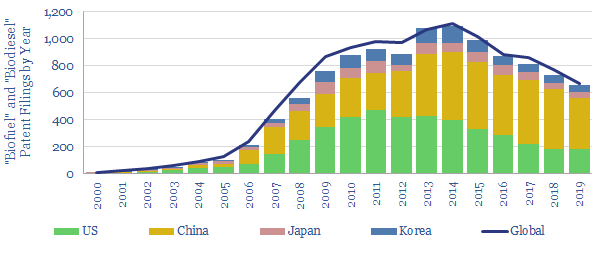

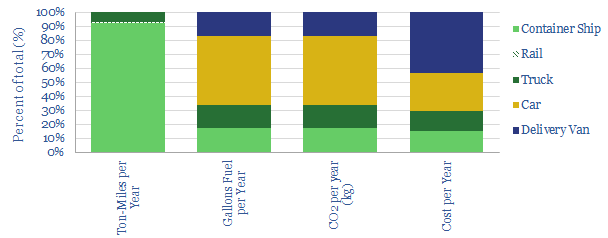

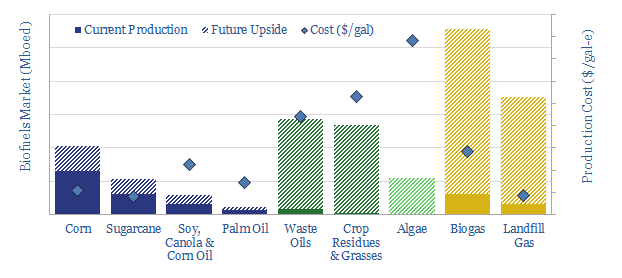

This data-file provides an overview of the 3.5Mbpd global biofuels industry, across its main components: corn ethanol, sugarcane ethanol, vegetable oils, palm oil, waste oils (renewable diesel), cellulosic biomass, algal biofuels, biogas and landfill gas.

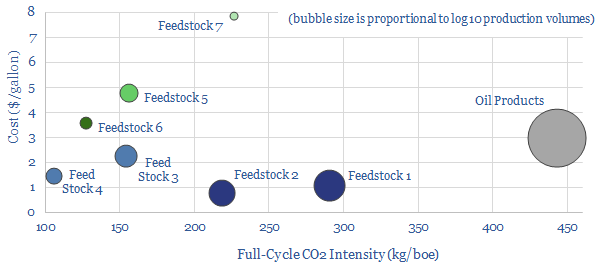

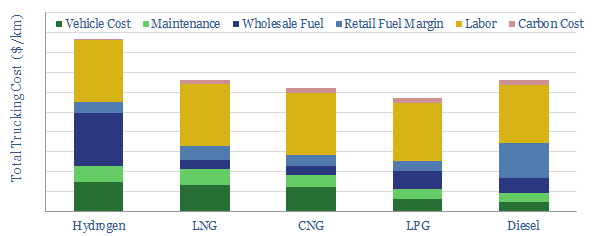

For each biofuel technology, we describe the production process, advantages and drawbacks; plus we quantify the market size, typical costs, CO2 intensities and yields per acre.

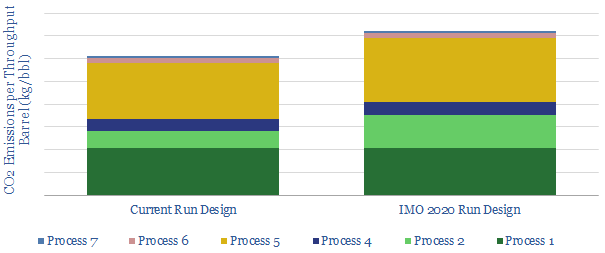

While biofuels can be lower carbon than fossil fuels, they are not zero-carbon, hence continued progress is needed to improve both their economics and their process-efficiencies.

Our long-term estimate is that the total biofuels market could reach 20Mboed (chart below), however this would require another 100M acres of land and oil prices would need to rise to $125/bbl to justify this switch.

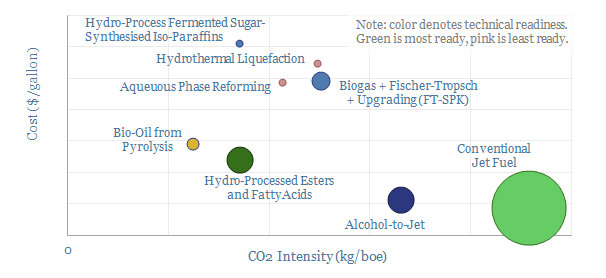

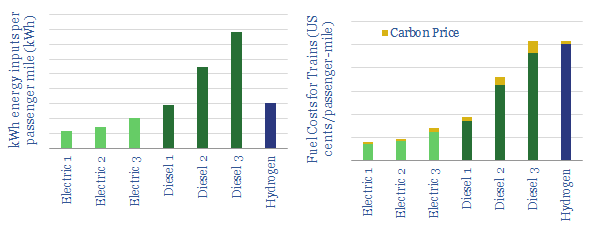

The data-file also contains an overview of sustainable aviation fuels, summarizing the opportunity set, then estimating the costs and CO2 intensities of different options.