Search results for: “climate model”

-

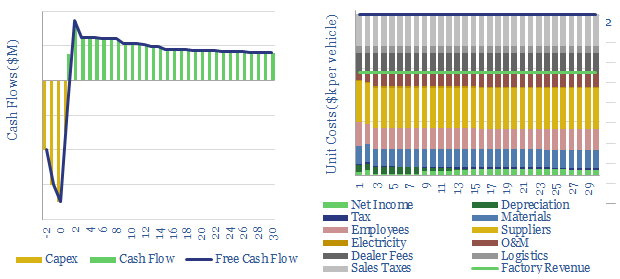

Auto manufacturing: the economics?

This is a simple model, to break down the $30k sales price of a typical mass-market automobile. c25% accrues to suppliers, c20% is sales taxes, c20% is dealer costs/logistics, c10% employees, c10% material inputs, c10% O&M, 1% electricity and c5% auto-maker margins. Prices may inflate 60% amidst industrial shortages.

-

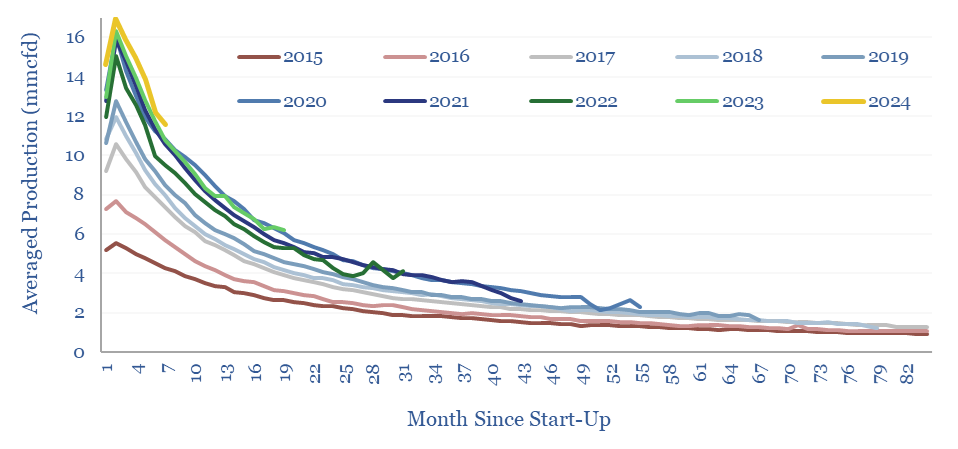

Marcellus shale: well by well production database?

This large data-file tracks activity, well-by-well, across c11,000 wells in the Pennsylvania Marcellus, month-by-month, from 2015-2021. First tier operators stand out, especially as the basin has consolidated. They achieve higher IP rates and have been able to do more with less.

-

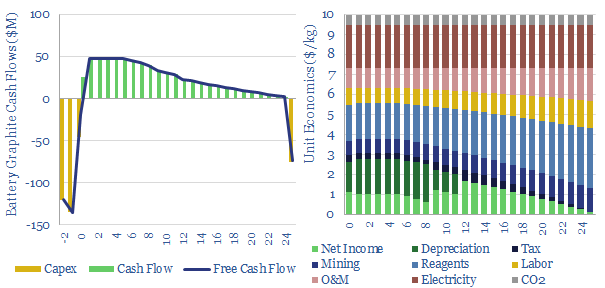

Graphite production: the economics?

This data-file captures simplified costs for producing battery-grade graphite (i.e., 99.9% pure, coated, spheronized graphite) in an integrated facility, from mine to packaged output. Our marginal cost is estimated at around $10,000/ton for a 10% IRR. CO2 intensity varies but averages 10kg/kg.

-

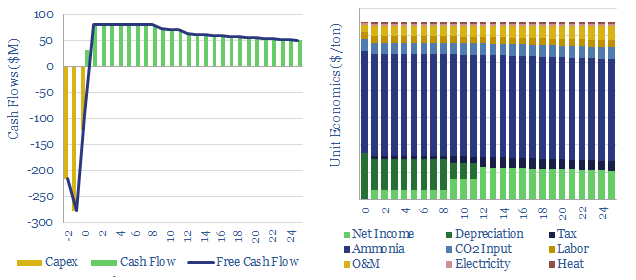

Urea production: the economics

This data-file captures the economics of producing urea, an important fertilizer and intermediate material. We estimate a marginal cost of $325/ton, based on $2/mcf-e energy inputs. CO2 intensity is 1.5 tons/ton. But costs will increase well above $800/ton during times of energy shortages.

