Search results for: “oil demand”

-

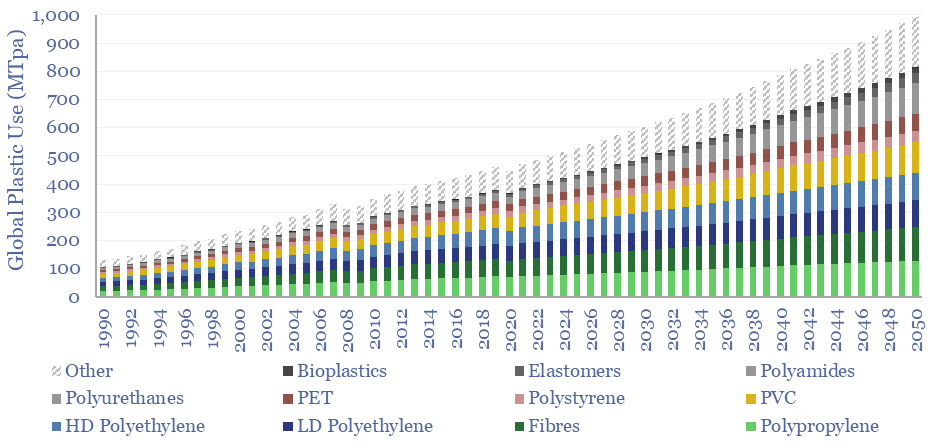

Global plastic demand: breakdown by product, region and use?

Global plastic is estimated at 470MTpa in 2022, rising to at least 800MTpa by 2050. This data-file is a breakdown of global plastic demand, by product, by region and by end use, with historical data back to 1990 and our forecasts out to 2050. Our top conclusions for plastic in the energy transition are summarized.

-

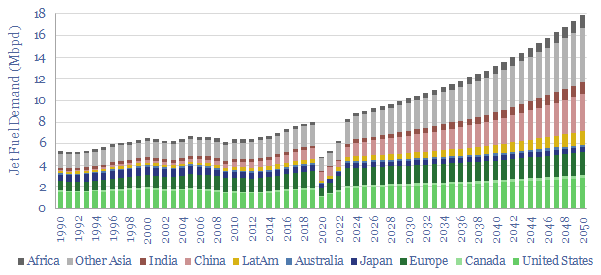

Jet fuel demand: by region and forecasts to 2050?

Jet fuel demand ran at 8Mbpd in 2019, the last year before COVID, and could rise to 18Mbpd by 2050, as global population rises 25%, jet fuel demand per capita doubles and fuel economy per aviation mile rises by 20%. This data file breaks down jet fuel demand by region, including our forecasts through 2050,…

-

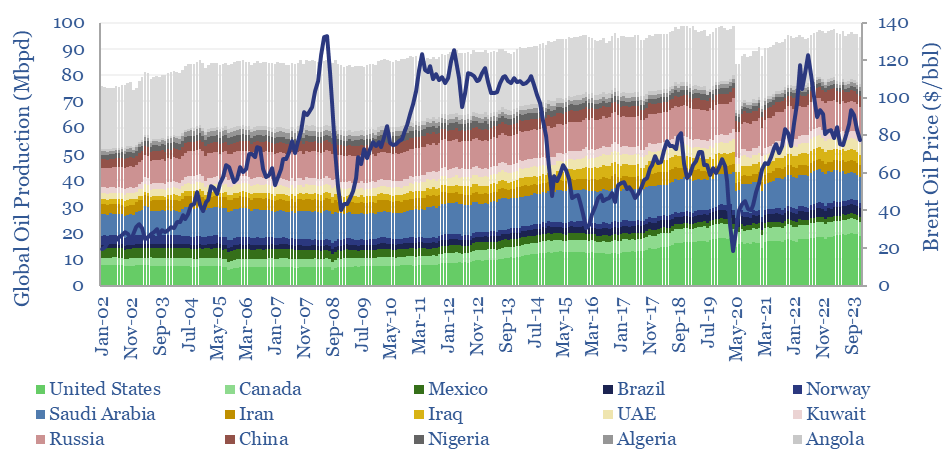

Global oil production by country?

