Downstream

-

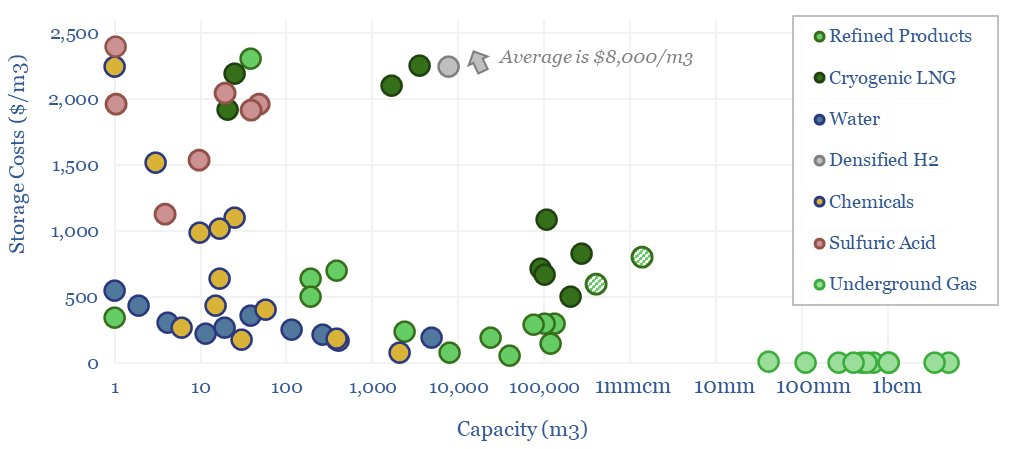

Storage tank costs: storing oil, energy, water and chemicals?

Storage tank costs are tabulated in this data-file, averaging $100-300/m3 for storage systems of 10-10,000 m3 capacity. Costs are 2-10x higher for corrosive chemicals, cryogenic storage, or very large/small storage facilities. Some rules of thumb are outlined below with underlying data available in the Excel.

-

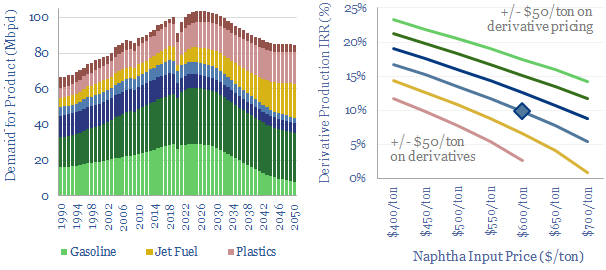

Crude to chemicals: there will be naphtha?

Oil markets are transitioning, with electric vehicles displacing 20Mbpd of gasoline by 2050, while petrochemical demand rises by almost 10Mbpd. So it is often said oil refiners should ‘become chemicals companies’. It depends. This 18-page report charts petrochemical pathways and sees greater opportunity in chemicals that can absorb surplus BTX.

-

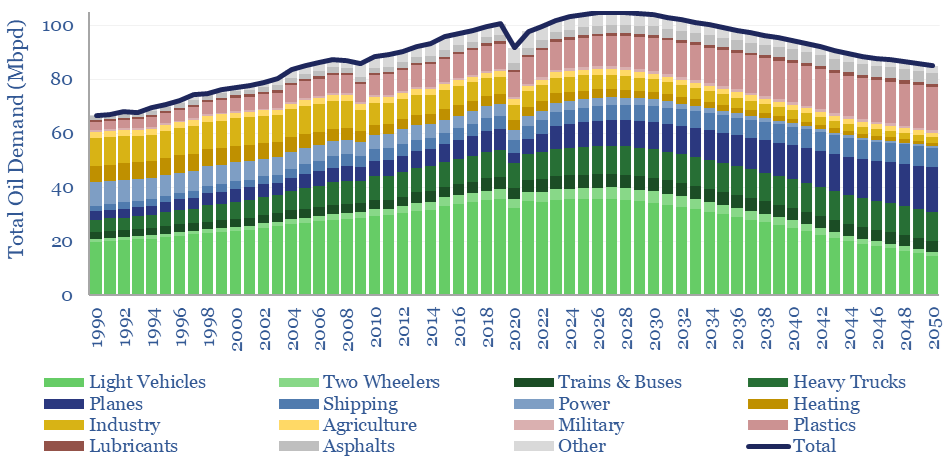

Global oil demand forecasts: by end use, by product, by region?

This model forecasts long-run oil demand to 2050, by end use, by year, and by region; across the US, the OECD and the non-OECD. We see demand gently rising through the 2020s, peaking at 105Mbpd in 2026-28, then gently falling to 85Mbpd by 2050 in the energy transition.

-

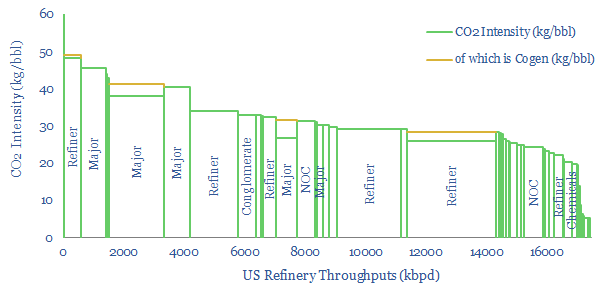

US Refinery Database: CO2 intensity by facility?

