A vast new up-cycle for LNG is in the offing, to meet energy transition goals, by displacing coal and improving industrial efficiency. 2024-25 LNG markets could by 100MTpa under-supplied, taking prices above $9/mcf. But at the same time, emerging technologies are re-shaping the industry, so well-run greenfield projects may resist the cost over-runs that marred the last cycle. This 18-page note outlines who might benefit and how.

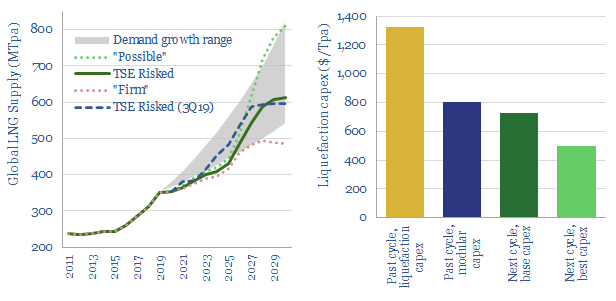

Global LNG supplies need to rise at an 8% CAGR to meet the energy transition objectives in our decarbonization roadmaps for China, Europe and broader industrial heat, as spelled out on pages 2-4.

But global LNG supplies are currently only set to rise at half of this rate, leaving a potential supply gap of 100MTpa by mid-decade, exacerbated by delays and deferrals amidst COVID (page 5).

Marginal costs for the LNG industry are disaggregated on pages 6-8, based on a detailed breakdown of capex costs, including upside-downside analysis of project characteristics.

Can future projects resist re-inflation if the industry undergoes a vast new up-cycle, as foreseen in our models? We present our reasons for optimism on pages 9-14, outlining evidence from 40 recent patents, plus the best new technologies from technical papers. This shows what the most resilient and lowest-risk projects will look like.

Beneficiaries in the LNG supply chain are described on pages 15-16, including next-generational modularization technologies, drone technologies to de-risk construction and the use of additive manufacturing for hard-to-manufacture components.

Beneficiaries among new LNG projects are described on pages 17-18, profiling examples and opportunities.