Global oil production by country by month is aggregated across 35 countries that produce 80kbpd of crude, NGLs and condensate, explaining >96% of the global oil market. Production has grown by +1Mbpd/year in the past two-decades, led by the US, Iraq, Russia, Canada. Oil market volatility is usually low, at +/- 1.5% per year, of…

-

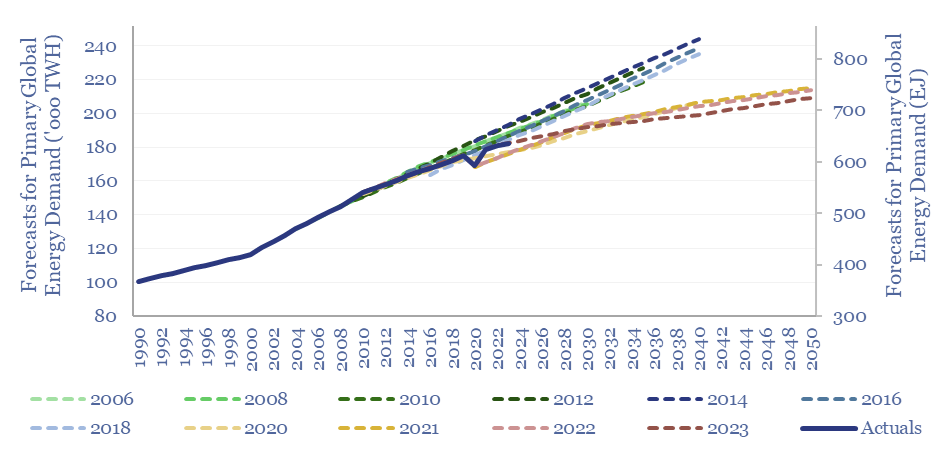

Energy demand forecasts: making predictions about the future?

How accurate are energy demand forecasts? Long-term forecasts for total global energy demand can easily be wrong by +/- 10%. Oil market forecasts tend to be amiss by 0.6% x the number of years away. Oil and coal seem to have been consistently under-estimated since 2020. Solar and wind were consistently underestimated in 2010-20, but…

