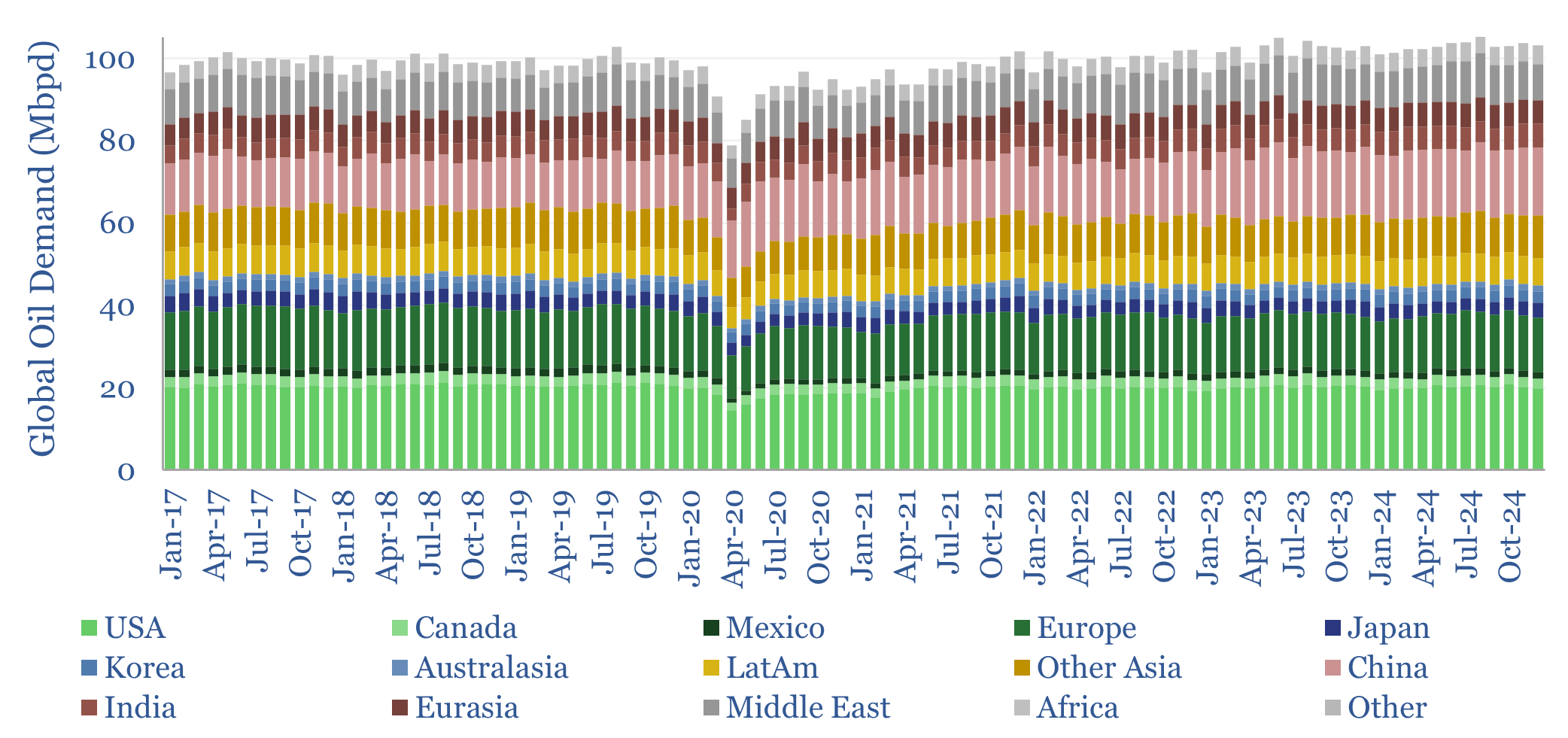

This data-file breaks down global oil demand, country-by-country, product-by-product, month-by-month, across 2017-2024. Global oil demand ran at 103 Mbpd in 2024, for +1.0 Mbpd of growth, according to our databases. For perspective, global oil demand rose at +1.2Mbpd per year in the 30-years from 1989->2019, so not much evidence, on face value, that “peak oil is nigh”.

