Search results for: “silver”

-

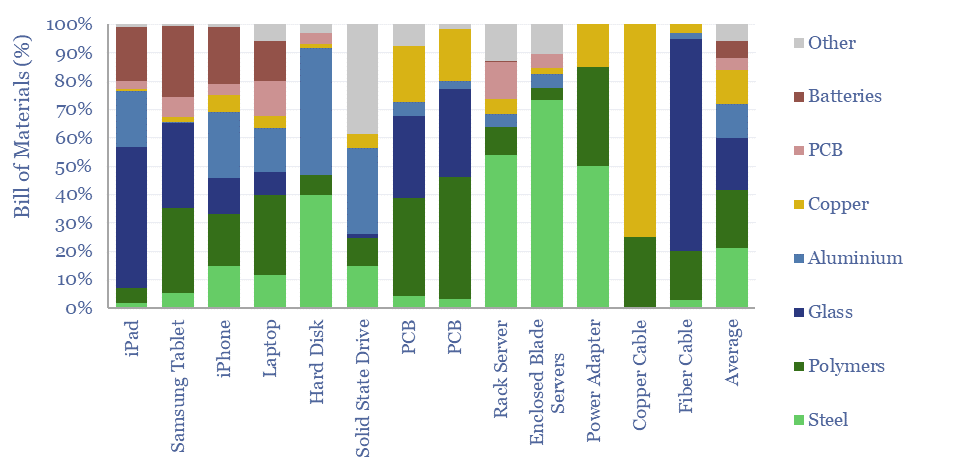

Bill of materials: electronic devices and data-centers?

Electronic devices are changing the world, from portable electronics to AI data centers. Hence what materials are used in electronic devices, as percentage of mass, and in kg/kW terms? This data-file tabualates the bill of materials, for different devices, across different studies.

-

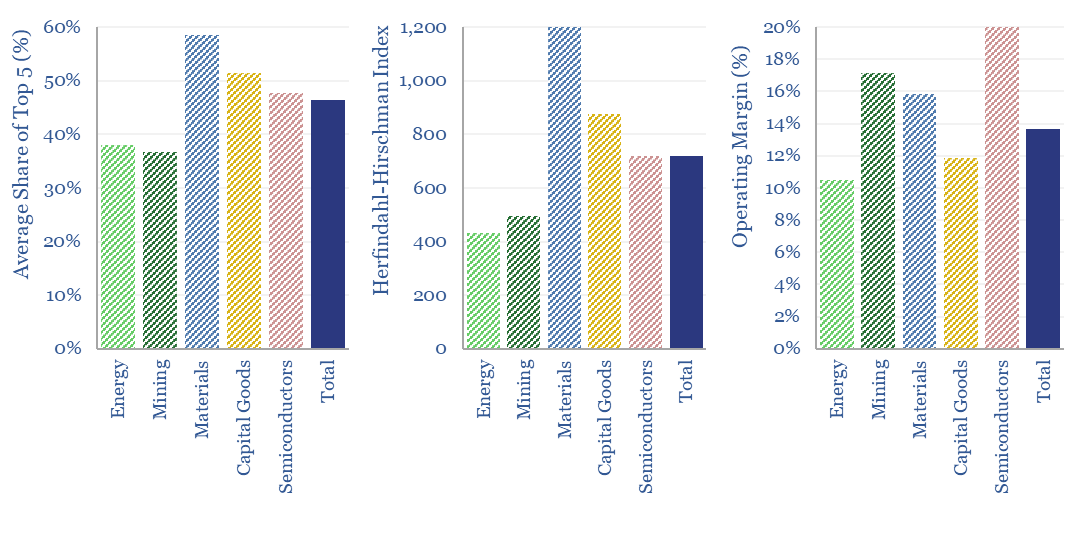

Market concentration by industry in the energy transition?

