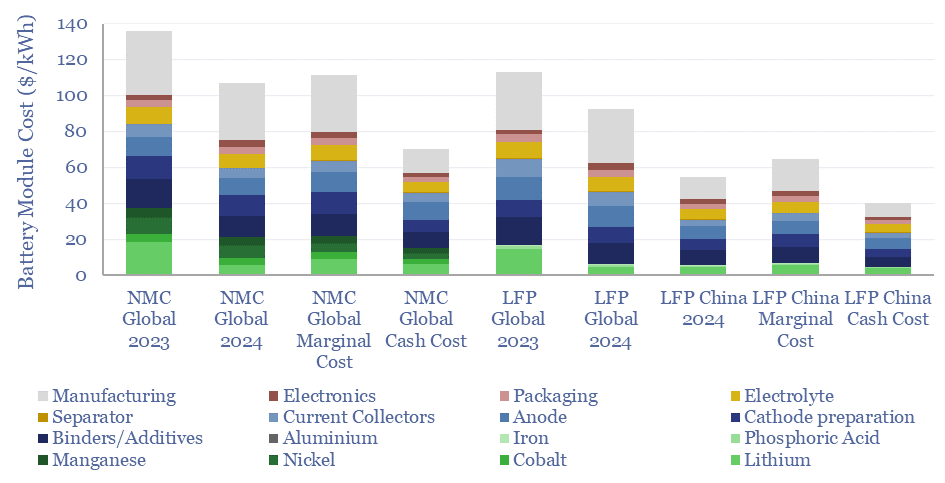

Lithium ion battery costs range from $40-140/kWh, depending on the chemistry (LFP vs NMC), geography (China vs the West) and cost basis (cash cost, marginal cost and actual pricing). This data-file is a breakdown of lithium ion battery costs, across c15 materials and c20 manufacturing stages, so input assumptions can be stress-tested.

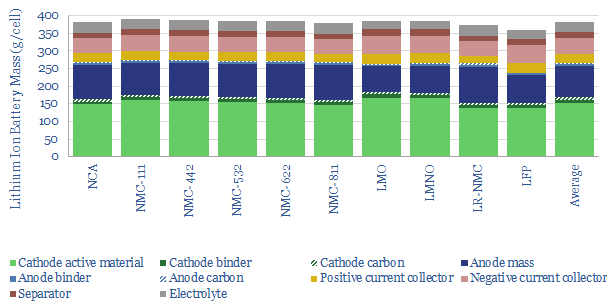

This data-file disaggregates the materials used in lithium ion batteries and their costs. The breakdown covers 25 categories (e.g., lithium, nickel, graphite), across 10 different battery chemistries (e.g., NCA, NMC, LFP and others, chart below).