This data-file is a breakdown of oil demand, month-by-month, across 120 countries/regions, and 12 oil products, from 2017 to 2024, based on the helpful online resource, JODI. We have compiled and cleaned the data as a reference for TSE clients.

Overall, global oil demand fell by -22Mbpd at trough in April-2020, during the COVID Crisis; and by -9Mbpd YoY in 2020 overall. Indeed, in 2020, many commentators were thus stating that 2019 would have been the all-time peak for fossil fuels, that demand would never recover to pre-COVID levels, and that the world should therefore “stop investing” in hydrocarbons.

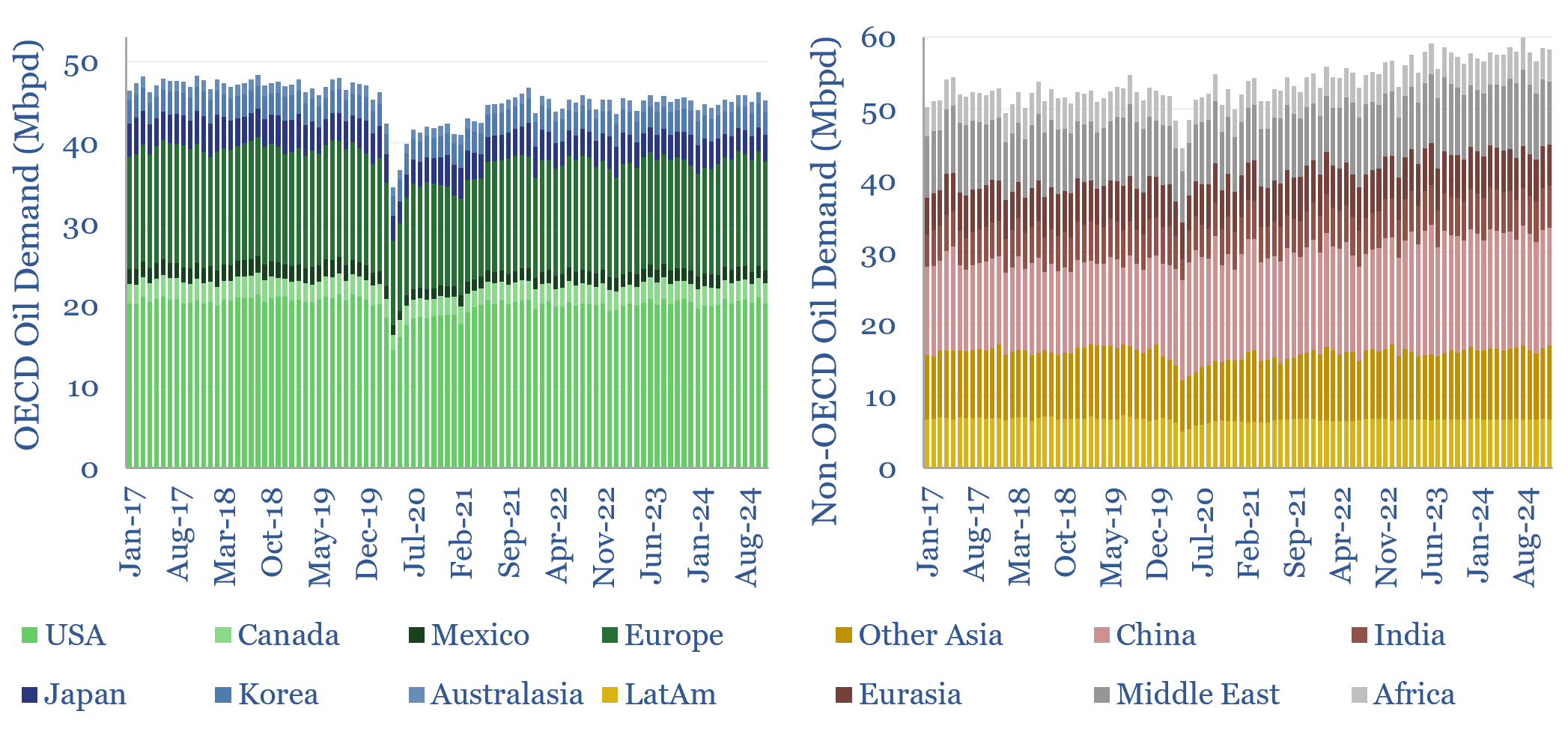

Yet in 2024, global oil demand again made a new all-time high, of 103Mbpd, which is around 3.5Mbpd higher than 2019 levels; of which +5.5Mbpd has been driven by the emerging world, while the developed world has declined -2Mbpd. It is worthwhile to dive into the numbers in further detail.

