US nuclear generation of 800 TWH pa has come from 94 reactors, at 54 nuclear plants, owned by c50 companies, with 102 GW of current capacity. This data-file breaks down the industry by plant and by owner/operator, and assesses the restart potential of shuttered nuclear plants.

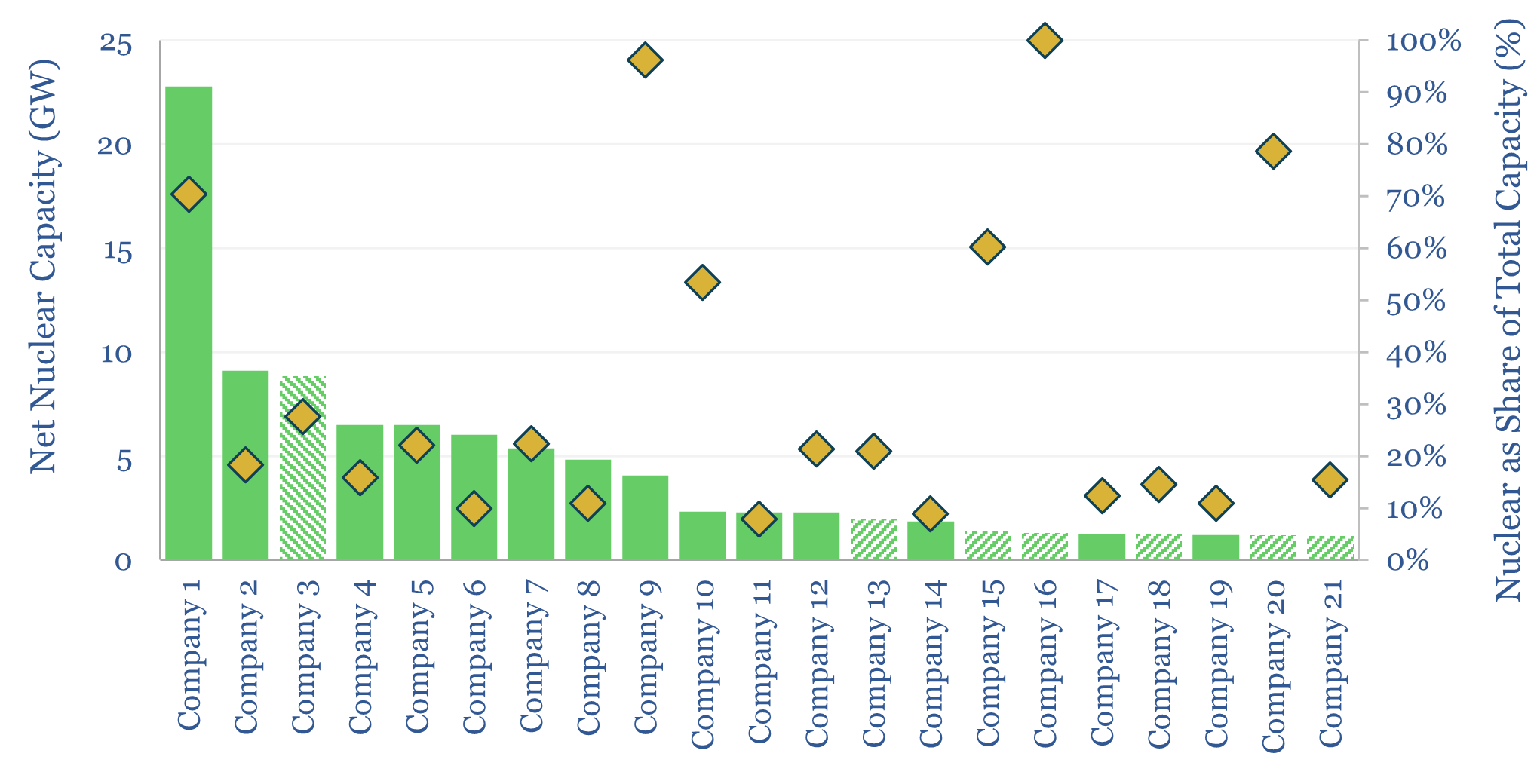

US nuclear capacity by owner? Constellation is the US’s largest nuclear operator, with stakes in 15 plants and 23GW of capacity, thus nuclear is c70% of CEG’s total portfolio today. Duke, Vistra, Dominion, NextEra and Entergy also all have 5-9GW of net capacity. In total 76% of US nuclear is owned by public companies. Details of US nuclear generation by company, and details of each company are in the data-file.

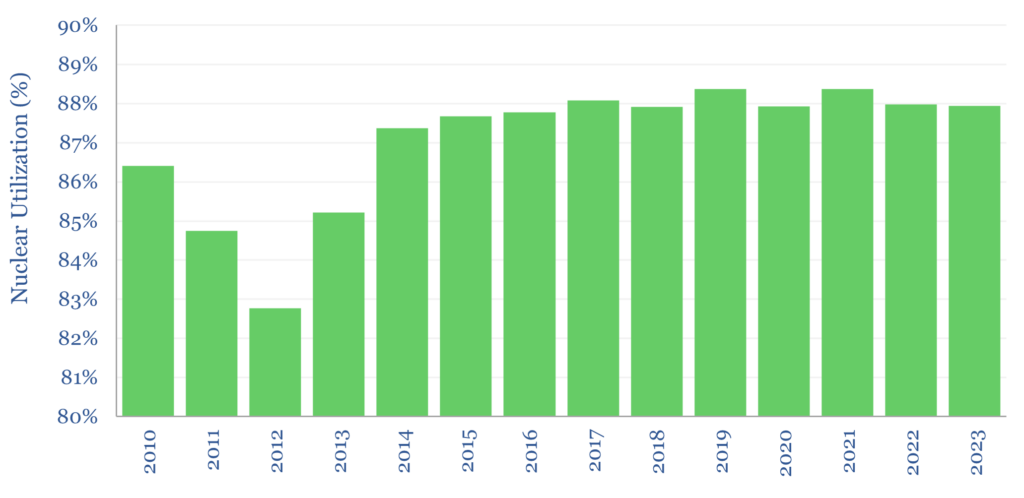

Utilization of the US’s nuclear fleet has averaged 88% in the past decade. This is materially higher than for other generation sources in our US energy models. Most impressively, Constellation’s 2.3 GW Limerick plant in Pennsylvania has run at 96% utilization over the past ten years.

On the other end of the spectrum, three previously shuttered reactors can be restarted: Palisades (Holtec, 812MW, 2025), Three Mile Island Unit 1 (Constellation, 980MW, 2028) and Duane Arnold (NextEra, 680MW, 2028). 10 other reactors have closed down since 2010, but in our assessment are “too far gone” to bring back. Details are in the data-file.

The black swan that we were hoping to find in this data-file is some hypothetical nuclear plant with 100MW+ scale spare capacity, which could be useful for powering data-centers. However, usually low utilization is simply a function of maintenance/refueling cycles. If existing nuclear capacity is mostly maxed out, then data-centers will pull on new gas turbines.

To capture the nuclear value chain, we have also modeled the economics of nuclear generation, screened uranium production by company and uranium enrichment by company.