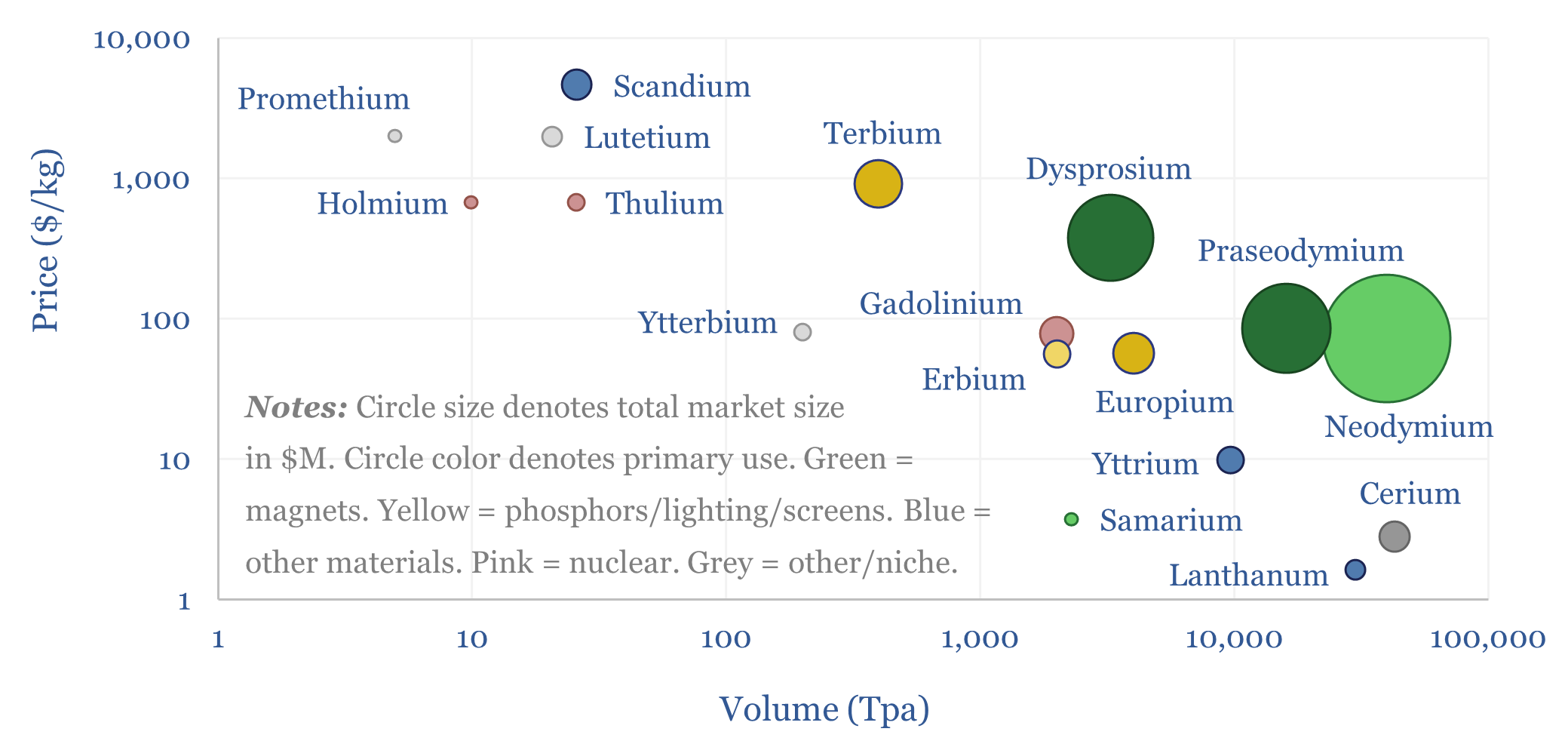

The global Rare Earth market is 390kTpa of mined Rare Earth Oxide equivalents, which is processed to yield 150kTpa of sellable Rare Earth materials, with a value of $7bn pa. But “price” is not “value”. This data-file breaks down the global Rare Earth market, by metal, by price (in $/kg), by volume (in Tpa), and summarizes the key uses of each Rare Earth metal.

The Rare Earth market comprises Yttrium, Scandium and the 15 Lanthanides, which are Lanthanum, Cerium, Praseodymium, Neodymium, Promethium, Samarium, Europium, Terbium, Dysprosium, Gadolinium, Holmium, Erbium, Thulium, Ytterbium, Lutetium.

The USGS estimates that 390kTpa of Rare Earth Oxide-equivalents were mined in 2024, of which 270kTpa were in China, and 90-95% were later refined in China.

In this data-file, looking across the 17 Rare Earth metals, we estimate that 150kTpa of Rare Earth elements were sold globally in 2024, embedded in products and materials (the remainder of the 390kTpa is not recovered from the mining process, via mixer-settlers, for technical and/or economic reasons).

Hence the global market for Rare Earth metals is $7bn per annum. 80% of this is Neodymium, Praseodymium and Dysprosium, which are used in NdFeB magnets, where the Rare Earths are 70-80% Neodymium, 20-30% Praseodymium, and up to 5% Dysprosium. The precise mix maximizes magnetic strength, coercivity, durability and resistance to demagnetization, for use in EVs, wind-turbines and servo motors of industrial robots. Neodymium, Praseodymium and Dysprosium are also the most targeted Rare Earth metals in our screen of upcoming Rare Earth projects.

But “price” is not “worth”. The implied total market value for Rare Earth metals is $7bn per annum, which is less than pet toys ($9bn pa), ski-equipment ($15bn) or board games ($20bn pa).

Yet, if Rare Earth supplies ever became severely disrupted in the future, it may turn out that market participants were willing to pay 100-1,000x more than they currently do, for some of these materials.

In a recent deep-dive note, for example, we showed that without yttrium you could not make a modern gas turbine or jet engine. Yttria-stabilized zirconia is deposited at 100-400μm thickness on these turbine/engine blades, as a thermal barrier coating, to prevent them melting under the heat of combustion. There is no substitute. In other words, a 200-300MW gas turbine, weighing 300 tons, and costing $50-100M, could be de-railed by the failure to source 50kg of yttria once priced at just c$400.

Likewise, without the metals in this screen, you could not make screens display vivid colors (terbium, europium, lanthanum), could not re-fuel some nuclear reactors (gadolinium, holmium, dysprosium), could not move data through >100km long fiber-optic cables (erbium, terbium), could not polish semiconductor wafers (cerium), could not produce a high-resolution MRI-scan (gadolinium), could not use aluminium alloys in hot aircraft parts (scandium), could not produce Euro bank notes (Europium), could not produce radar/sonar transducers (lanthanum, samarium).

One frustration we have had in the past is that many articles simply say “Rare Earths are used in electronics”. So we have tried to compile as many highly specific examples as we can. For example, “Silica is the most commonly used material for fiber optic strands, and has the lowest attenuation rate at 1,550nm wavelengths. Hence Erbium doped lasers, which emit light at 1,550nm are the most important laser sources and amplifiers in long-range communications”.

For each metal in the screen, we have tabulated its concentration in the Earth’s crust (in ppm), its average 2024-25 pricing ($/kg), its 2024-25 production volumes (in Tpa), its market size (in $M), the percent of production that comes from China (in %) and summarized some of the most interesting examples of global demand. We hope this is a useful overview for decision-makers and will continue adding more notes over time.