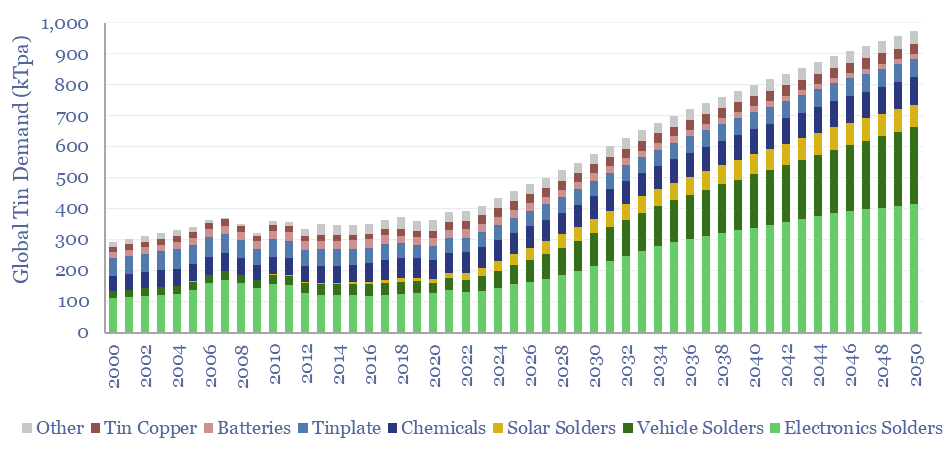

Global tin demand stands at 400kTpa in 2023 and rises by 2.5x to 1MTpa in 2050 as part of the energy transition. 50% of today’s tin market is for solder, which sees growing application in the rise of the internet, rise of EVs and rise of solar. Global tin supply and demand can be stress-tested in the model.

Global tin demand exceeds 400kTpa in 2023, in a market worth $10bn per year. 50% of the market is for solder, i.e., conductive material with a melting point around 180-200ºC, used to affix electrical connections onto circuit boards in semiconductors.

Global tin demand rises 2.5x as part of the energy transition, reaching 1MTpa by 2050. Mechanically, our model is linked to our model for solar additions, our model for global vehicle sales, our model for the rise of the internet and our model for global electricity demand.

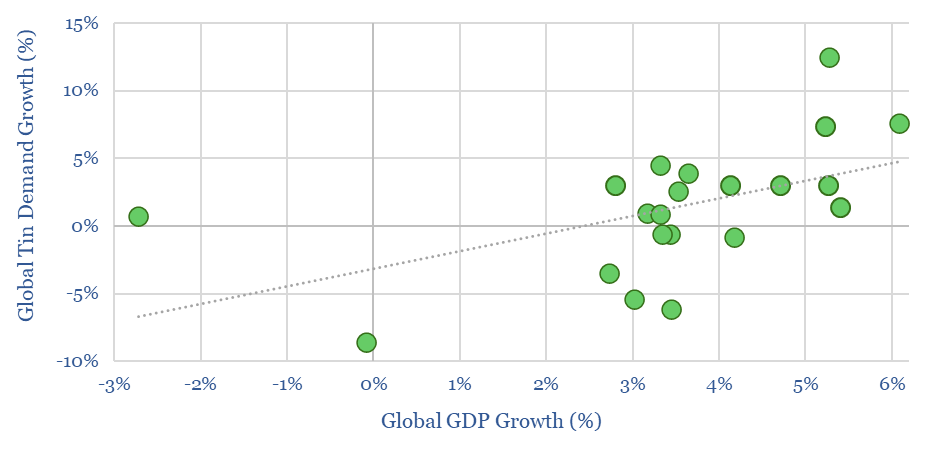

Demand forecasts can be stress-tested in the data-file, varying with GDP (chart below), future growth of solar, EVs and digital devices, phasing out of lead acid batteries for other battery alternatives and intensity of use factors: e.g., how much tin is used in a solar cell (in g/kW) or in an electric vehicle (in kg/vehicle).

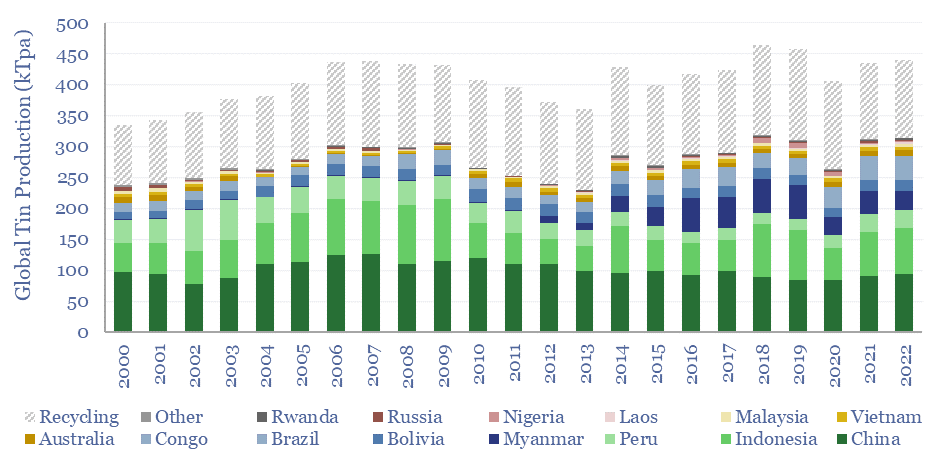

Our historical tin demand data is sourced from the International Tin Association and technical papers, while our historical supply demand is sourced from the USGS.

Primary global tin production is sourced almost entirely from emerging world countries, of which 30% is China, 25% is Indonesia, 15% is Myanmar and c10% is Peru (chart below). Hence primary production is dominated by emerging market firms.

Two listed European companies with exposure to tin are also noted in the data-file. One is a metals recycling company, Aurubis, and the other has the world’s leading technology for tin-smelting.