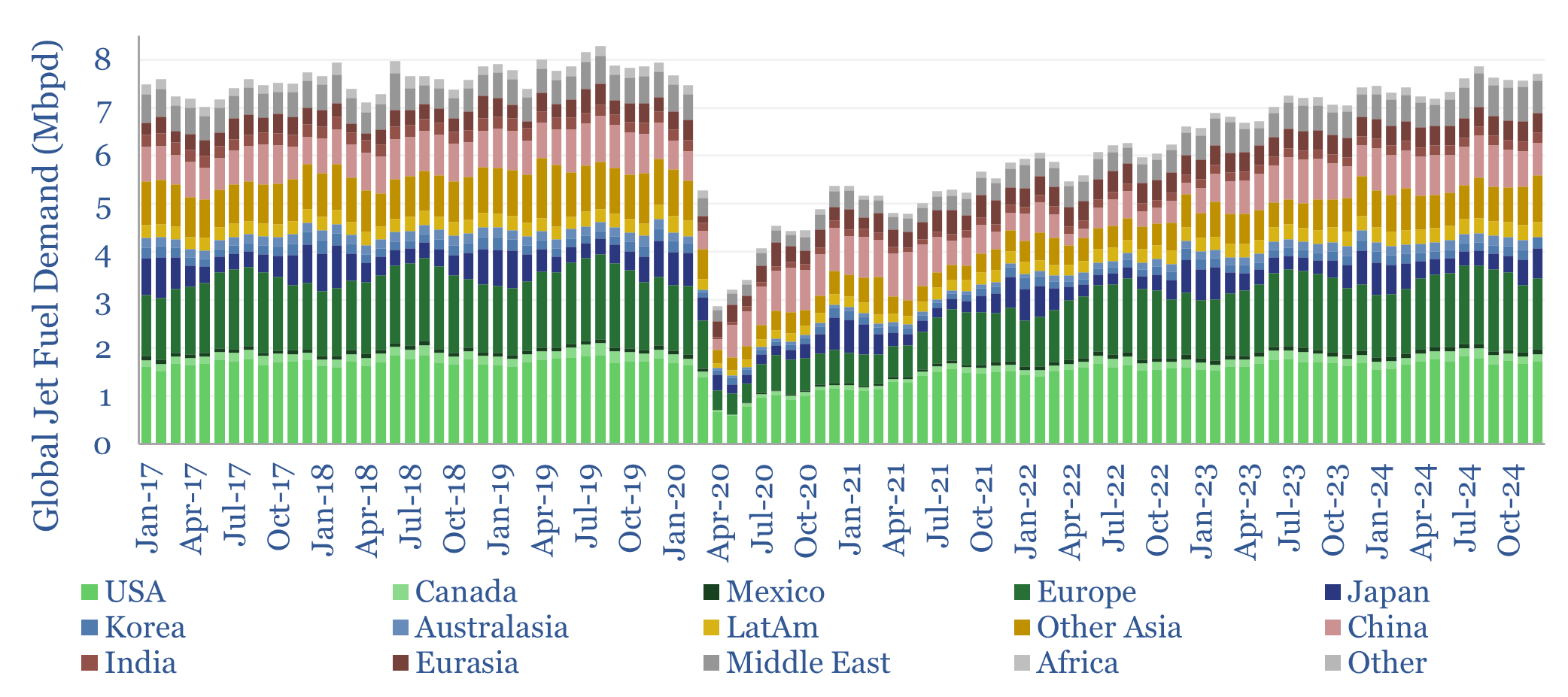

Jet fuel demand rose by +520kbpd in 2024, as it is still playing catch-up from COVID. For perspective, global jet fuel demand rose +0.2Mbpd in the 10-years from 2009->19 and we project +0.25Mbpd/year of growth ahead from 2024->34, in our forecasts for global jet fuel demand by region.

