-

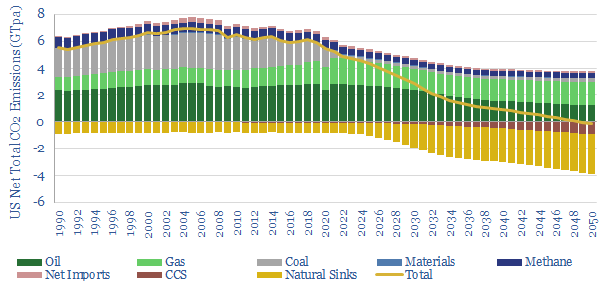

The great leveler: why CO2 prices are crucial?

Energy policies currently act as kingmakers for a select few transition technologies. But they offer no incentives for other, lower cost and more practical alternatives, which could economically decarbonize the whole world by 2050. Hence this 14-page note presents the top five arguments for a simple, transparent, economy-wide CO2 price. We also illustrate who would…

-

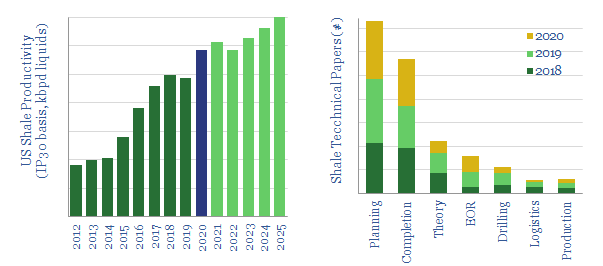

US Shale: the second coming?

US shale productivity can still rise at a 5% CAGR to 2025, based on evaluating 300 technical papers from 2020. The latest improvements are discussed in this 12-page note. Thus unconventionals could quench deeply under-supplied oil markets by 2025. Leading technologies are also becoming concentrated in the hands of fewer operators.

-

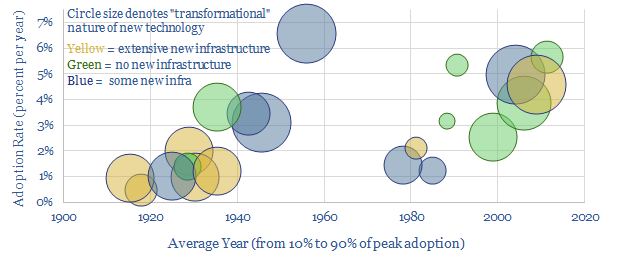

Technology transitions: thinking fast and slow?

It takes 15-100 years for a major new technology to ramp from 10% to 90% of its peak adoption rate. But what determines the pace? This 15-page note finds answers by evaluating 20 examples that changed the world from 1870 to 2020. We derive four rules of thumb, in order to quantify the pace at…

-

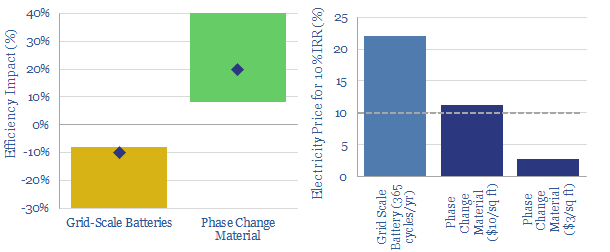

Backstopping renewables: cold storage beats battery storage?

Phase change materials could be a game-changer for energy storage. They can earn double digit IRRs unlocking c20% efficiency gains in freezers and refrigerators, which make up 9% of US electricity. This is superior to batteries which add costs and incur 8-30% efficiency losses. We review 5,800 patents and identify leading companies.

-

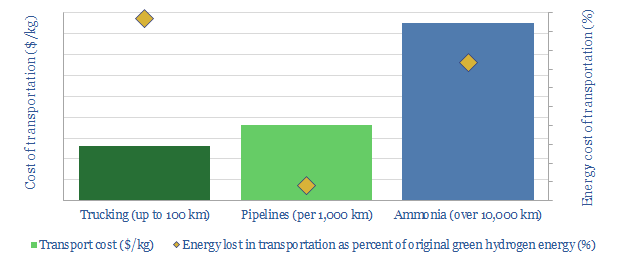

Hydrogen: lost in transportation?

Transporting hydrogen will be more challenging than any other energy commodity ever commercialised. This 19-page note reviews the costs and complexities of cryogenic trucks, pipelines and chemical carriers (e.g., ammonia). Midstream costs will be 2-10x higher than natural gas, while up to 50% of hydrogen’s embedded energy may be lost in transit.

