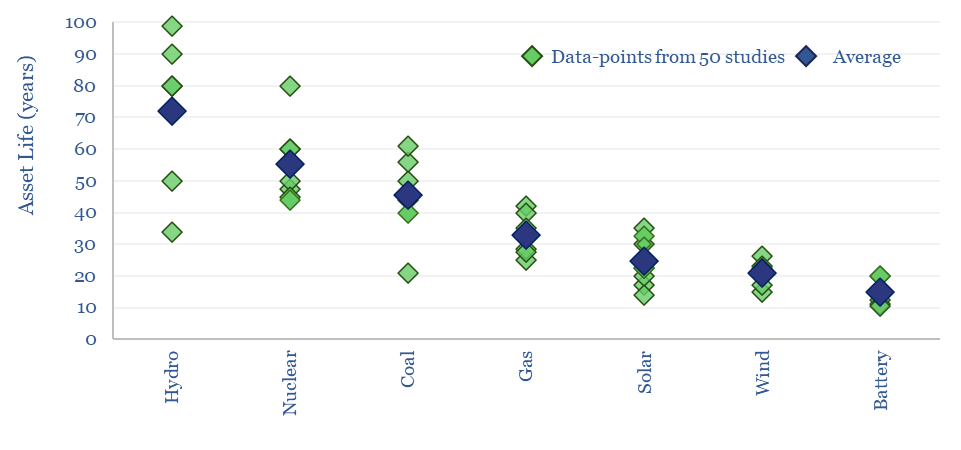

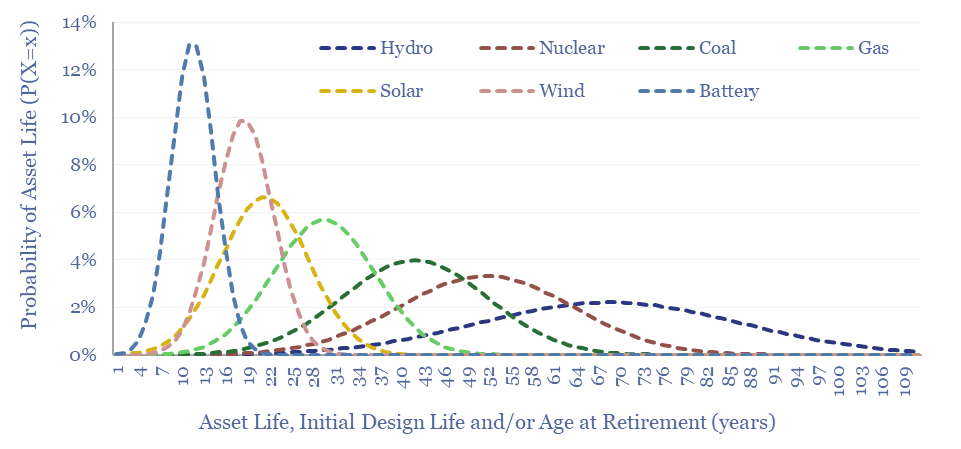

Power generation asset lives average c70-years for large hydro, 55-years for new nuclear, 45-years for coal, 33-years for gas, 20-25 years for wind/solar and 15-years for batteries. This flows through to LCOE models. However, each asset type follows a distribution of possible asset lives, as tabulated and contrasted in this data-file.

Asset lives of power generation infrastructure are tabulated in this data-file, covering both the design life and age at retirement, for coal, gas, wind, solar, batteries, nuclear and hydro.

Average lives are c70-years for large hydro, 55-years for nuclear, 45-years for coal, 33-years for gas, 20-25 years for wind/solar, 15-years for batteries. However, the numbers follow a distribution, as can be quantified based on data in the data-file.

Thus, the capex of c$1,000/kW for wind, solar and batteries is not necessarily cheaper (per year) than $1,000-1,500/kW for gas or $3,000/kW for hydro. These very long-run costs/benefits are not well captured in LCOE models.

Our personal perspective is that long-term infrastructure has huge hidden value within stable, developed world countries. Their public benefits continue long after their capex costs have been forgotten. Our favorite example is the Brooklyn Bridge, completed for $15M in 1883, yet still standing today.

Some power plants can also be replaced and re-fitted, piece by piece, like Theseus’s Ship. It might cost $650/kW to extend a nuclear plant’s life by a further 20-years (attractive for data-centers, and stoking the order books of nuclear contractors, such as Westinghouse, now owned by Cameco).

Likewise for new energies, there may be upside in the 2030s for module-makers, turbine-makers and battery materials and manufacturers, as existing assets need to replace failing components.