-

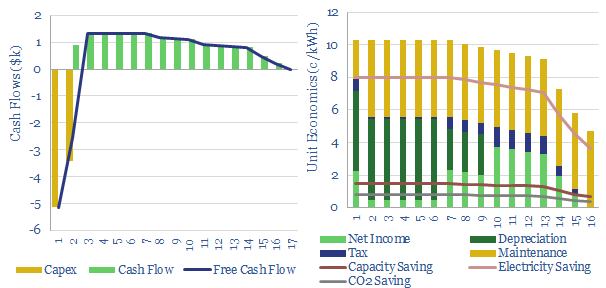

Capacitor banks: the economics?

This model captures the economics of power factor correction via installing capacitor banks upstream of inductive loads. A 10% IRR is derived from a system costing $30/kVAR, reducing real power losses by 0.5%, thus saving on 8c/kWh electricity prices (75% of savings), $3.5/kW demand charges (15%) and a $20/ton CO2 price (10%).

-

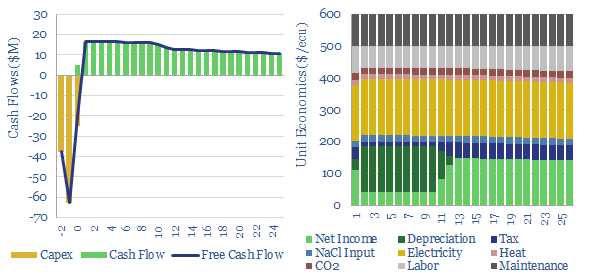

Chlor-alkali process: the economics?

This data-file captures chlor-alkali process economics, to produce 80MTpa of chlorine and 90MTpa of caustic soda. Our base case requires $600 per ecu for a 10% IRR and a growth project costing $600/Tpa. Electricity is 45% of cash cost. CO2 intensity is 0.5 tons/ton. Interestingly, chlor-alkali plants can demand shift.

-

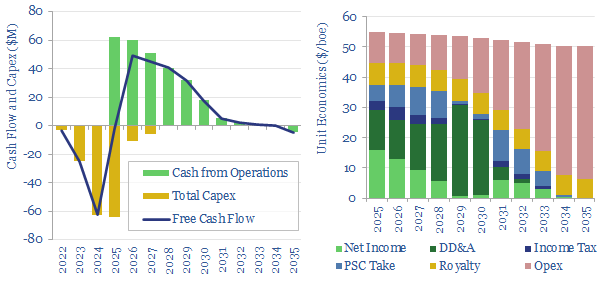

Offshore oil: marginal cost?

What is the marginal cost of offshore oil and gas? This data-file captures a small project, off Africa, with $15/boe development cost, $15/boe opex, 70% fiscal take. Break-even is at $35-45/bbl. But a $90/bbl forward curve may be needed for definitive go-ahead.

-

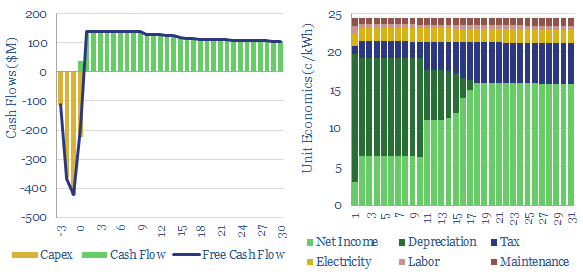

Pumped hydro: the economics?

This data-file assesses pumped hydro costs, to back up wind and solar. A typical project has 0.5GW of capacity, 12-hours storage duration, 80% efficiency, and capex costs of $2,250/kW. Thus it requires a 25c/kWh storage spread, in order to generate a 10% IRR.

-

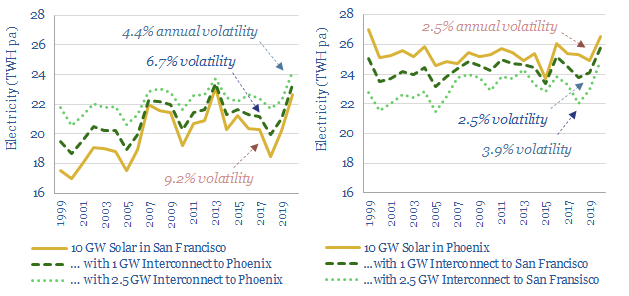

Power transmission: inter-connectors smooth solar volatility?

