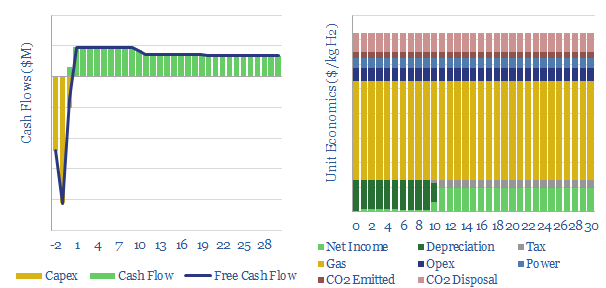

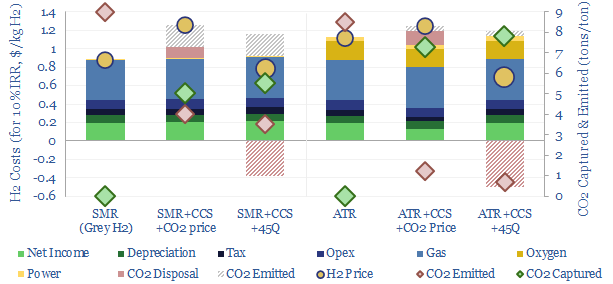

This data-file captures the costs of hydrogen production via reforming natural gas, either via steam-methane reforming (SMR) or autothermal reforming (ATR). Our base case costs of grey hydrogen are $0.6-0.9/kg, which rise to $1-1.5/kg costs of blue hydrogen when CO2 is captured. The file contains detailed mass balances and energy uses for SMRs and ATRs.

The costs of hydrogen production from methane reforming are modelled in this data-file, capturing SMRs, ATRs, grey hydrogen and blue hydrogen. Our best note discussing our conclusions for the industrial hydrogen industry is linked here.

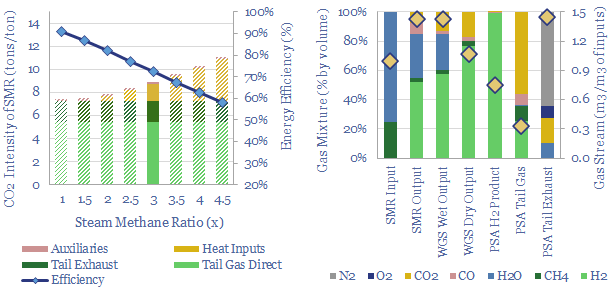

Steam methane reforming is the incumbent technology for hydrogen production, with over 115 SMRs currently operating in the US hydrogen industry. Our model breaks down the SMR process, stage by stage, including the mass flows and energy flows at each stage (chart below right). The CO2 intensity follows, and is largely determined by the steam-methane ratio (chart below left).

Our base case costs of grey hydrogen are $0.6-0.9/kg, and a good rule of thumb is that each $1/mcf on the input gas price will add $0.15/kg to the costs of the resultant hydrogen.

Costs of blue hydrogen production are modelled using inputs drawn from technical papers and chemistry. Our base case is in the range of $1/kg to $1.5/kg, depending on input gas prices, in order to earn a 10% IRR at a newbuild facility.

Auto-thermal reforming (ATR) is preferable to steam methane reforming (SMR) due to CO2 intensity (as quantified in tons/ton, or kg/kg, chart below). ATR eliminates 90% of the CO2 emissions, versus only 60% for SMR.

Reaction chemistry of blue hydrogen production drives these costs and CO2 intensities too, and the model estimates the relative balances of partial oxidation, combustion and water gas shift (all exothermic) versus steam methane reactions (endothermic).

Energy efficiency of blue hydrogen production is most likely c70%, converting the thermal energy in the methane molecule into thermal energy in hydrogen molecules (enthalpy basis). The main reason for the losses is driving endothermic reactions.

We find that blue hydrogen production may be competitive with CCS, and see an emerging boom in decarbonizing hydrogen-consuming value chains, especially blue ammonia and blue steel, and especially in the US Gulf Coast region, due to incentives under the Inflation Reduction Act.

For more on the complexities of real-world reactors, including minimizing uptime and reliability issues associated with ultra-high flame temperatures, please see our overview of Tospoe’s ATR technology.

Details from technical papers are aggregated in the final four tabs of the data-file, which also include our notes on blue hydrogen and an explanation of operating parameters in the model.

Please download the data-file to stress-test sensitivities to capex costs, opex costs, gas efficiency, gas prices, power prices, CO2 prices and fiscal regimes.