Search results for: “electronic electronics”

-

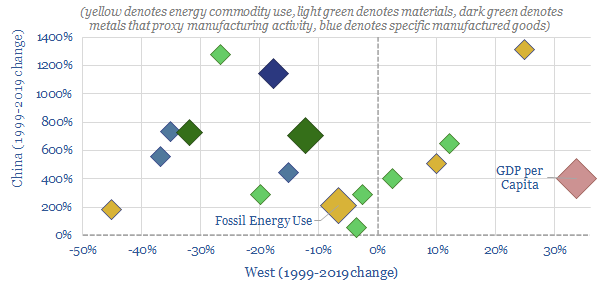

Carbon leakage: China versus the West, 1999-2019

The purpose of this data-file is to assess how ‘industrial activity’ has changed, in China and in the West (US and Europe), from 1999-2019, as a proxy for ‘carbon leakage’. We find heavier industrial activity is down 12% in the West over this 20-year period, and up 6.5x in China.

-

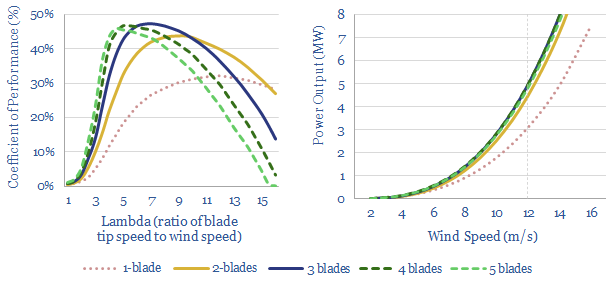

Windy physics: how is power of a wind turbine calculated?

This data-file is an overview of wind power physics. Specifically, how is the power of a wind turbine calculated, in MW, as a function of wind speed, blade length, blade number, rotational speed (in RPM) and other efficiency factors (lambda). A large, modern offshore wind turbine will have 100m blades and surpass 10MW power outputs.

-

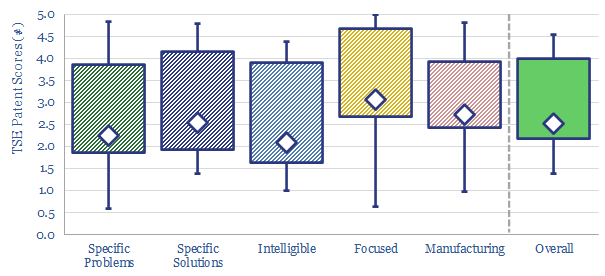

TSE Patent Assessments: a summary?

This data-file aggregates all of our patent assessments into a single reference file, so different companies’ scores can be compared and contrasted. Our average score is 3.5 out of 5.0. Skew is to the downside. Intelligibility is the biggest challenge. Scores correlate with TRL and revenues.

-

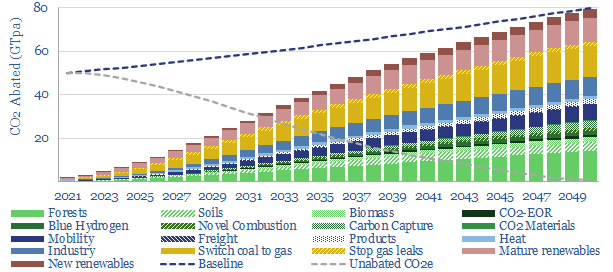

Decarbonizing global energy: the route to net zero?

This 18-page report revises our roadmap for the world to reach ‘net zero’ by 2050. The average cost is still $40/ton of CO2, with an upper bound of $120/ton, but this masks material mix-shifts. New opportunities are largest in efficiency gains, under-supplied commodities, power-electronics, conventional CCUS and nature-based CO2 removals.

-

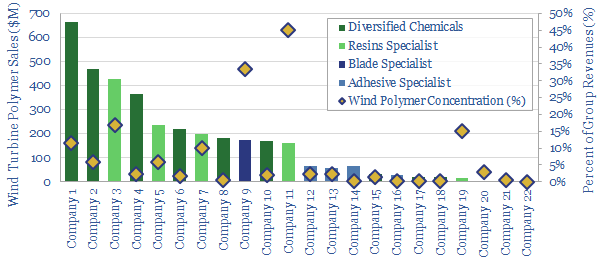

Wind turbines: screen of resin and polymer specialists?

This data-file tabulates details for 20 companies that make epoxy- or polyurethane resins and adhesives, especially those that feed into the construction of wind turbines. We think there are 5 public companies ex-China with 5-35% exposure to this sub-segment of the wind industry.