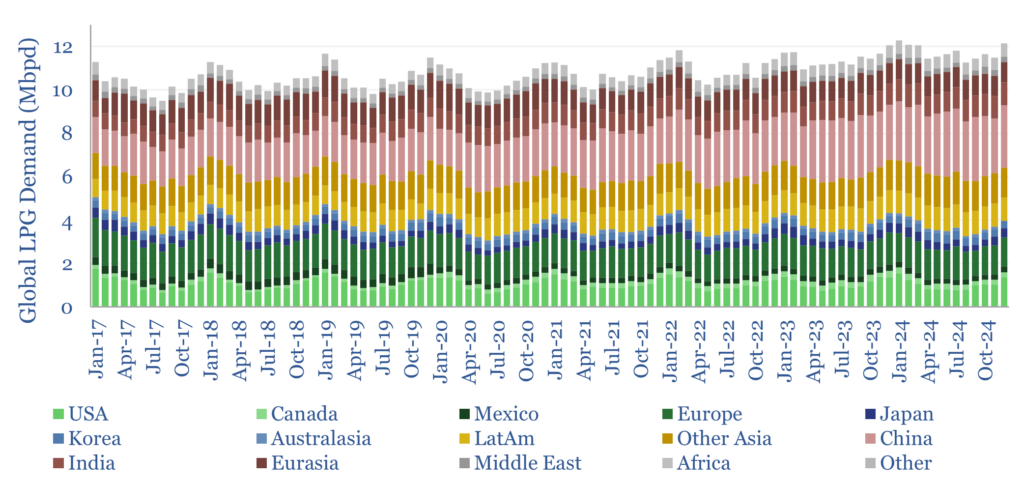

LPG demand, which is mainly for heating, was the second strongest category in 2024, growing +320kbpd YoY. This was almost all driven by China, India and other Asia. But it was counterbalanced by a c300kbpd reduction in the use of dirtier heating fuels, such as fuel oil and heavier distillates.

