Search results for: “LNG”

-

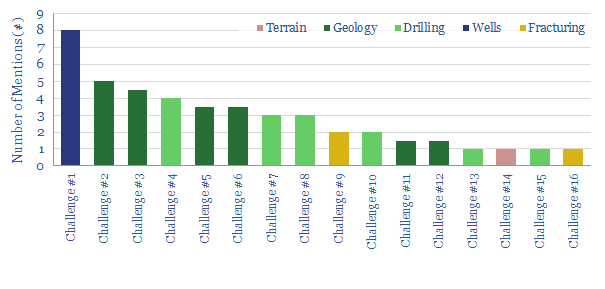

China’s Shale Challenge?

This data-file quantifies the most-discussed challenges for developing Chinese shale gas, after a review of the technical literature, as well as the solutions suggested to combat them, and our “top ten conclusions” on Chinese shale.

-

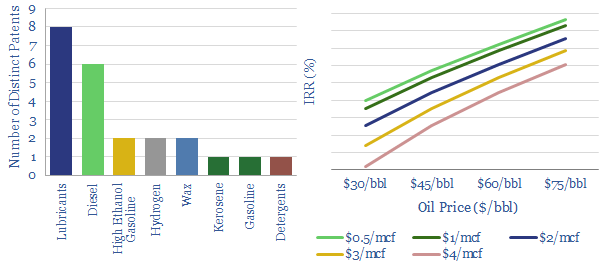

US Shale Gas to Liquids?

Shell filed 42 distinct new patents around GTL in 2018. This data-file reviews them, showing how the broad array of GTL products confers defensiveness and downstream portfolio benefits. Hence, we have modeled the economics of “replicating” Pearl GTL in Texas. Our base case is a 11% IRR taking in 1.6bcfd of stranded gas from the…

-

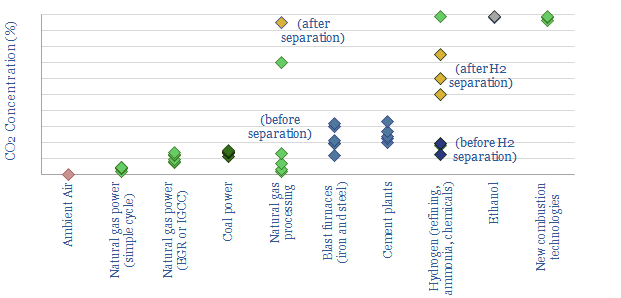

CO2 concentrations in industrial exhaust streams?

The aim of this data-file is to compile CO2 concentrations in industrial exhaust streams, as a molar percentage of flue gas. This matters for the costs of CO2 separation. Most promising CCS candidates are bio-ethanol plants, industrial hydrogen production and some gas processing, followed by cement and steel plants.

-

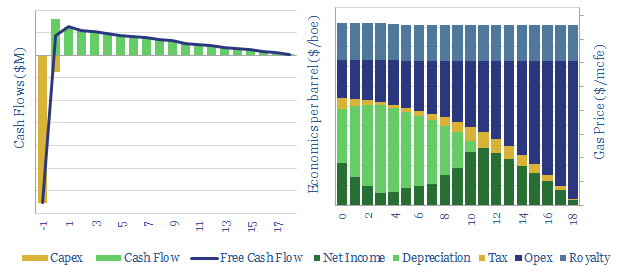

US shale gas: the economics?

This data-file breaks down the economics of US shale gas, in order to calculate the NPVs, IRRs and gas price breakevens. There is a perception that the US has an infinite supply of gas at $2/mcf, but rising hurdle rates and regulatory risk may require higher prices.

-

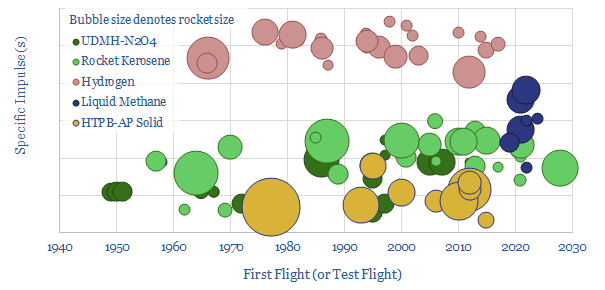

Rocket fuels: an overview?

This data-file profiles five rocket fuels, based on data from 100 rockets: kerosene, hydrogen, solid fuels, nitrogen tetroxides and an exciting new-comer, LNG. Notably, SpaceX and Blue Origin are tilting away from hydrogen/kerosene and towards LNG.