-

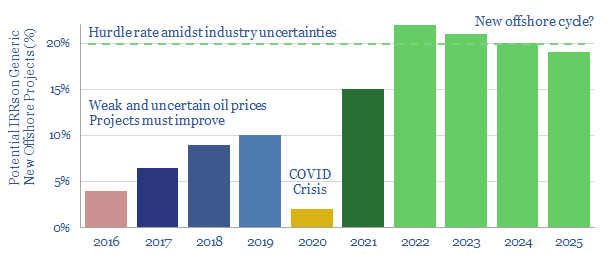

Turning the tide: is another offshore cycle brewing?

Oil markets look primed for a new up-cycle by 2022, which could culminate in Brent surpassing $80/bbl. This is sufficient to unlock 20% IRRs on the next generation of offshore projects, and thus excite another cycle of offshore exploration and development. We address potential pushbacks to the thesis and outlines who benefits.

-

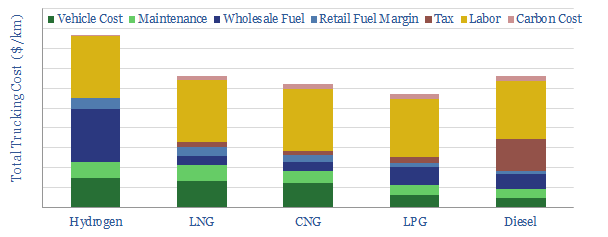

Green hydrogen trucks: delivery costs?

We have modelled full-cycle economics of a green hydrogen value chain to decarbonize trucks. In Europe, at $6/gallon diesel, hydrogen trucks will be 30% more expensive in the 2020s. They could be cost-competitive by the 2040s. But the numbers are generous and logistical challenges remain. Niche adoption is more likely than a wholesale shift.

-

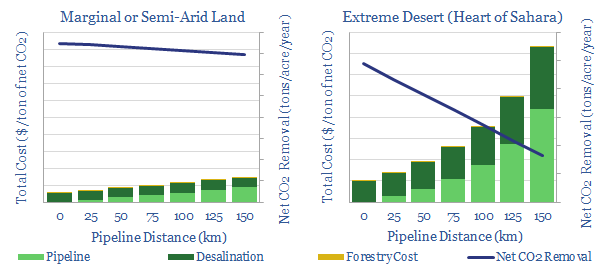

Green deserts: a final frontier for forest carbon?

Is there potential to afforest any of the world’s 11bn acres of arid and semi-arid lands, by desalinating and distributing seawater? Energy economics do not work in the most extreme deserts (e.g., the Sahara). Buy $60-120/ton CO2 prices may suffice in semi-arid climates. The best economics of all use waste water from oil and gas,…

-

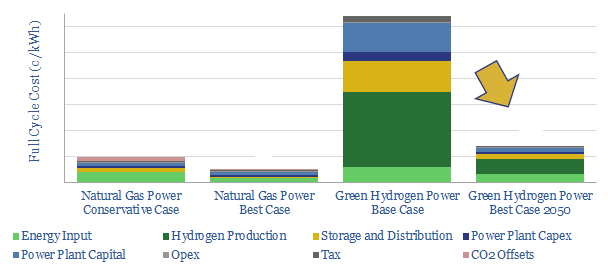

Green Hydrogen Economy: Holy Roman Empire?

We model the green hydrogen value chain: harnessing renewable energy, electrolysing water, storing the hydrogen, then generating usable power in a fuel cell. Today’s costs are very high, at 64c/kWh. Even by 2050, our best case scenario is 14c/kWh, which elevates household electricity bills by $440-990/year compared with decarbonizing natural gas.

-

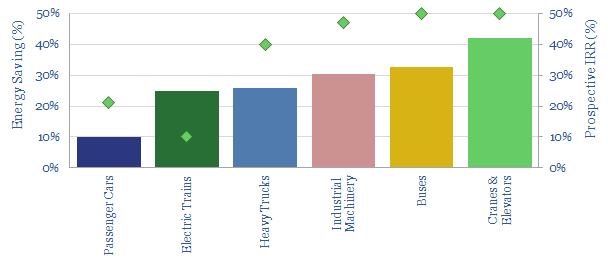

Energy storage: batteries versus supercapacitors?

Supercapacitors may eclipse lithium ion batteries in the hybridization of transport and industry. Their energy density is improving. Potential CO2 savings could surpass 1bn tons per year. IRRs of 10-50% can be achieved. This 20-page note presents are our conclusions after reviewing 2,000 Western patents, and identifies leading companies.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)