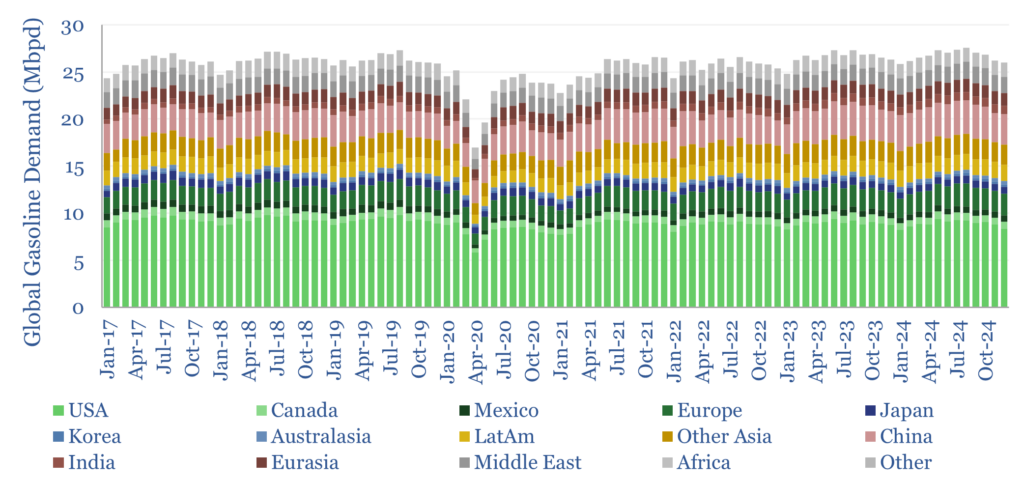

Road transportation fuels – gasoline and diesel – were flat on a global basis in 2024, as the OECD declined -200kbpd, while the non-OECD rose +200kbpd. Despite its amazing progress deploying 11M new EVs, China’s gasoline use still rose +60kbpd YoY in 2024. For more, please see our forecasts for global electric vehicle sales and broader vehicles research.

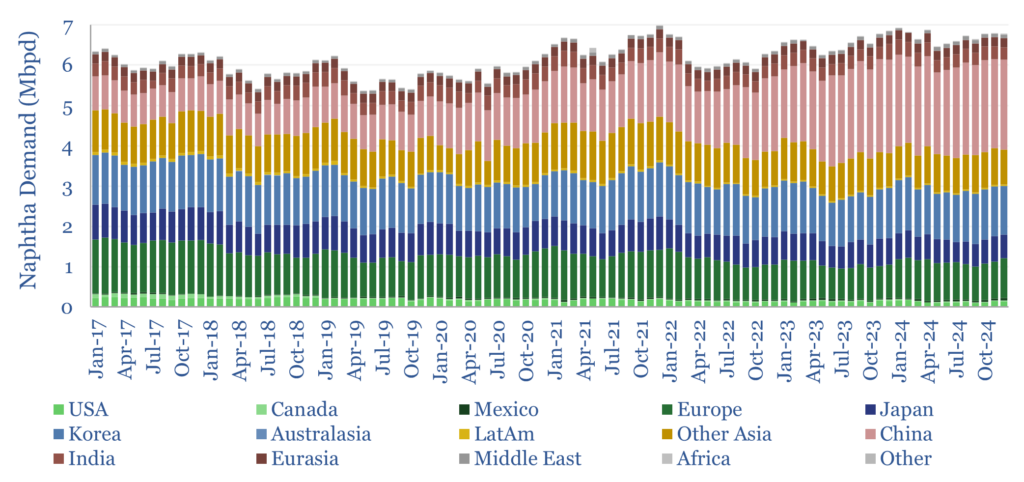

Naphtha use, for petrochemicals, rose +160kbpd YoY in 2024, compared to a 20-year average of +90kbpd/year. Our forecasts see plastic demand growing +0.15Mbpd/year in the next decade. Please see our forecasts for global plastic demand in the energy transition.