-

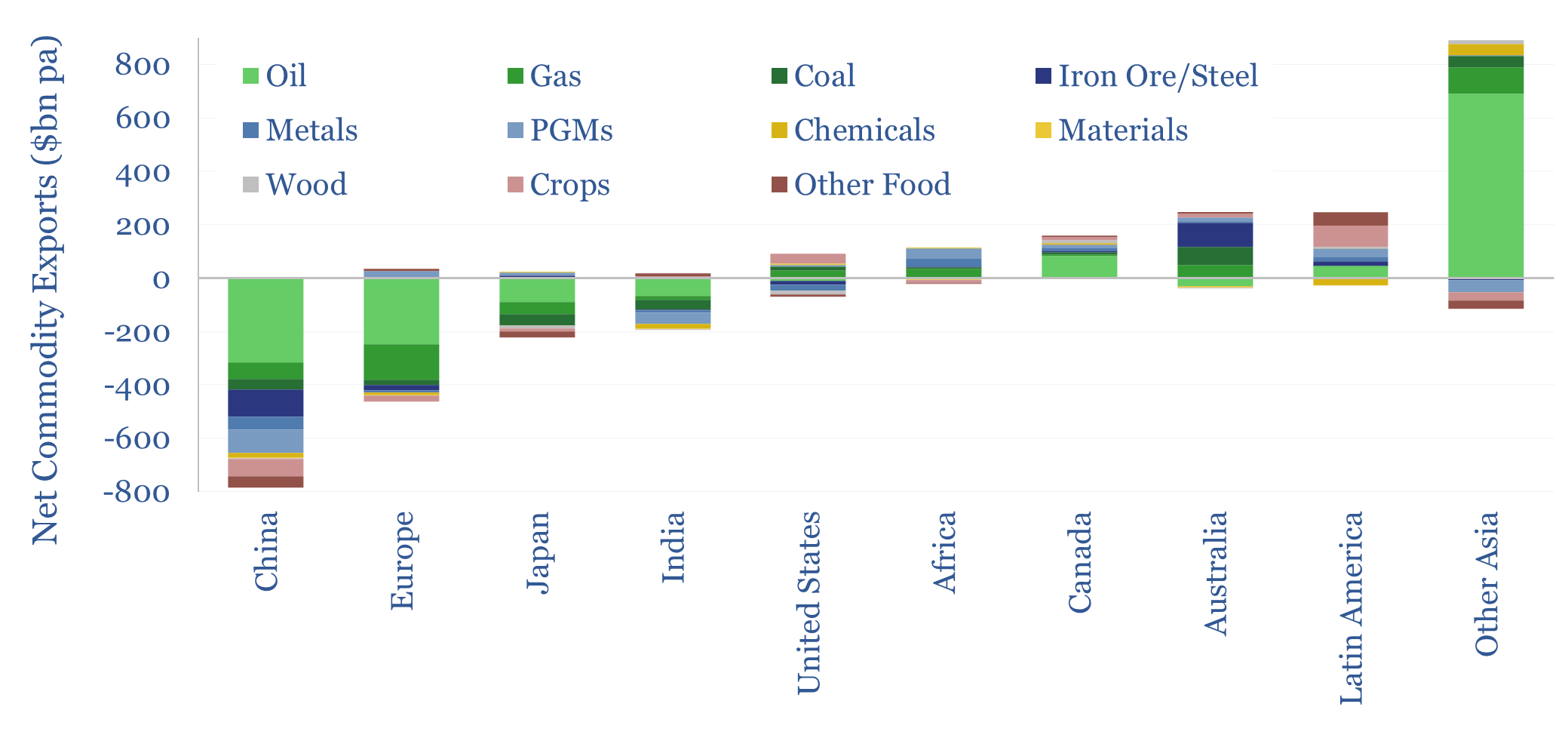

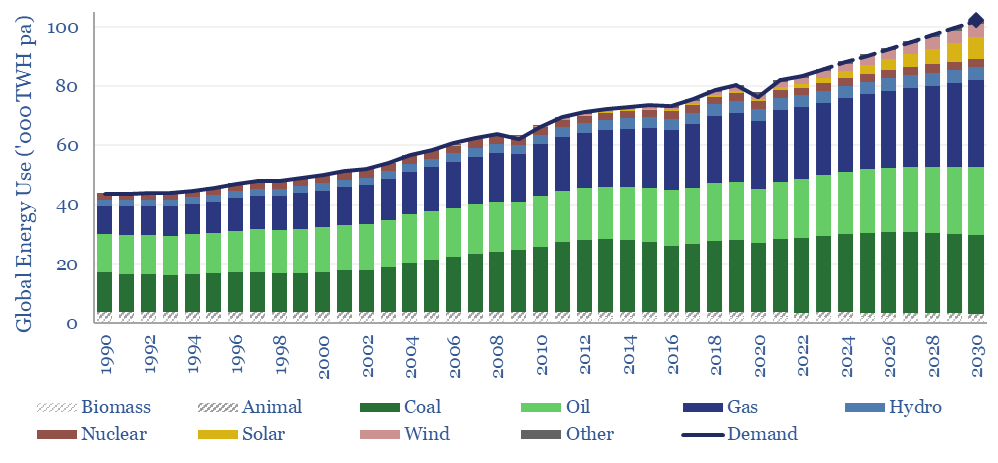

Global energy: supply-demand model?

This global energy supply-demand model combines our supply outlooks for coal, oil, gas, LNG, wind and solar, nuclear and hydro, into a build-up of useful global energy balances in 2023-30. Energy markets can be well-supplied from 2025-30, barring and disruptions, but only because emerging industrial superpowers will continuing using high-carbon coal.

-

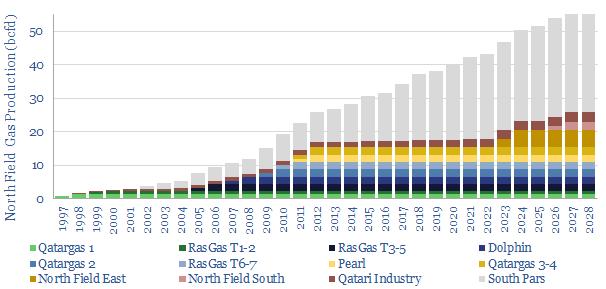

Qatar’s North Field: production and productivity?

We have aggregated production data from the largest gas fied in the world: Qatar’s North Field, aka Iran’s South Pars field, with 1,260 TCF reserves. Output is running at 43bcfd in 2022, more than doubling in the past decade, which is possibly impacting future well productivity.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)