Can large-scale power transmission smooth renewables’ volatility? To answer this question, this horrible 18MB data-file aggregates 20-years of hour-by-hour solar insolation arriving at four cities in the US. The volatility in year-by-year can be halved by a single inter-connector.

-

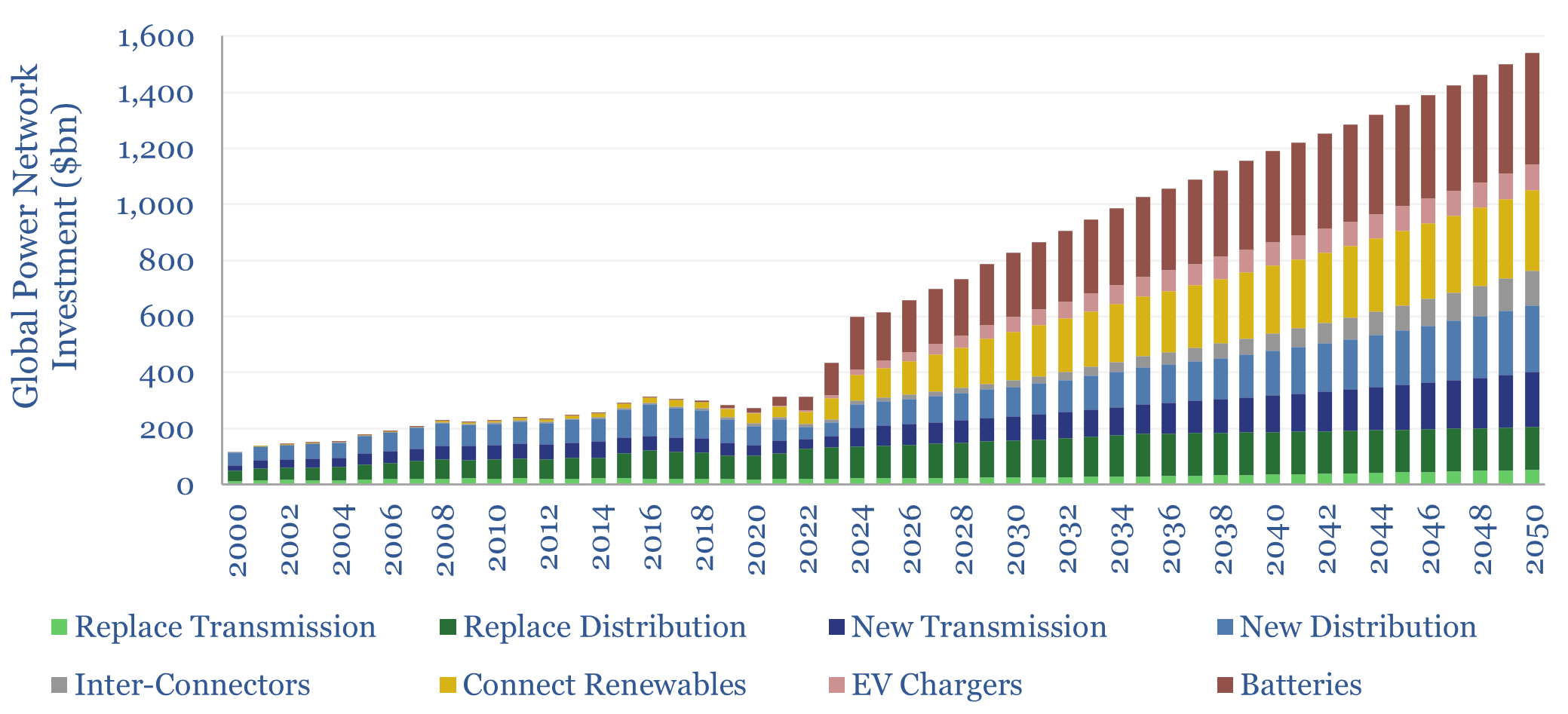

Power grids: global investment?

Global investment into power networks averaged $280bn per annum in 2015-20, of which two-thirds was for distribution and one-third was for transmission. Amazingly, these numbers step up to $600bn in 2030, >$1trn in the 2040s and can be as large as all primary energy investment.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)