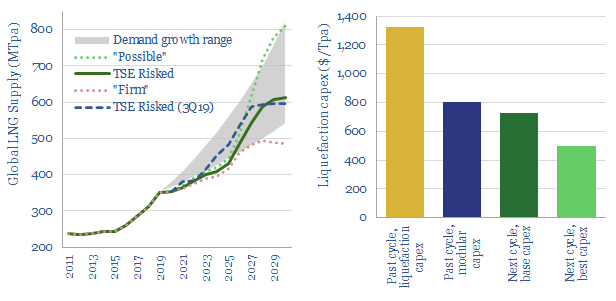

LNG in the energy transition: rewriting history?

A vast new up-cycle for LNG is in the offing, to meet energy transition goals, by displacing coal. 2024-25 LNG markets could by 100MTpa under-supplied, taking prices above $9/mcf. But emerging technologies are re-shaping the industry, so well-run greenfields may resist the cost over-runs that marred the last cycle.

-

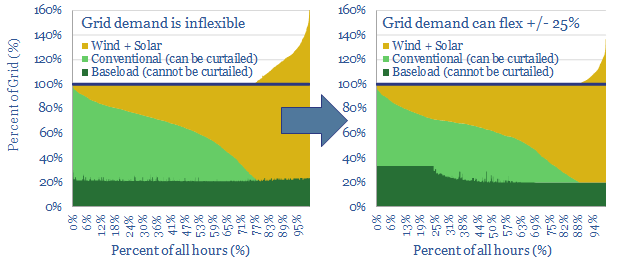

Shifting demand: can renewables reach 50% of grids?

25% of the power grid could realistically become ‘flexible’, shifting its demand across days, even weeks. This is the lowest cost and most thermodynamically efficient route to fit more wind and solar into power grids. We are upgrading our renewables ceilings from 40% to 50%. This 22-page note outlines the opportunity.

-

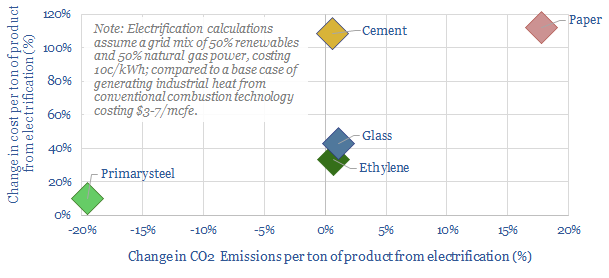

Industrial heat: the myth of electrify everything?

“Electrify everything then decarbonize electricity”. This mantra is dangerously incorrect for industrial heating. It raises output costs by 10-110% without lowering CO2. Our 19-page note presents case studies in the steel, cement, glass, petrochemical and paper industries, which exceed 15% of global CO2.

-

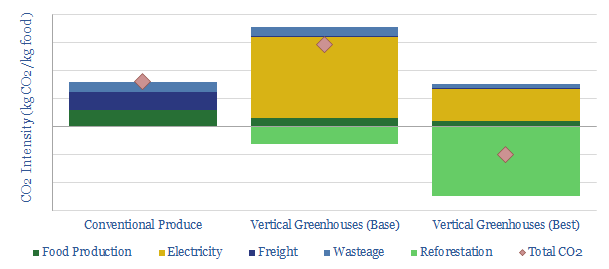

Vertical greenhouses: what future in the transition?

Vertical greenhouses achieve 10-400x greater yields per acre than field-growing, stacking layers of plants indoors, and illuminating each layer with LEDs. Economics are exciting. CO2 intensity varies. But it can be carbon-negative if powered by renewables. This 17-page case study outlines the opportunity.

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (831)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (351)