-

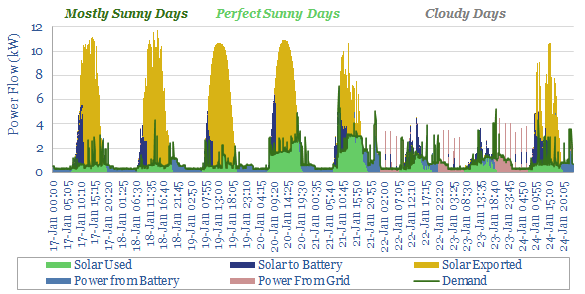

Residential solar plus batteries: granular data from Australia?

This data-file contains actual power flows, kindly shared by a client of Thunder Said Energy, who is based in sunny Australia, with 13.5kW of residential solar panels and the 13.5kWh Tesla Powerwall system as a back-up. The system meets an impressive 92% of year-round power needs.

-

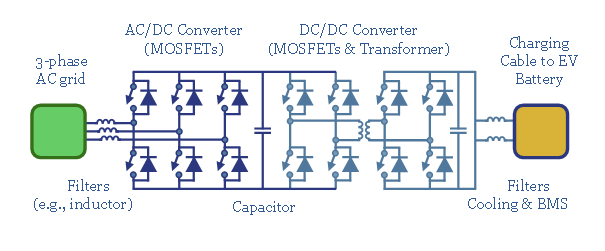

EV fast charging: opening the electric floodgates?

This 14-page note explains the crucial power-electronics in an electric vehicle fast-charging station, running at 150-350kW. Most important are power-MOSFETs, comprising c5-10% of charger costs. The market trebles by the late 2020s.

-

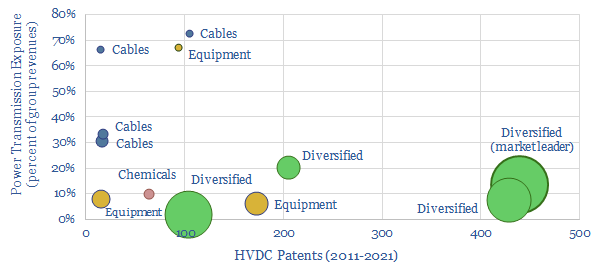

HVDC transmission: leading companies?

The global HVDC market is $10bn pa, and it might typically cost c€100-600 M to connect a large and remote renewables project to the grid or run a small HVDC inter-connector. This data-file reviews the market leaders in HVDC, based on 5,500 patents. A dozen companies stand out, with c$40bn of combined revenues from power…

-

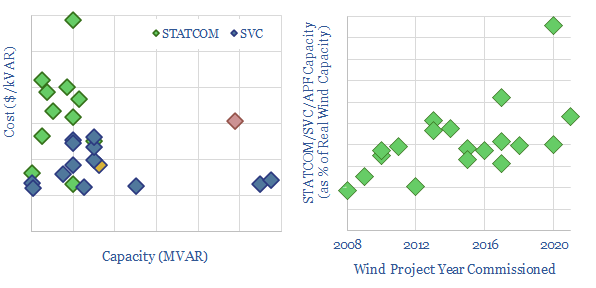

FACTS: costs of STATCOMs and SVCs?

Flexible Alternating Current Transmission System components (FACTS) include Static Synchronous Compensators (STATCOMs) and Static VAR Compensators (SVCs). A typical wind project has 0.5 – 1.0 kVAR of FACTS per 1.0 kW of real power capacity. Each kVAR of SVCs and STATCOMs costs $100/kVAR and $150/kVAR respectively.

-

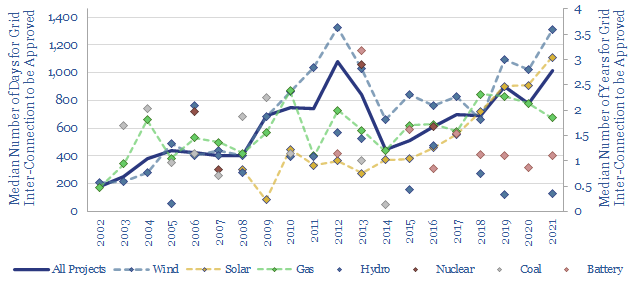

Renewables: how much time to connect to the grid?

Is the power grid becoming a bottleneck for the continued acceleration of renewables? The median approval time to tie a new US power project into the grid has climbed by 30-days/year since 2001, and doubled since 2015, to over 1,000 days (almost 3-years) in 2021. Wind and solar projects are now taking longest. This data-file…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)