Verbio is a bio-energy company, founded in 2006, listed in Germany, producing bio-diesel, bioethanol, biogas and fertilizers. The company has stated “we want to be in a position to convert anything that agriculture can deliver to energy”. Our Verbio technology review is based on its patents. We find some fascinating innovations in cold mash ethanol, integrated with biogas production, and making biogas from lignocellulosic feedstock.

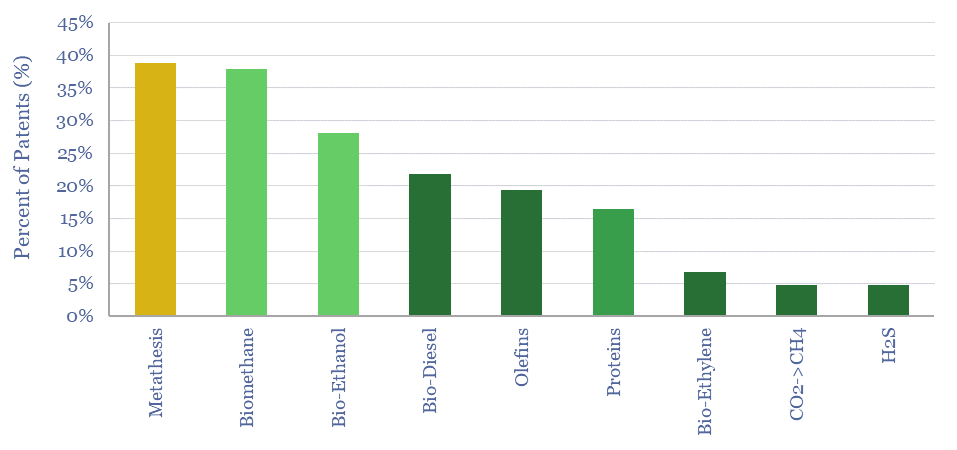

50-60% of Verbio’s EBITDA has recently come from its bio-diesel. We think bio-diesel will see increasing competition for feedstocks and possibly also due to food shortages. Numerically, the largest focus in Verbio’s patents was into metathesis catalysts (chart above), which is the rupturing and re-forming of C-C or C=C bonds, to ‘swap’ the hydrocarbon tails, and produce a more varied range of outputs, especially in bio-diesel. But we found these patents to be disjunctive, and hard to de-risk.

40-45% of Verbio’s EBITDA has recently come from bio-ethanol and bio-methane. And we found the patents here particularly interesting and high-quality. Verbio is using a cold-mash process, which results in 80% lower CO2/energy use than gasoline, and perhaps as much as 50% lower than US corn ethanol using hot mash processes. The patents explain how this is being achieved, including by combining bio-ethanol plants and bio-methane plants, then recirculating the stillage. Some nice flow diagrams are copied in our data-file. But most interestingly, halving the heat use on a bio-ethanol facility, and holding all else equal, would uplift its IRR by 3%, or conversely, lower its total production cost by 5%.

Converting lignocellulosic crop wastes into bio-methane is also covered in the patent library and by the company. This is likely to harness a particularly low-value feedstock (straw), and yield what will be, for the foreseeable future in European gas markets, a high-value product. The patents seem to overcome challenges in the breakdown of waxy coatings, ‘floating layers’, and yields. These patents include some clear and simple details.

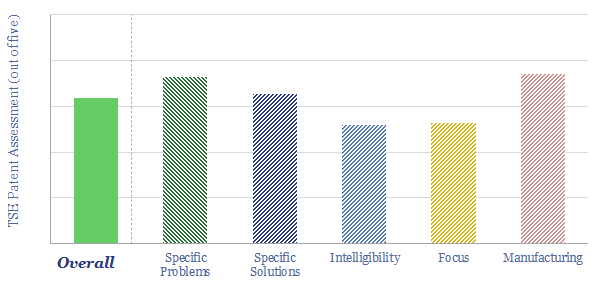

Overall our Verbio technology review yielded a mixed score, but this was due to a mix effect. Low carbon bio-ethanol production and forming biogas from lignocellulosic feedstocks seemed most interesting, and also appears to be the focus for new investment in the company’s EUR 300M capex plans.

Is there value in bio-energy technology? We see persistent shortages of hydrocarbons in the 2020s (model here). Energy Majors have also been acquiring biofuels companies in 2022, such as Chevron buying Renewable Energy Group ($3.2bn), BP buying Archaea ($3.3bn) and Shell buying Nature Energy ($2bn).