Generac is a US-specialist in residential- and commercial-scale power generation solutions, founded in 1959, headquartered in Wisconsin, with 8,800 employees and $7bn of market cap. What outlook amidst power grid bottlenecks? To answer this question, we have tabulated data on 250 Generac products.

Generac‘s $4bn pa of sales, in 2023, were >50% residential, >35% commercial, 10% other. 80% was domestic within the US, and 20% was international. 12% is attributed to ‘energy technologies’ which includes storage, solar MLPE, EV charging, smart thermostats, electrification, etc. But what about the product mix? How is it exposed to power grid bottlenecks? Or indeed a broader US construction boom?

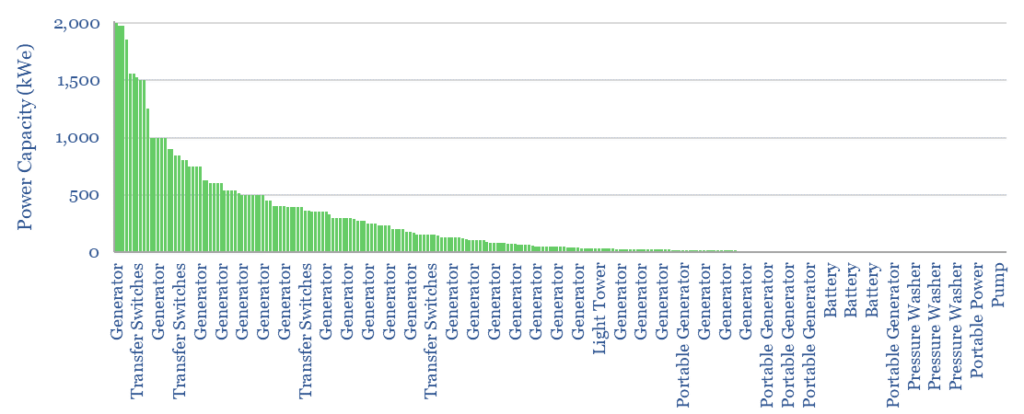

In this data-file, we have tabulated details on 250 Generac Products. 70% are generators, and another c10% are transfer switches to connect generators to loads. Our data show the breakdown of units by size, fuel, prices and other technical parameters.

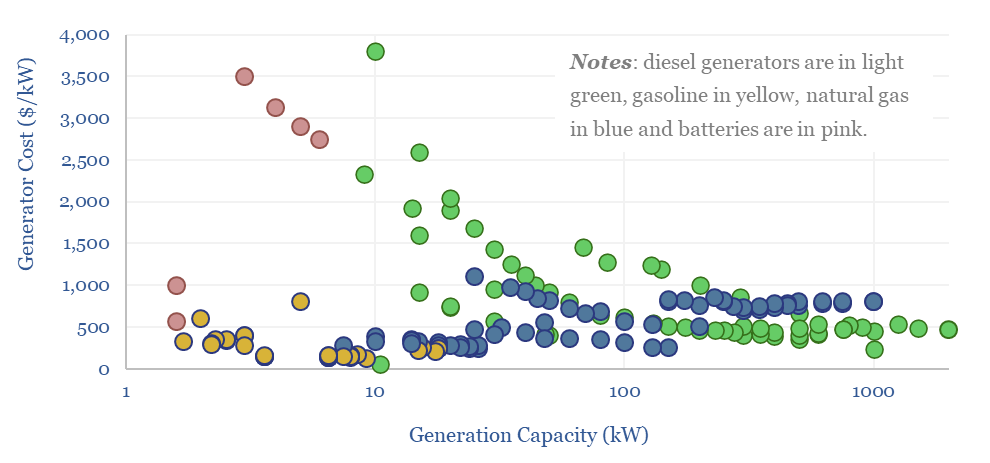

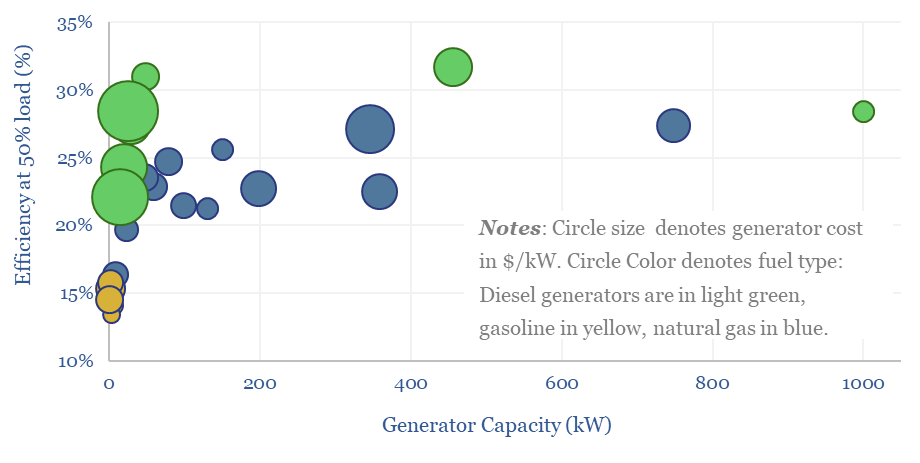

Residential solutions comprise 55% of Generac’s revenues, as 6% of US homes now have standby generators, but a smaller share of the SKUs. Our data show the average size (in kW), list prices (in $) and costs (in $/kW), but we also think low efficiency in some of these residential generation units is not entirely helpful for decarbonization aspirations.

Generac’s larger industrial generators range from 100kW to 2MW in size. Generac’s diesel-fired units cost $500/kW and are c30% efficient, while its larger gas-fired units cost $700/kW and are c25% efficient. These units tend to generate 10-40 kW/m3 of space, and discharge exhaust at 700-800ºC, so they could find application amidst grid bottlenecks?

In our base case model for a diesel genset, we assume a 16-20c/kWh LCOE is needed for a $700/kW installation of a 10MW unit with 42% efficiency buying wholesale diesel. Generac units would appear to have higher costs for reasons in the data-file.

In our base case model for a CCGT, we need a 6.5c/kWh LCOE at an $850/kW installation of a 300MW unit with 55% efficiency buying $4/mcf wholesale natural gas. Again, for the Generac units, we get to a higher LCOE, yes this is the area we think could be most economically justified by growing power grid bottlenecks, especially at industrial facilities that can harness the 700-800ºC waste heat.

Outside of the generation business, remaining SKUs comprise transfer switches to connect generators to loads, pressure washers, light towers for construction, pumps, batteries and mobile heaters, hence there may be heavy exposure to construction and infrastructure projects.