Search results for: “EOR”

-

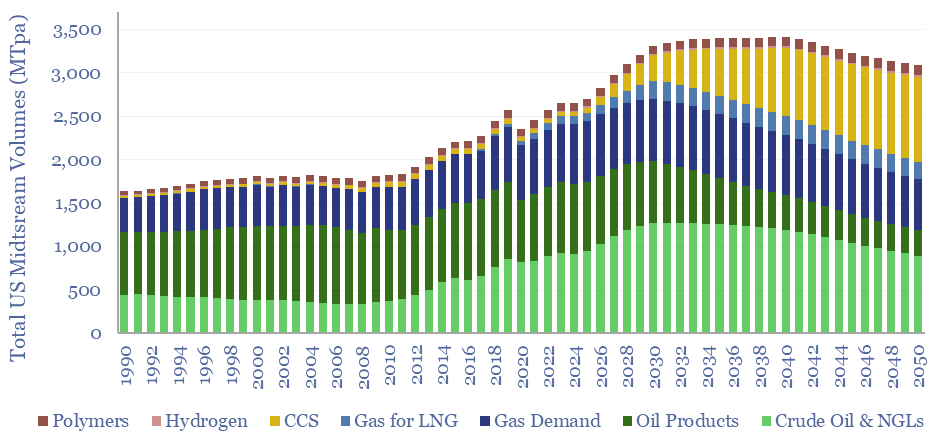

Midstream opportunities in the energy transition?

The midstream industry moves molecules, especially energy-molecules, and especially in pipelines. Despite the mega-trend of electrification, there are still strong midstream opportunities in the energy transition, backstopping volatility and moving new molecules. This short note captures our top ten conclusions. (1) Our overall outlook on the US midstream industry sees the total tonnage of molecules…

-

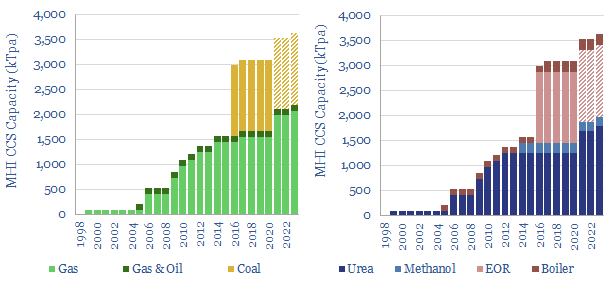

MHI CCS technology: performance, costs and emissions?

MHI has deployed an amine-based CO2 capture technology, in 15 plants globally, going back to 1999. Reboiler duties are around 2.6 GJ/ton on a 10% CO2 feed. Capture rates and capture purity are high. Degradation and amine emissions are controlled, and c80-90% below MEA. CCS costs and complexities remain high. In our view, this is…

-

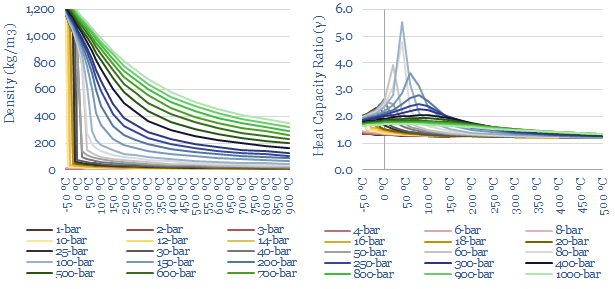

CO2 compression: stranger things?

CO2 is a strange gas. This matters as energy transition will require over 120 GW of compressors for 6GTpa of CCUS. This 13-page notes explains CO2’s strange properties, which helps to fine-tune appropriate risking factors for vanilla CCS, blue hydrogen, CO2-EOR, CO2 shipping, super-critical CO2 power cycles. There is also a wide moat around leading…

-

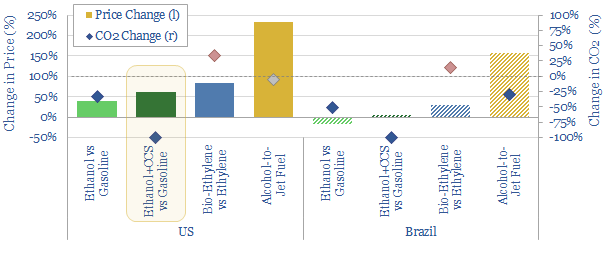

Ethanol: hangover cures?

