Search results for: “companies”

-

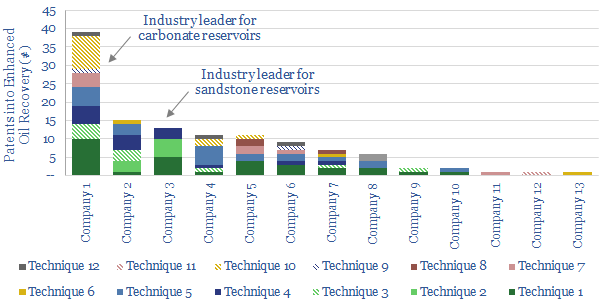

At the cutting edge of EOR?

This data-file summarises 120 patents into Enhanced Oil Recovery, filed by the leading Oil Majors in 2018. Hence, we can identify clear leaders in EOR technology, and what they are doing at the cutting edge, to improve recovery and lower decline rates. As the world’s oilfields age, leading EOR technology will help avoid the higher…

-

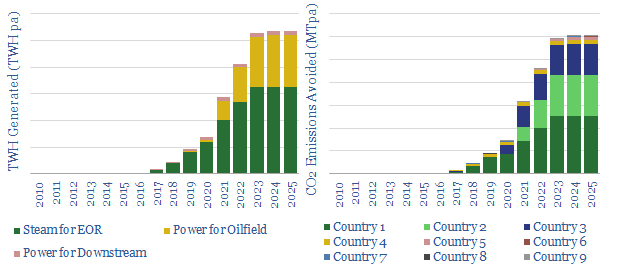

Solar Use within the Oil Industry?

20 solar projects are being undertaken across the oil industry, to reduce CO2 emissions. But today’s project pipeline will obviate less than 1% of oil industry CO2 by 2025. So momentum must build behind these leading examples, which are: steam-EOR in Oman and California, Solar PV in the Permian, and specific companies such as Occidental,…

-

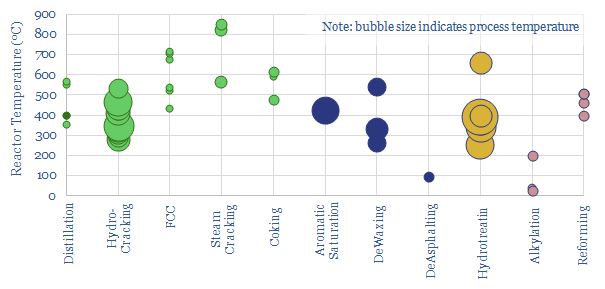

Upgrading Catalysts: lower refinery temperatures and pressures?

Refineries are CO2-intensive, as their average process takes place at 450C. But improved catalysts can help, based on reviewing over 50 patents from leading energy Majors, and their requisite temperatures and pressures. Combining all the best-in-class new catalysts, we think the average refinery could save 5kg/bbl of CO2 intensity.

-

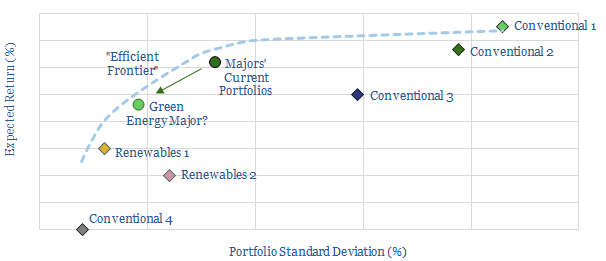

Portfolio Construction for Energy Majors?

This data-model calculates risk-adjusted returns for different portfolio weightings in the energy sector, as companies diversify across upstream, downstream, chemicals, corporate; and increasingly, renewables and CCS. A set of optimal portfolio allocations are calculated, which maximise Sharpe ratios. You can also stress-test your own inputs.

-

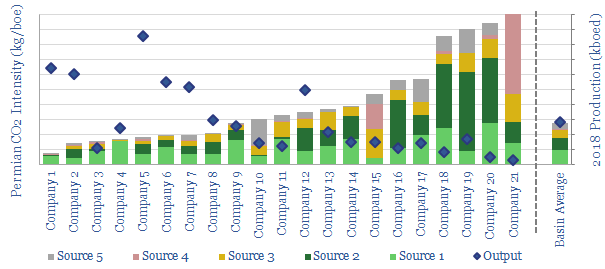

Permian CO2 Emissions by Producer

This data-file tabulates Permian CO2 intensity, based on regulatory disclosures from 20 of the leading producers to the EPA. The data are disaggregated by company, across 18 different categories, such as combustion, flaring, venting, pneumatics, storage tanks and methane leaks. There are opportunities to lower emissions.

-

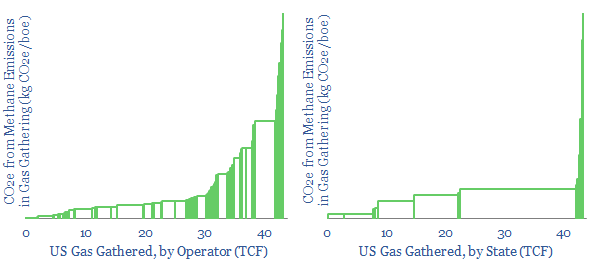

Gas Gathering: how much CO2 and Methane?

Gas gathering and gas processing are 50% less CO2 intensive than oil refining. Nevertheless, these processes emitted 18kg of CO2e per boe in 2018. Methane matters most, explaining 1-7kg/boe of gas industry CO2-equivalents. This data-file assesses 850 US gas gathering and processing facilities, to screen for leaders and laggards, by geography and by operator.