This US refinery database covers 125 US refining facilities, with an average capacity of 150kbpd, and an average CO2 intensity of 33 kg/bbl. Upper quartile performers emitted less than 20 kg/bbl, while lower quartile performers emitted over 40 kg/bbl. The goal of this refinery database is to disaggregate US refining CO2 intensity by company and…

-

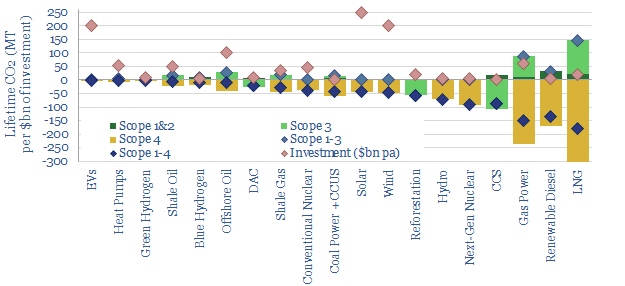

Scope 4 emissions: avoided CO2 has value?

Scope 4 CO2 reflects the CO2 avoided by an activity. This 11-page note argues the metric warrants more attention. It yields an ‘all of the above’ approach to energy transition, shows where each investment dollar achieves most decarbonization and maximizes the impact of renewables.

-

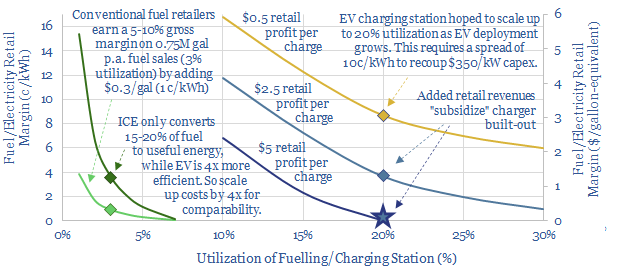

Electric vehicles: chargers of the light brigade?

This 14-page note compares the economics of EV charging stations with conventional fuel retail stations. Our main question is whether EV chargers will ultimately get over-built. Hence prospects may be best for charging equipment and component manufacturers.

-

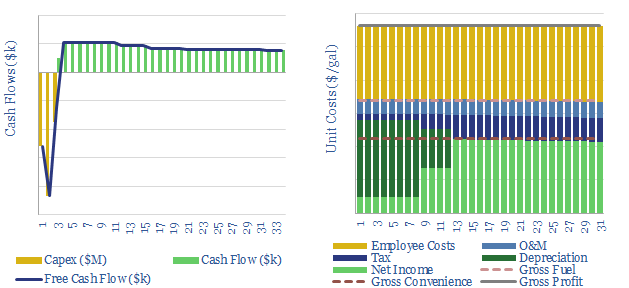

Fuel retail: economics of a petrol station?

This data-file captures the economics for a fuel-retailing “petrol station” to earn a 10% IRR. A typical EBIT margin is 17c/gallon; with a c6% margin on direct fuel sales; plus 10-20% of revenues from convenience retail at a higher, c25-30% margin.

-

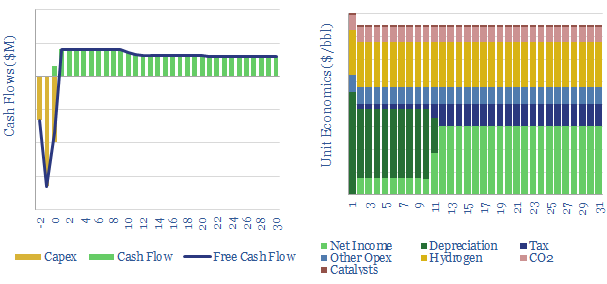

Hydroprocessing: the economics?

This model requires a $7.5/bbl upgrade spread to earn a 10% IRR across a new hydrocracking or hydrotreating unit. CO2 emissions are around 25kg/bbl. Green hydrogen could be used for decarbonization, but it would require 3x higher upgrading spreads to remain economical.

-

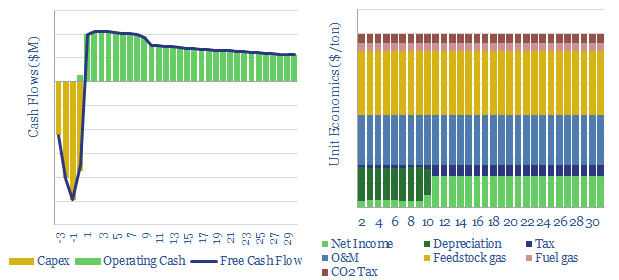

Methanol production: the economics?

This model captures the economics and CO2 intensity of methanol production in different chemical pathways. We find exciting potential for bio-methanol and blue methanol. These are logistically simple substitutes for oil products, but with lower carbon content. Full cost breakdowns can be stress-tested in the data-file.

-

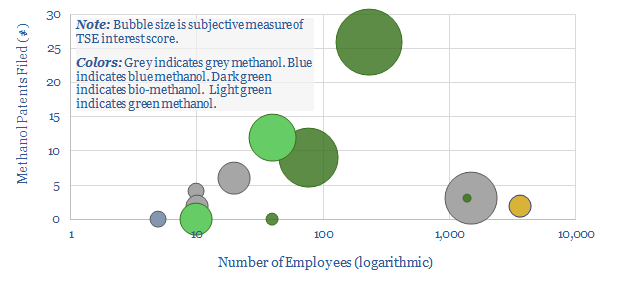

Methanol: leading companies?

This data-file tabulates details of companies in the methanol value chain. For incumbents, we have quantified market shares. For technology providers, we have simply tabulated the numbers of patents filed. For newer, lower-carbon methanol producers, we have compiled a screen to assess leading options.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)