Could new technologies reinvigorate corn-based ethanol? This 12-page note assesses three options. We are constructive on combining CCS or CO2-EOR with an ethanol plant, which yields a carbon-negative fuel. But costs and CO2 credentials look more challenging for bio-plastics or alcohol-to-jet fuels.

-

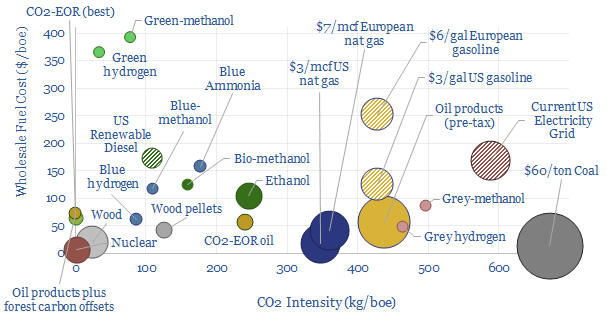

Fuel costs and CO2 intensities?

We have produced a cross-plot of the costs and CO2 intensities of different fuels, in $/boe and kg of CO2 per boe, to compre the relative attractiveness of decarbonization options. Favored decarbonization options are nature based solutions, CO2-EOR, blue hydrogen and coal-to-gas switching.

-

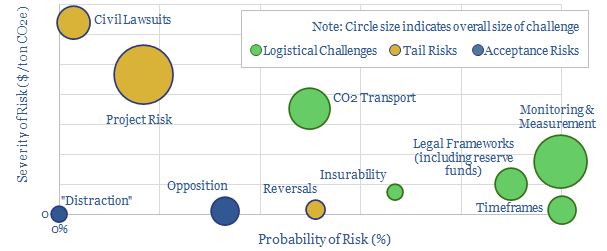

CO2 Storage: the top ten challenges in CCS?

This data-file tabulates the “top ten” challenges for geological storage of CO2, based on reviewing the technical literature. There is c$8-30/ton of tail-risk for a typical CO2 storage operation. 25 monitoring and measurement technologies are summarized. We conclude CCS is no ‘less risky’ than nature based solutions to climate change.