-

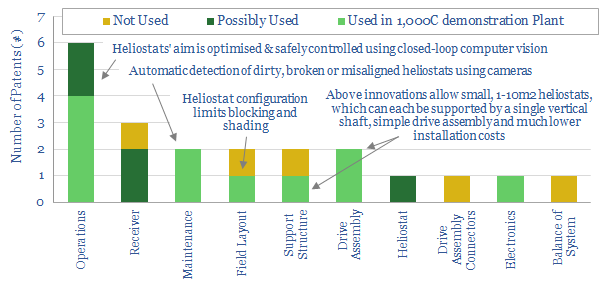

Heliogen: concentrated solar breakthrough?

Heliogen has set a new record for concentrated solar power in 2019, generating >1,000C temperatures from an array of c370 hexagonal mirrors, which are precisely controlled using computer vision. This is almost 2x traditional CSP plants. Hence this data-file reviews 21 of Heliogen’s patents, finding impressive innovations and ultimate costs.

-

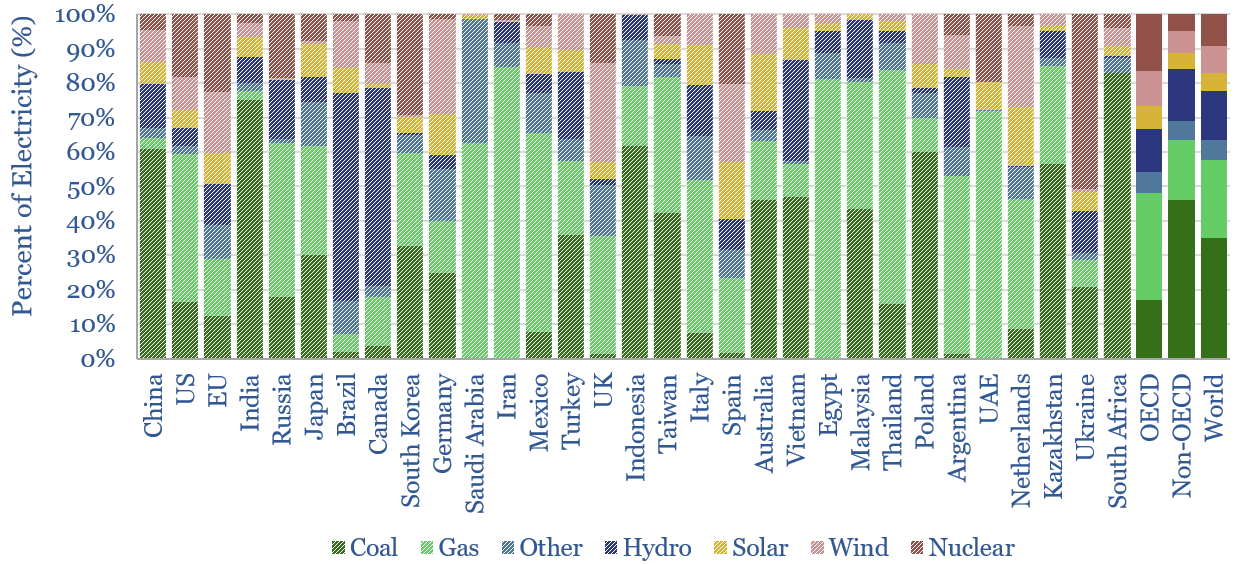

Renewables: share of global energy and electricity by country?

This data-file is an Excel “visualizer” for some of the key headline metrics in global energy: such as total global energy use, electricity generation by source and growing renewables penetration; broken down country-by-country, and showing how these metrics have changed over time.

-

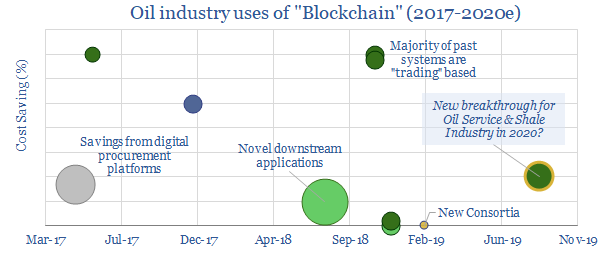

Blockchain in the Oil & Gas Supply Chain

This datafile tabulates ten examples of deploying Blockchain in the oil and gas industry since 2017; including companies and cost savings. Most prior examples are in trading. For 2020, we are particularly excited by the broadening of Blockchain technologies into the procurement industry, which can deflate shale costs.

-

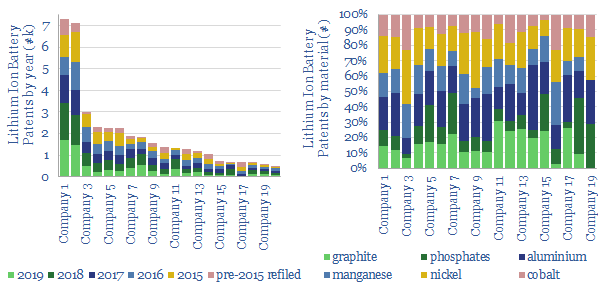

Battery Patents: Lithium Leaders and New Breakthroughs?

Continued deflation in lithium ion batteries is suggested by a new record of 26,000 patents filed in 2019, hence this data-file identifies the technology leaders. Elsewhere, redox flow batteries patents have doubled since 2014, while interest has been waning in solid state batteries (-57% since 2014) and liquid metal batteries (-67%).

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)