What is the market concentration by industry in energy, mining, materials, semiconductors, capital goods and other sectors that matter in the energy transition? The top five firms tend to control 45% of their respective markets, yielding a ‘Herfindahl Hirschman Index’ (HHI) of 700.

-

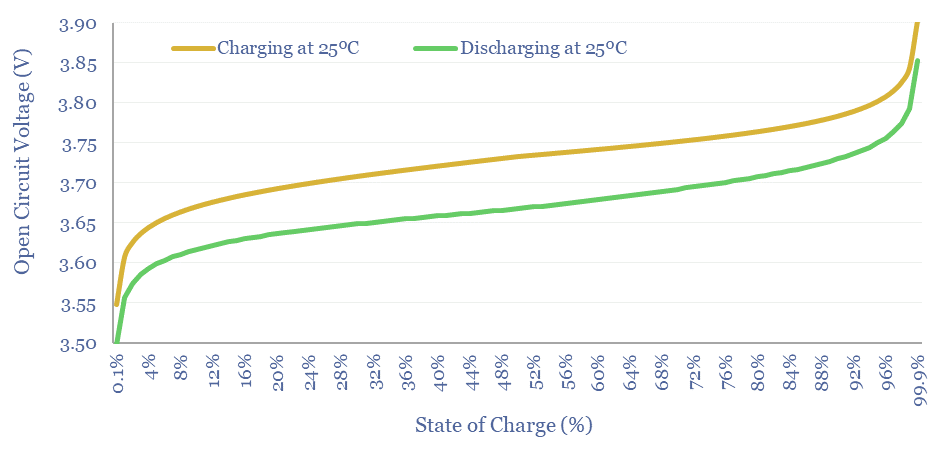

Electrochemistry: battery voltage and the Nernst Equation?

What determines the Voltage of an electrochemical cell, such as a lithium ion battery, redox flow battery, a hydrogen fuel cell, an electrolyser or an electrowinning plant? This note explains electrochemical voltages, from first principles, starting with Standard Potentials and the Nernst Equation.

-

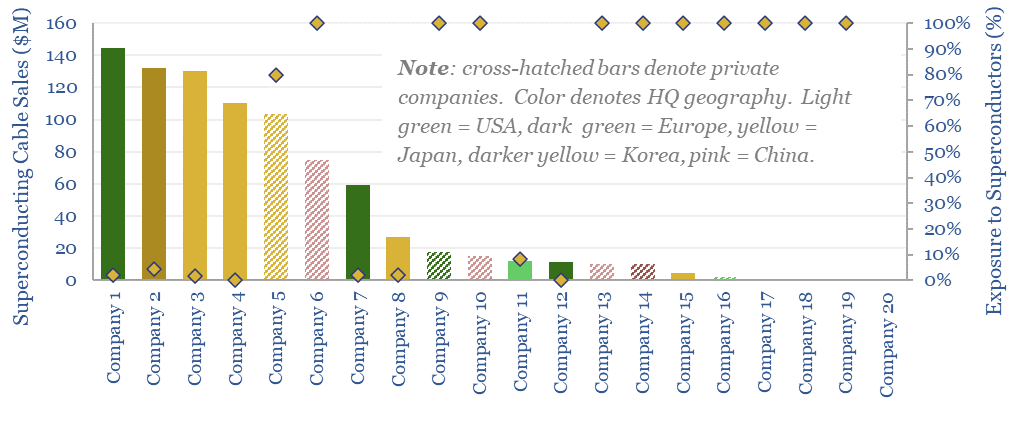

Superconductor screen: projects, materials, companies?

This superconductor screen summarizes all of our work into superconductors, screening past projects, active companies, superconductor materials and the properties of commercial HTS tapes. Five listed companies in Europe, Japan and the US are particularly important for superconducting cable projects to relieve grid bottlenecks?

