This data-file is a screen of leading companies in vapor deposition, manufacturing the key equipment for making PV silicon, solar, AI chips and LED lighting solutions. The market for vapor deposition equipment is worth $50bn pa and growing at 8% per year. Who stands out?

Vapor deposition uses 250-1,250ºC temperatures and vacuums as low as 1 millionth of an atmosphere, to deposit nm-μm thick layers of ultra-pure materials onto semiconductor and solar substrates, to make PV silicon, solar modules, computer chips, AI chips, LEDs, plus for hardened metals, cutting tools, insulated glass and aluminized food packaging.

We figured that we needed to compile this screen after reviewing LONGi‘s patents in early-2024. The technology underpinning HJTs and TOPCON modules is very clever, but it is clear from the patents, that it all relies upon vapor deposition. Hence who are the crucial shovel-makers here?

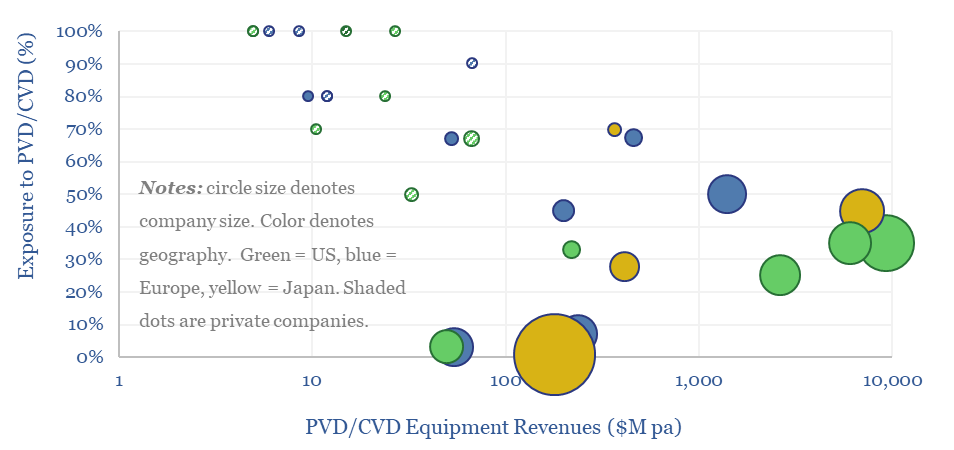

Half of the $50bn pa market is dominated by five public companies with 25-50% exposure to vapor deposition and c30% EBIT margins, based on our screen of leading companies in vapor deposition.

In overall Semiconductor Production equipment, the world leader is Applied Materials, which is based in the US, produces vapor deposition for the solar industry plus for the ‘angstrom era’ of chips, and has $170bn of market cap, more than Schlumberger, Baker Hughes and Halliburton combined.

In chemical vapor deposition for the semiconductor industry, a large Japanese company stood out, claiming 43% market share, and also the only integrated product suite covering the four sequential processes of deposition, coating/developing, etching and cleaning.

In the $700M niche of Metal Organic CVD, as used to make 70% of LEDs globally, but also for wide-bandgap semiconductors, such as SiC and GaN, the market leader is a publicly listed German specialist, with 70% market share.

In laser annealing, which can modify chemical properties over 10-100nm within nanoseconds, for making AI chips, a US-listed specialist stood out as a leader, and it also has a well-regarded ion beam deposition line, seen as a successor to PVD as it achieves larger and uniformly deposited grains.

Our experience as energy analysts has been that companies in the semiconductor supply chain are now just as relevant to the future of global energy as those in the subsea supply chain. Hence over time we will add to this screen of leading companies in vapor deposition.