Search results for: “renewables”

-

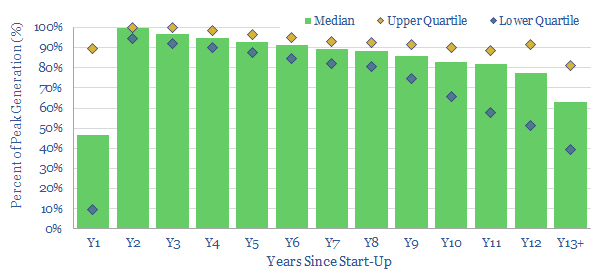

Solar power: decline rates?

This data-file tabulates the ‘decline rates’ of 3,200 US solar power plants going back to 2001. The median YoY decline is found to run at 2.5%. However, the data are volatile and variable. Hence this data-file gives full granularity, asset by asset. Decline rates could detract c4pp from the IRRs of future solar projects and…

-

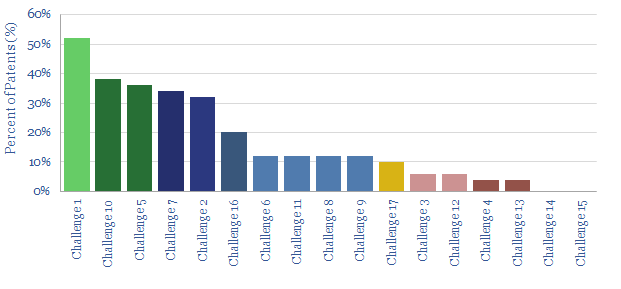

Floating offshore wind: what challenges?

This data-file ranks the greatest challenges for the floating offshore wind industry, by reviewing 50 recent patents, filed by leading companies. The challenges are relatively immutable. They likely double capex and levelized costs, compared with traditional offshore wind.

-

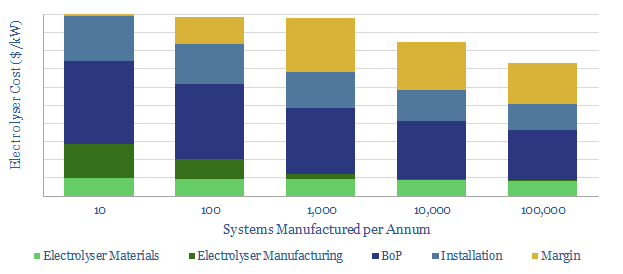

Electrolysers: how much deflation ahead for hydrogen?

For green hydrogen to become competitive, total electrolyser costs must deflate by over 75% from current levels around $1,000/kW. This 14-page note breaks down the numbers and the challenges, based on patents and technical papers. We argue 15-25% total cost deflation may be more realistic if manufacturers also strive to make a margin.

-

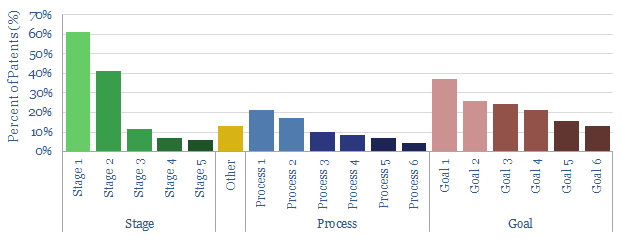

Solar power: what challenges?

This data-file reviews 70 patents filed by leading solar manufacturers in 2020. We expect double-digit deflation to continue, while solar panels will also gain greater efficiency and longevity. The cutting edge is now in current collectors. Examples and improvements areas are described for each company.

-

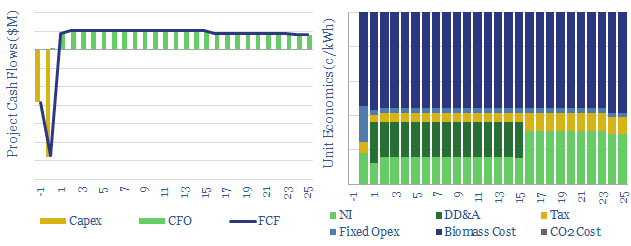

Biomass power: costs, levelized costs and BECCS?

This data-file captures the economics of producing wood pellets, generating electricity from biomass, and potentially also building a further CCS facility to yield ‘carbon negative power’ (which is nevertheless more CO2 intensive than burning gas!). Our numbers are backstopped by industry data, including 340 US biomass plants.