-

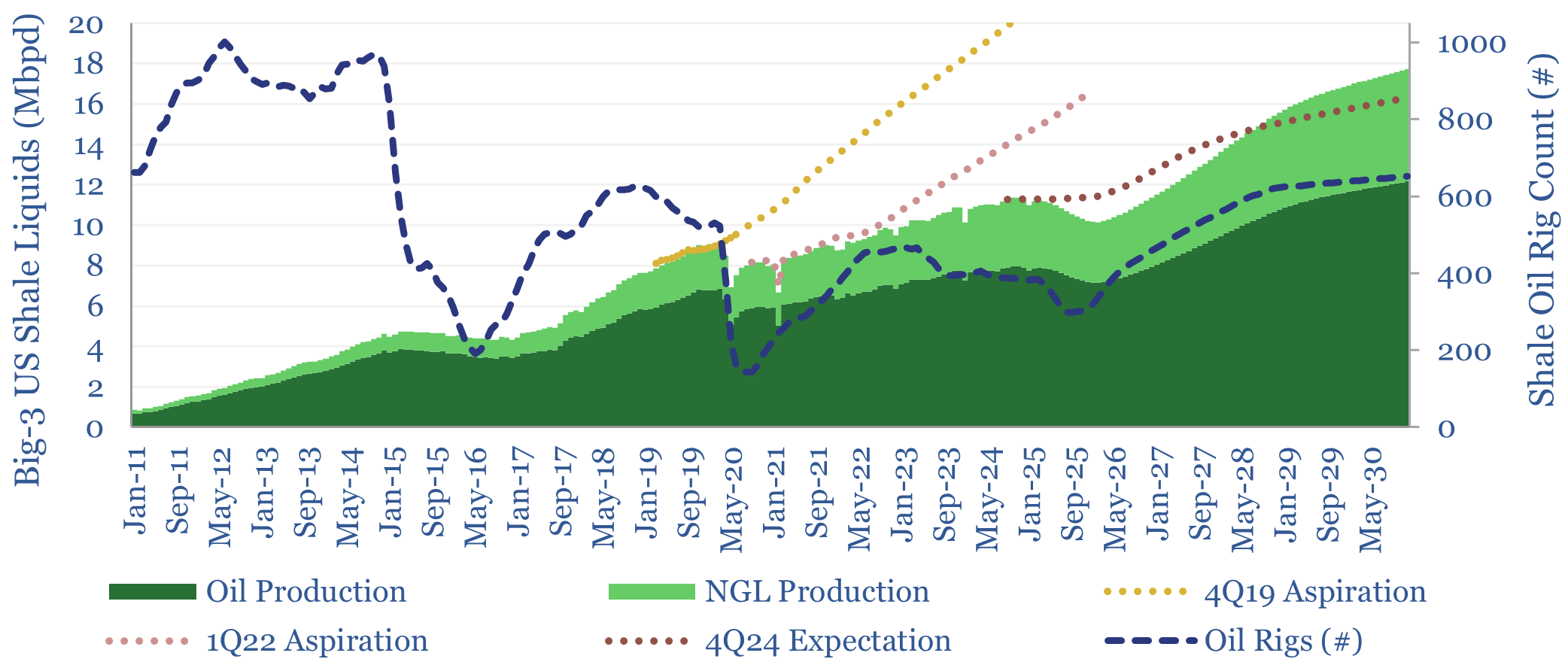

US shale: outlook and forecasts?

This model sets out our US shale production forecasts by basin. It covers the Permian, Bakken, Eagle Ford, Marcellus/Utica and Haynesville, as a function of the rig count, drilling productivity, completion rates, well productivity and type curves. The data-file was last updated in May-2025, revising liquids growth negative in 2025-26, which in turn tightens US…

-

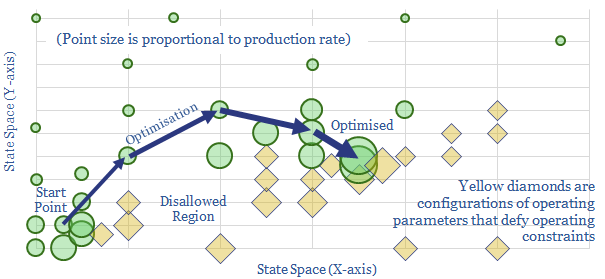

Well-by-well optimisation?

Well-by-well production optimisation can uplift mature fields’ output 5-20%. This data-file summarises the methodology employed by BP, which has filed the most detailed patent we have seen on the topic, from our screen of 3,000 patents around the industry.

-

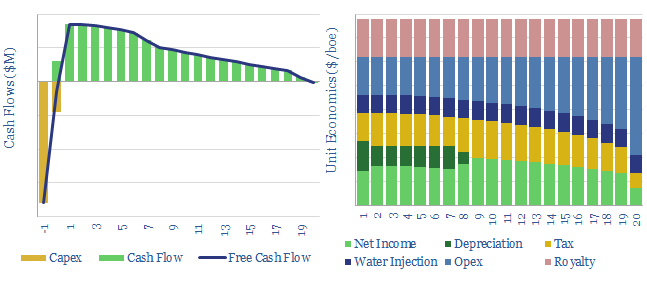

Water injection at oil fields: the economics?

This model captures the economics of a conventional waterflood project, in order to maintain reservoir pressure at maturing oilfields. Our base case calculations suggest 30% IRRs at $40/bbl oil, on a project costing $2.5/boe in capex and $1/bbl of incremental opex costs.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)