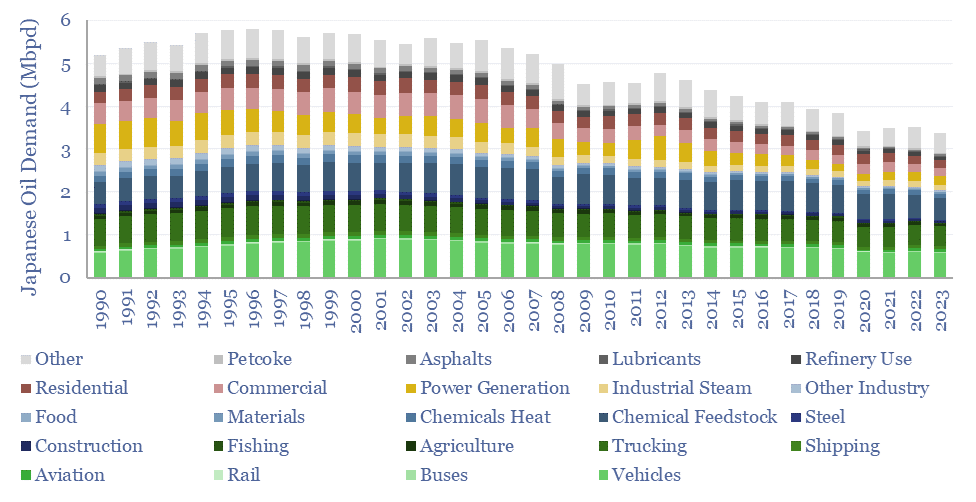

Japan’s oil demand peaked at 5.8Mbpd in 1996, and has since declined at -2.0% per year to 3.4Mbpd in 2023. To some, this trajectory may be a harbinger of events to come in broader global oil markets? While to others, Japan has unique features that will not generalize?

The 7-page report, linked via the first button below, contains our own observations into Japan’s oil demand, which does not generalize globally.

The data-file, linked via the second button below, contains all of the underlying data, to interrogate Japanese oil demand over time.

Our roadmap to net zero sees global oil demand rising to 105Mbpd in the mid-late 2020s, then declining at a rate of -1%pa to 85Mbpd by 2050. But does Japan’s decline in oil demand, set a precedent for steeper declines ahead?

This 7-page note argues that there are key features of Japan’s energy mix, which mean its history cannot be generalized more broadly: including Japan’s reliance on imports motivating efficiency gains across the board (pages 2-3), declines in manufacturing activity (pages 4-5) and the underlying structure of Japan’s oil market, which has always been weighted to easy-to-substitute categories (pages 6-7).

The underlying data-file breaks down Japan’s oil demand over time, based on data from METI, across Passenger Vehicles, Commercial Vehicles, Motorcycles, Taxis, Buses, Trucking, Rail, Aviation, Shipping, Agriculture, Mining, Construction, Steel, Chemical Feedstock, Chemicals Heat, Materials, Food, Industrial Heat, Industrial Steam, Retail, Hotels, Restaurants, Hospitals, Schools, Waste Collection, Commercial, Power Generation, Residential Heat, Refineries, Lubricants, Asphalts, Petcoke, annually, from 1990 to 2023.

The underlying data-file also breaks down Japan’s oil demand across all of these categories, for different oil products: total oil products, gasoline, distillates, jet fuel and fuel oil.

Further data is available on the TSE site into Japan’s gas and power demand, energy security, population and GDP, and other commodities supply-demand.