-

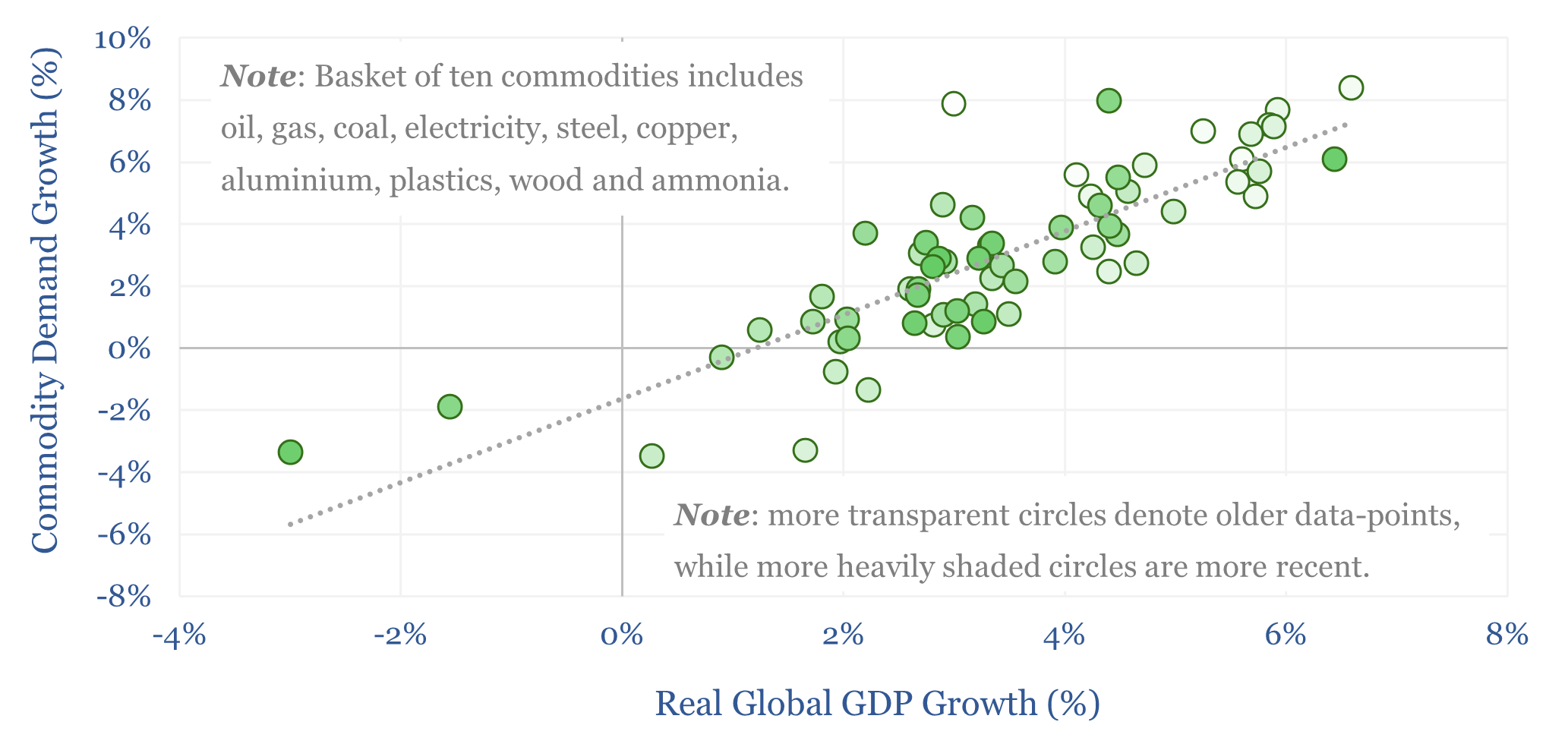

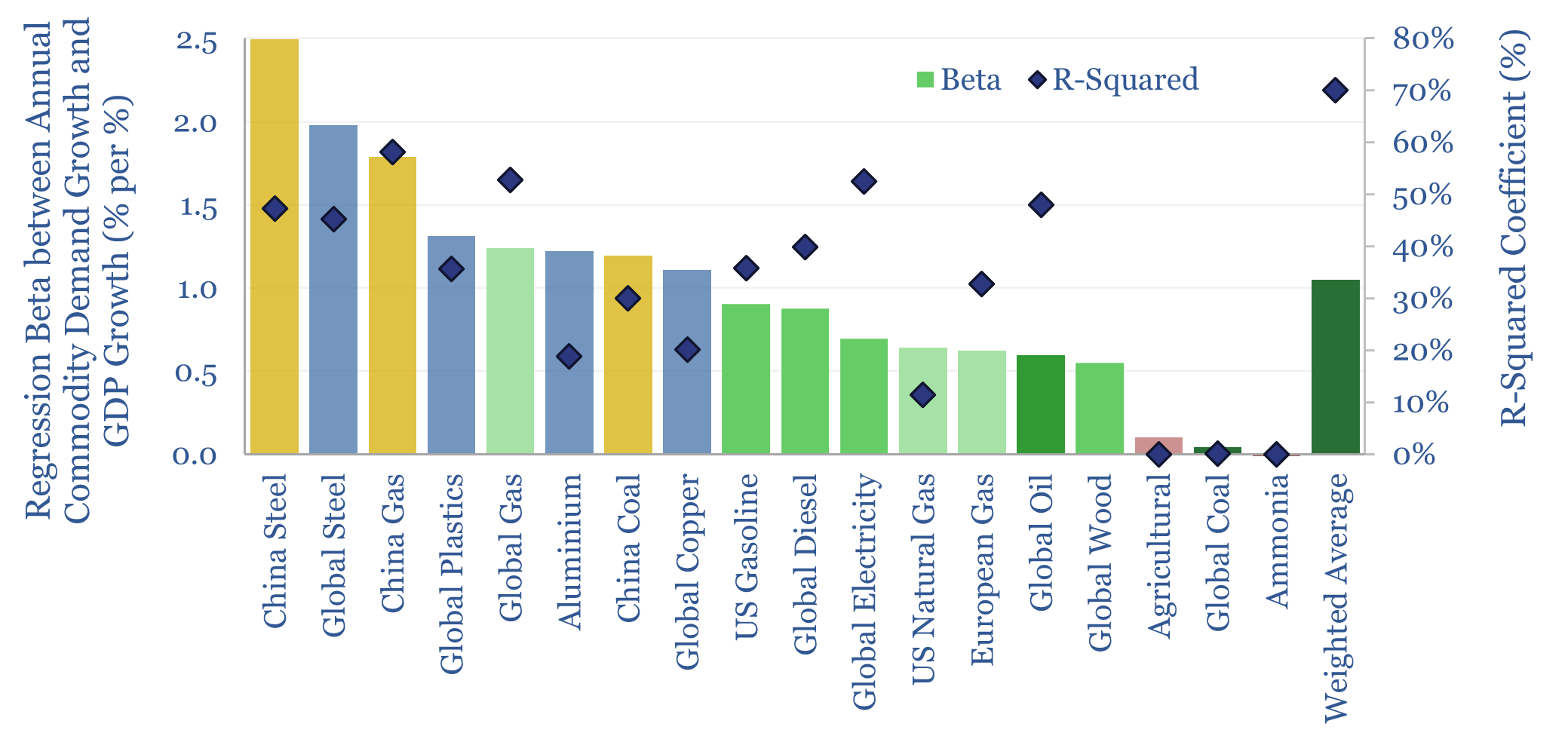

Commodity demand: how sensitive to GDP growth?

How sensitive is global commodity demand to GDP growth? This 15-page report runs regressions for 25 commodities. Slower GDP growth matters most for oil markets, which are entering a new, more competitive, era. China is also slowing. But we still see bright spots in gas, metals, materials in our 2025 commodity outlook.

