Search results for: “gas”

-

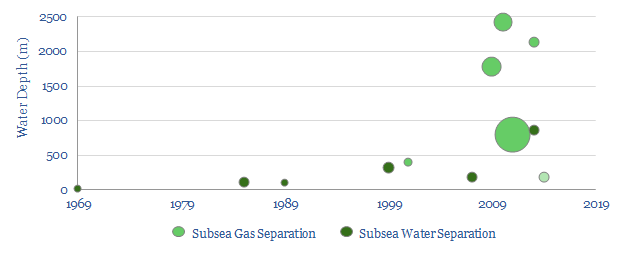

Subsea Separation: the elusive history

This database covers all 14 subsea separation projects across the history of the oil industry, going back to the “dawn of subsea” in 1969. The technology has been elusive, with just a handful of applications, the largest of which is 2.3MW. This could change, with the pre-salt partners pioneering an unprecedented 6MW facility at Mero.

-

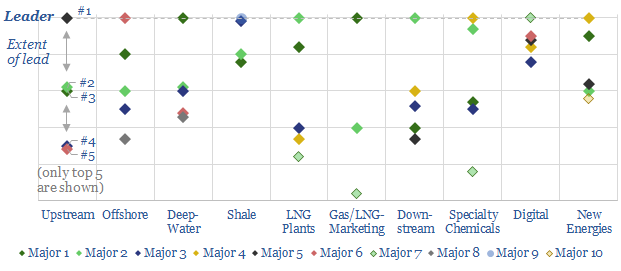

Patent Leaders in Energy

Technology leadership is crucial in energy. But it is difficult to discern. Hence, we reviewed 3,000 patents across the 25 largest companies. This note ranks the industry’s “Top 10 technology-leaders”: in upstream, offshore, deep-water, shale, LNG, gas-marketing, downstream, chemicals, digital and renewables. In each case, we profile the leading company, its edge and the proximity…

-

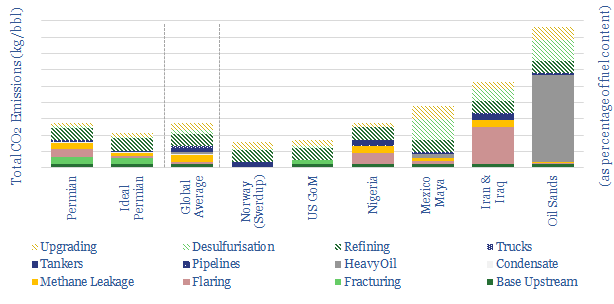

Oil industry CO2 per barrel?

We have constructed a simple model to estimate full-cycle CO2 emissions of an oil resource, as a function of its flaring, methane leakage, gravity, sulphur content, production processes and transportation to market. A c10x energy return on energy investment is estimated. Relative advantages are seen for well-managed resources offshore and in shale; relative disadvantages are…

-

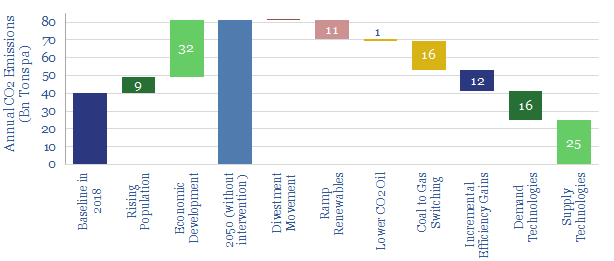

Investing for an Energy Transition

What is the best way for investors to drive decarbonisation? We argue a new ‘venturing’ model is needed, to incubate better technologies. CO2 budgets can also be stretched furthest by re-allocating to gas, lower-carbon oil and lower-carbon industry. But divestment is a grave mistake.

-

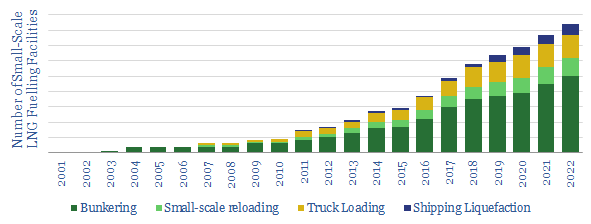

The Ascent of Small Scale LNG?