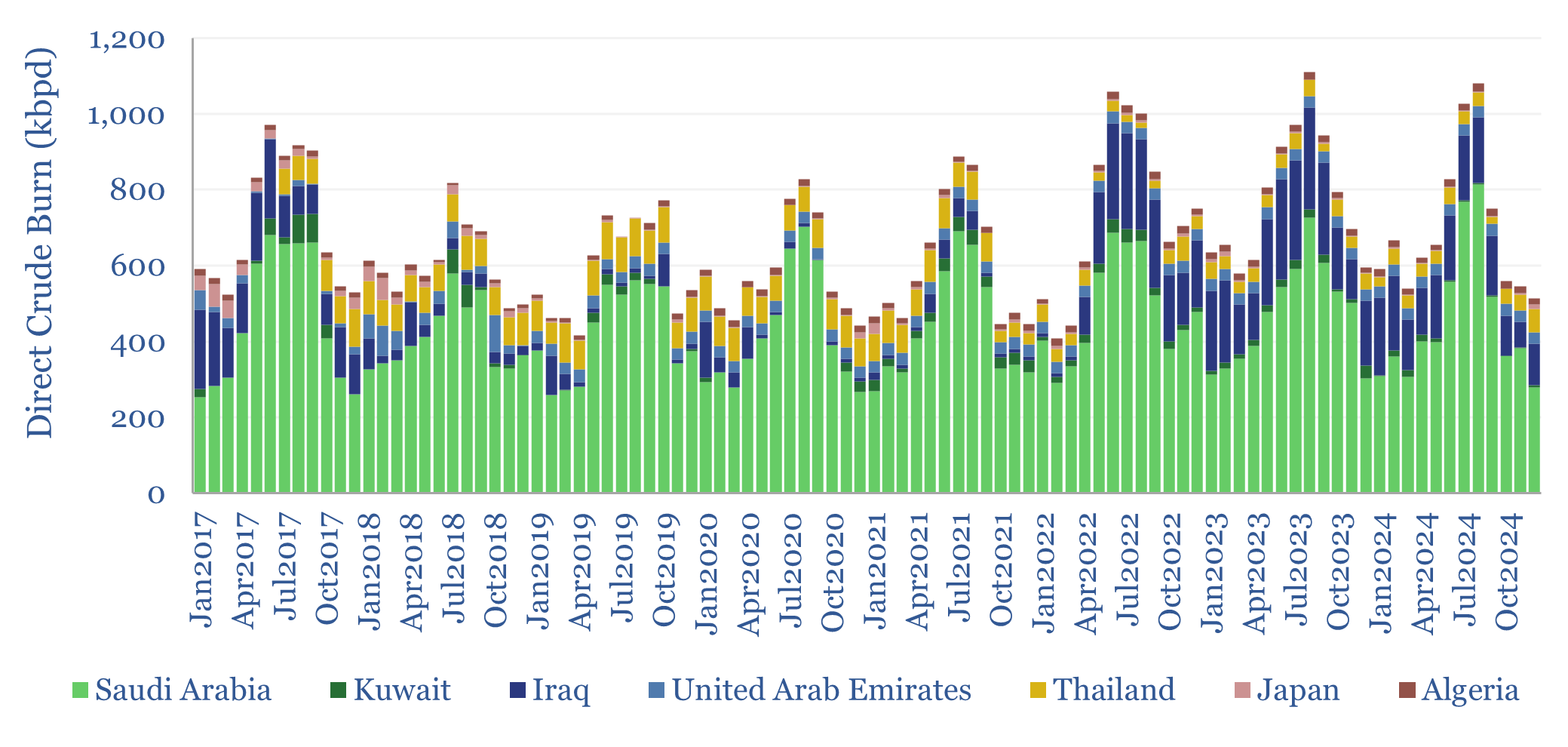

“Energy addition not transition” is a phrase that has resonated with us recently. We are massively bullish on the potential for solar energy to transform human civilization. Yet Saudi Arabia’s direct crude burn for power generation still made an all time high of 814kbpd in August-2024.

The IEA’s projections in early 2025 call for +1.1Mbpd of growth in global oil demand in 2025. If we had to guess, we would expect slightly less, maybe +0.8Mbpd in 2025, as jet growth normalizes, electrification continues (and ramifies with new initiatives such as battery swapping) and risks worsen for a slowdown in global trade. Our long-term oil demand forecasts are updated here.

However, there is some uncertainty in this data-set, as the original data-source (JODI) only covers 80% of the oil market. We estimate the remaining countries by taking a proxy from “analogous countries” (the methodology is described in our original report here). There is always some guesswork involved, including for the ever-elusive “other products” category, which can be particularly erratic, especially in countries such as China. Full details are in the data-file.