-

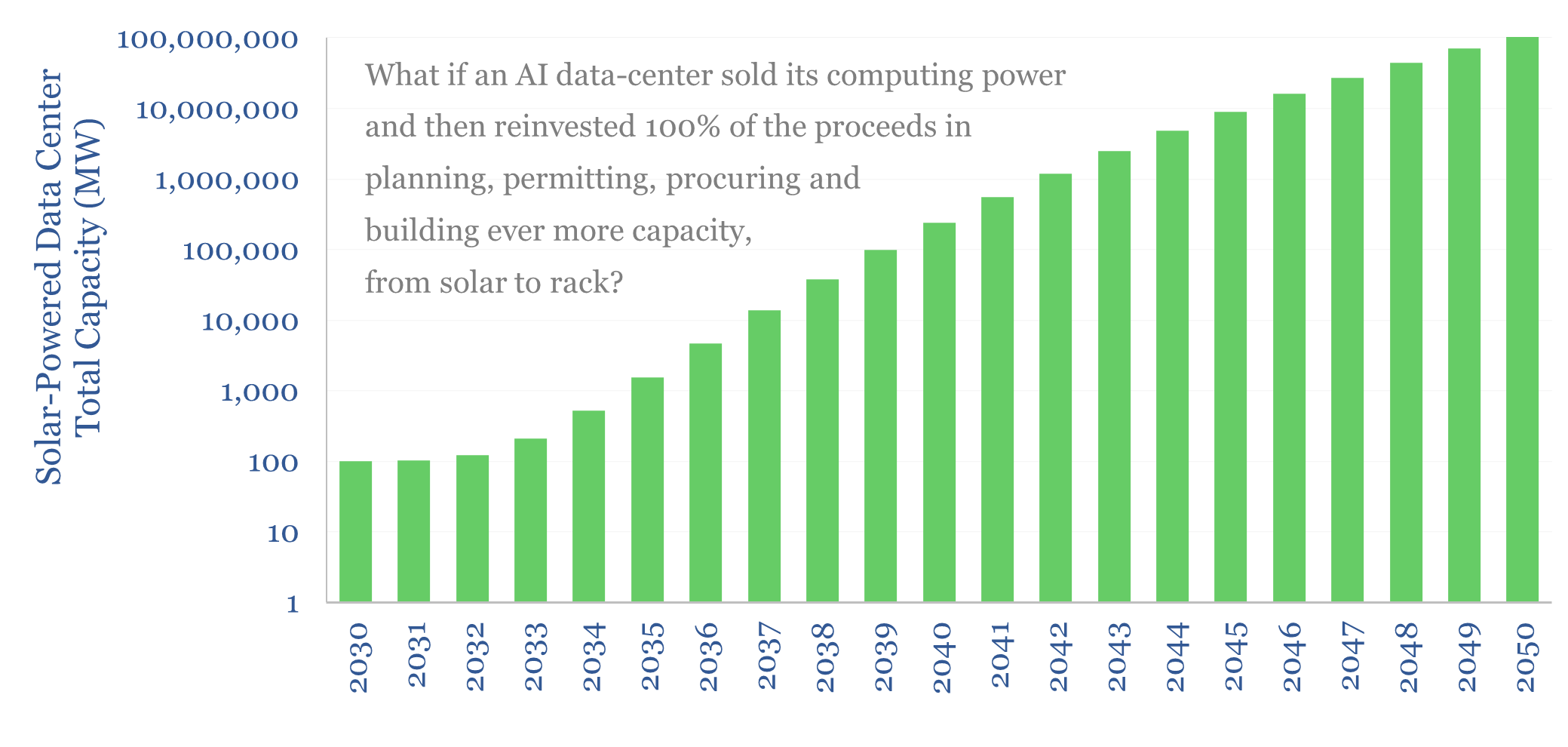

Solar+AI: bootstrapping a sci-fi scenario?

What if a data center was powered entirely by solar, and then the profits and spare computation resources from the data-center were fully reinvested in building more solar and building more racks? Could you end up with 100TW-scale data-centers?! Would this scenario fail to materialize because we would run out of things to compute? Or…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)