Large LNG projects make large headlines. But we are excited by the ascent of small-scale LNG facilities. At less than 1MTpa each, these facilities can be harder to track, which is the objective of this data-file. We find small LNG liquefaction capacity is set to double, to 25MTpa. Liquefaction facilities for shipping will rise 8x…

-

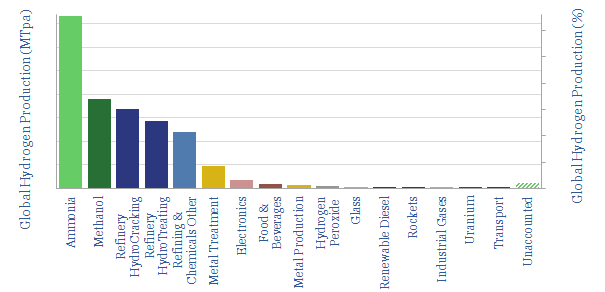

Global hydrogen: market breakdown?

This data-file is a global hydrogen market breakdown, disaggregating the 110MTpa market (mainly ammonia, methanol and refining), how it is met via different production technologies, and our estimates of those technologies’ costs (in $/kg) and CO2 intensities (in kg/kg or tons/ton).

-

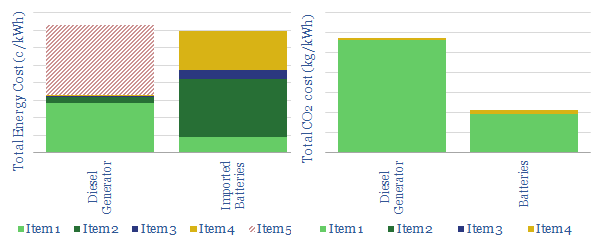

Shipping in batteries: the economics?

What if it were possible to displace diesel from high-cost, high-carbon island grids, by charging up large batteries with gas- and renewable power, then shipping the batteries? We model the economics to be cost-competitive, while CO2 emissions can be halved. Futher battery cost deflation will also help.

-

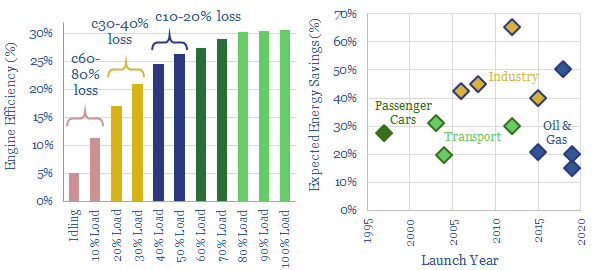

Hybrid horizons: industrial use of batteries?

Gas and diesel engines can be 30-80% less efficient when idling, or running at low loads. This is the rationale for hybridizing engines with backup batteries. Industrial applications are increasing, achieving 30-65% efficiency gains, across multiple industries. In 2018-19, the biggest new horizon has been in oil and gas, including hybrid rigs, supply vessels, construction…

-

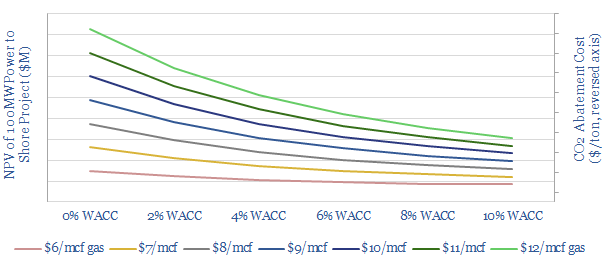

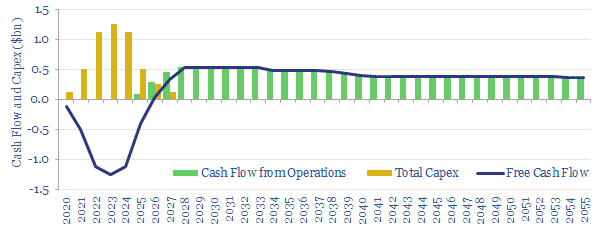

Power from Shore: the economics?

We model the economics of powering an oil platform from shore, using cheap renewable power instead of traditional gas turbines. This can lower upstream CO2 emissions by by around 70%, saving 5-15kg/bbl, for a cost of $50-100/ton. NPVs can be positive with low WACCs and high gas prices, but the primary aim is low-cost decarbonisation.

-

LNG liquefaction: the economics?

This model captures the economics for a typical LNG liquefaction project, breaking down IRRs and NPVs as a function of key input-variables. In our base case, a new LNG project costing $750/Tpa must charge a $3.6/mcf liquefaction spred for a 10% IRR.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (131)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (356)