-

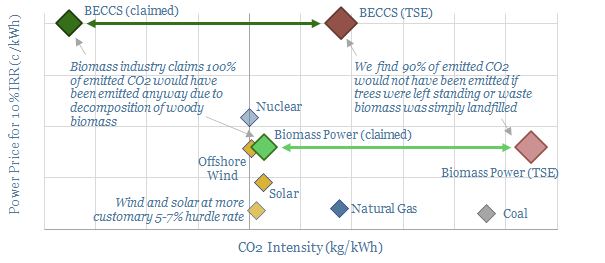

Biomass and BECCS: what future in the transition?

20% of Europe’s renewable electricity currently comes from biomass, mainly wood pellets, burned in facilities such as Drax’s, 2.6GW Yorkshire plant. But what are the economics and prospects for biomass power as the energy transition evolves? This 18-page analysis leaves us cautious.

-

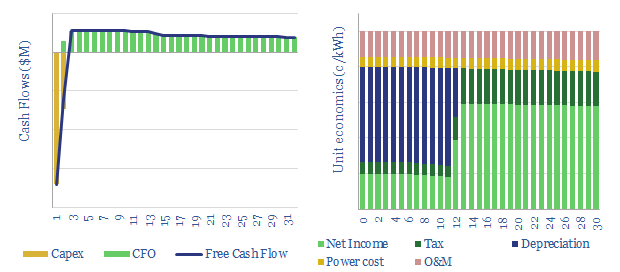

Geothermal energy: costs and economics?

Geothermal energy costs are modelled from first principles in this data-file. LCOEs of 6c/kWh are available in geothermal hotspots. Outside of the hotspots, enhanced geothermal heat can cost 2-14c/kWh-th for a 10% IRR on $500-5,000/kW-th capex, while a rule of thumb is that geothermal electricity costs 5x geothermal heat.

-

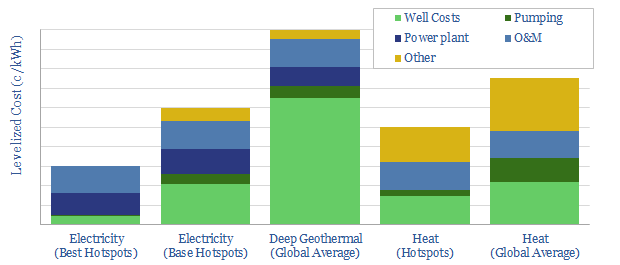

Geothermal energy: what future in the transition?

Drilling wells and lifting fluids to the surface are core skills in oil and gas. Hence could geothermal be a natural fit in the energy transition? Next-generation geothermal economics can be very competitive, both for power and heat. Pilot projects are accelerating. This 17-page note presents the opportunity.

-

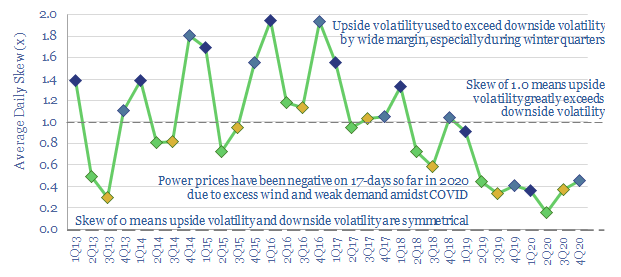

Prevailing wind: new opportunities in grid volatility?

UK wind power has almost trebled since 2016. But its output is volatile, now varying between 0-50% of the total grid. Hence this 14-page note assesses the volatility, using granular, hour-by-hour data from 2020, to outline which backup opportunities are best-placed.

-

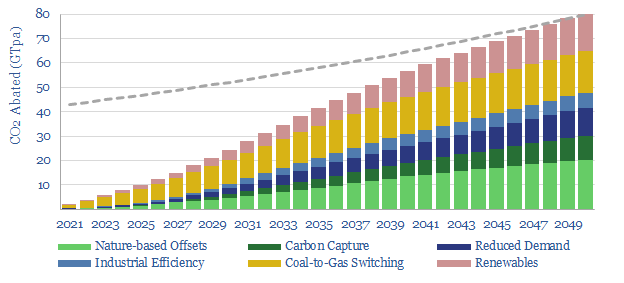

Decarbonizing global energy: the route to net zero?

The global energy system can be fully decarbonized by 2050, for an average CO2 cost of $42/ton. Remarkably, this is almost half the cost foreseen one year ago. 85Mbpd of oil and 375TCF pa of gas are still required in this 2050 energy system, together with efficiency technologies, carbon capture and offsets.

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (831)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (351)