-

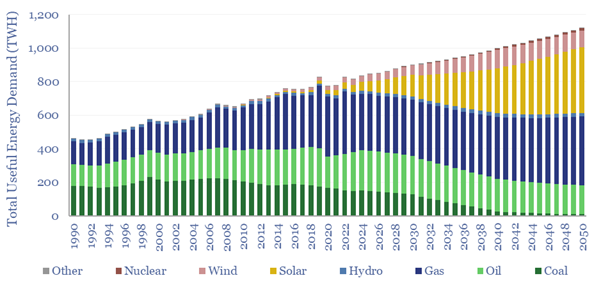

Australia energy supply-demand model?

Australia’s useful energy consumption rises from 820TWH pa in 2023, by 1.2% pa 1,100 TWH pa in 2050. As a world-leader in renewables, it makes for an interesting case study. This Australia energy supply-demand model is disaggreated across 215 line items, broken down by source, by use, from 1990 to 2023, and with our forecasts…

-

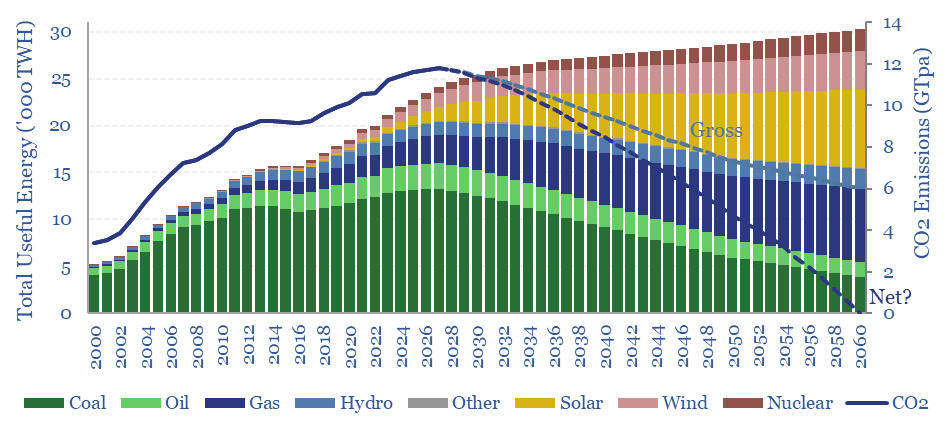

China Energy Demand and CO2 Emissions, 2000-2060

This data-file is our China Energy Model and China CO2 Model, disaggregating China’s energy demand by industry, across coal, oil, gas, wind, solar, hydro and nuclear, across c200 lines, from 2000-2060, with 20-input variables that can be stress-tested. There are routes to reach Net Zero in China by 2060, but it requires some heroic assumptions.

-

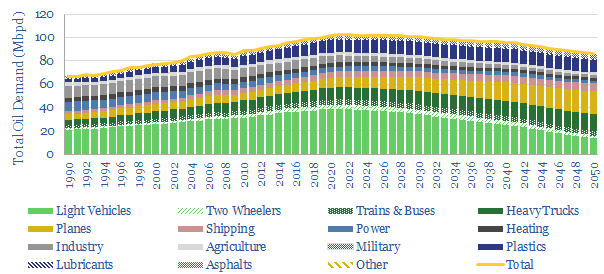

2050 oil markets: opportunities in peak demand?

Seven technology themes can save 45Mbpd of long-term oil demand. They make the difference between 2050 oil consumption surpassing 130Mbpd and our own forecasts: for a plateau in the 2020s, then a gradual descent to 87Mbpd in 2050. This is still an enormous market, equivalent to 1,000 bbls of oil consumed per second. Opportunities abound…

-

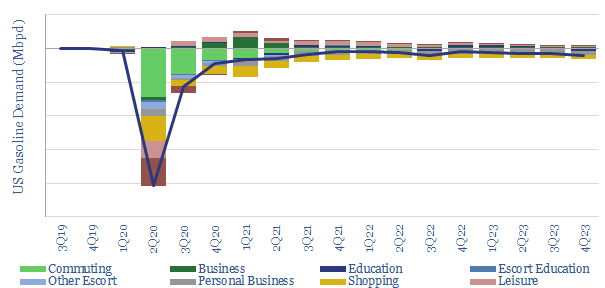

COVID-19 Impacts on US Gasoline Demand?

US gasoline is the largest component of global oil demand, at c9% of the market. Hence we have modelled the disruption from COVID-19. -2Mbpd of YoY demand destruction is not inconceivable. But when the market turns, it may also recover very quickly.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)