This data-file looks through 17 major nuclear plants in Japan with 45GW of operable capacity, covering the key parameters and restart news on each facility. Japan’s nuclear restart had ramped output back to 78TWH pa by 2023, and may rise by a further 100 TWH by 2030, to meet targets for 20% nuclear in the country’s generation mix.

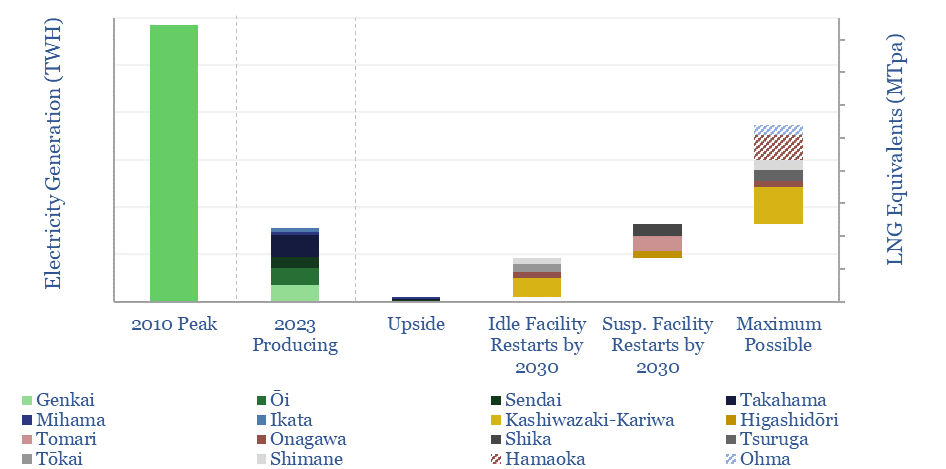

In 2010, before the Fukushima crisis, Japan produced 292 TWH of nuclear electricity, which would have required about 40MTpa of LNG imports if it had all been generated by gas power instead.

With all its nuclear plants shut down in 2011-12, LNG imports jumped by around 20MTpa, while the remaining shortfall was covered by ramping oil-fired power back upwards by c600kbpd.

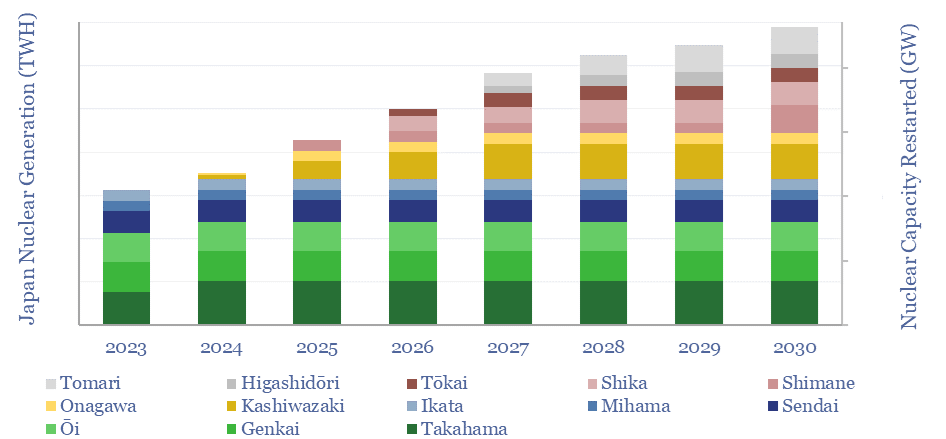

Japan’s nuclear restart is evaluated in this data-file, tracking Japanese nuclear output by facility. Sendai was the first facility to restart, in 2015, after passing “the world’s toughest safety screening” and adding anti-terrorism safeguards.

Japan’s nuclear restart also includes output from Takahama, Ikata, Mihama, Genkai, Ōi and Sendai, by 2024. Output by facility is shown in the ‘RestartSchedule’ tab. Restarting many facilities requires safety upgrades and lifetime extensions.

Every reactor restarted so far has been a PWR. BWRs (like Daiichi) are more costly to upgrade to new safety standards (work on safety measures for Onagawa BWR started in 2013 and has cost $4.5bn), or there is more public opposition to restarting BWRs (local government must give its approval to restart a reactor).

Japan’s GX Decarbonisation Power Supply Bill came into force in 2024, and aims to ramp the share of nuclear electricity from 5% to over 20% by 2030. This is captured in our estimates, which see partial restarts at Kashiwazaki-Kariwa (the largest nuclear plant in the world), Higashidōri, Onigawa, Shika, Shimane, Tōkai and Tomari.

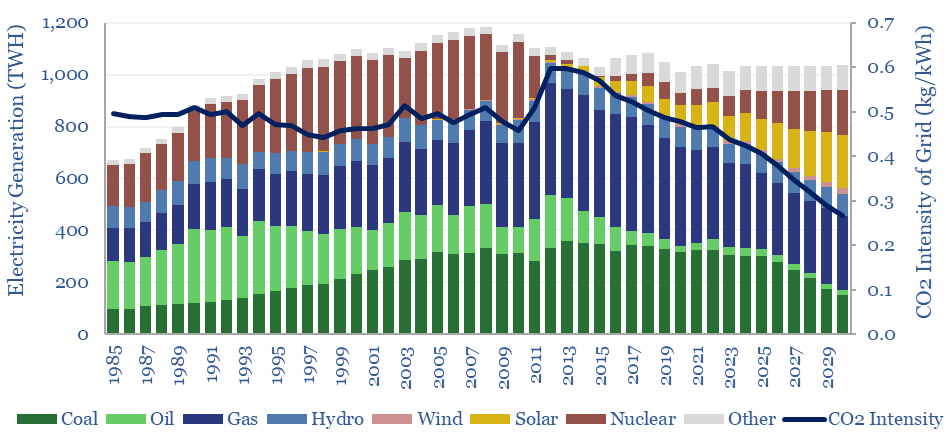

As of July-2024, we have also included a simple model of Japan’s electricity mix, from 1985 to 2023, plus our forecasts through 2030. The best option for decarbonization would be to ramp nuclear, solar, hydro and wind, hold LNG imports flat, and then reduce coal use by 60%, which can halve total CO2 intensity of Japan’s grid by 2030. Numbers can be stress-tested in the data-file.

Total global nuclear generation is around 2,800 TWH pa, so adding 100TWH of generation in Japan is c3.5% upside, and adds 6M lbs of demand to uranium markets. The impact is milder on LNG markets, especially if the nuclear ramp predominantly displaces coal. For further details, please see our outlook for nuclear in the energy transition.