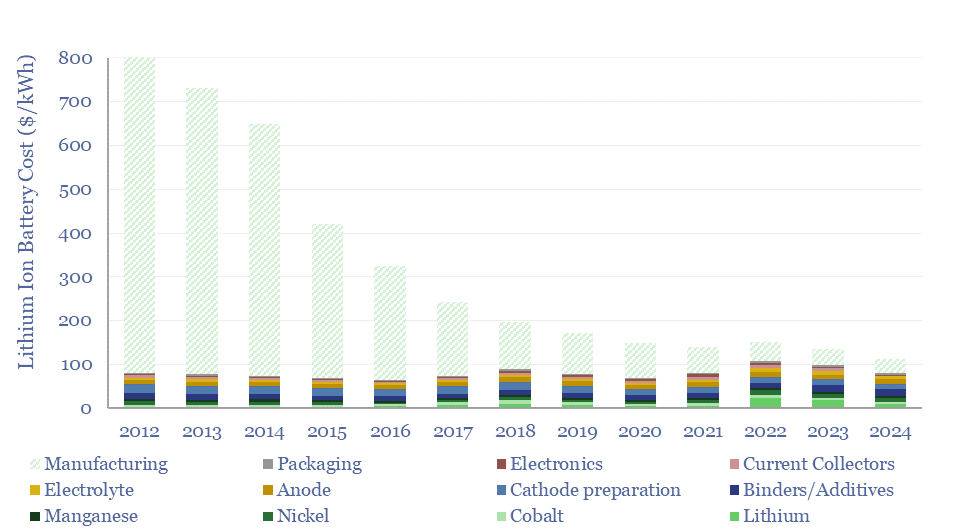

Materials costs of lithium ion batteries can be calculated by comparing our mass balances above with the costs of different input commodity prices. Materials were 10% of the cost of a lithium ion battery in 2012, 50% in 2019, and as much as two-thirds during the commodity price spikes of 2022, when 8 of the 14 materials in our build-up rose to new ten-year highs. Over the past ten years, the cost of input materials has risen at a 3% pa CAGR.

The chart below shows the material costs of lithium ion batteries compared with the total cost of battery packs, estimated by BNEF. The comparison shows that it may be hard to continue the pace of deflation from the past decade without materials ‘thrifting’, while materials pricing is going to dictate the future trajectory of battery costs.

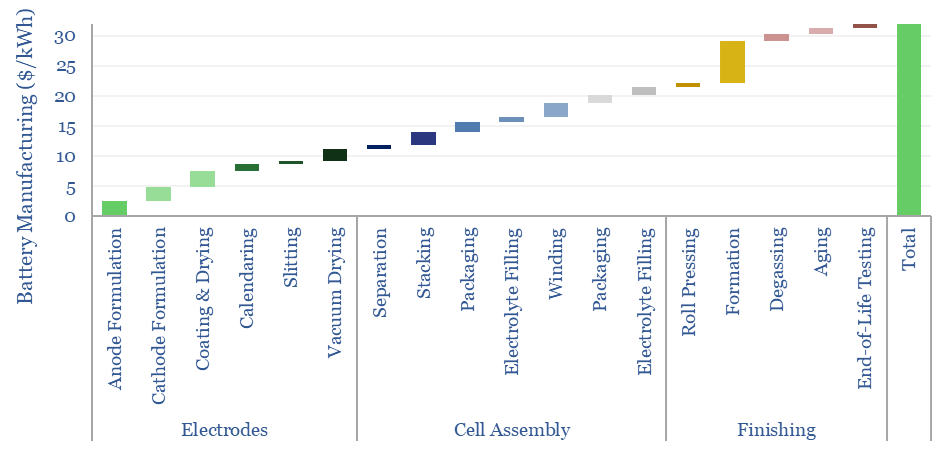

Manufacturing costs of lithium ion batteries are 45% electrode manufacturing (the largest line is coating and drying), 30% cell finishing (the largest line is formation) and 25% cell assembly. There is a full build-up across 20-lines in the data-file, based on the capex costs of highly specialized equipment, electricity prices, O&M costs and required returns.

LFP battery chemistries are a contender that can eliminate the use of nickel, manganese and cobalt. This comes at the expense of c20% lower energy density than NMC cells. It is not that the cells are heavier, but that LFP batteries run at 3.2V, versus others at 3.6V. Although some evidence also suggests LFP cells have lower battery degradation rates.

The scale-up of Chinese manufacturing is the other major cost improvement taking place in global battery supply chains. Full-cycle manufacturing costs can be 50% lower than in the West, while cash manufacturing costs are c60-75% lower again, which is relevant amidst China’s history of overbuilding capacity in other value chains such as solar and PV silicon. We published a deep-dive report into Chinese LFP battery costs in Sep-2024.

Our numbers also hinge on the capex costs of battery gigafactories, which are tabulated across 40 case studies, in a separate data-file shown below.

Future energy density of lithium ion batteries will double in the 2030s and can ultimately quadruple, using heroic assumptions, per our separate data-file here. We have also summarized all of our research into different batteries in the energy transition.