Search results for: “renewables”

-

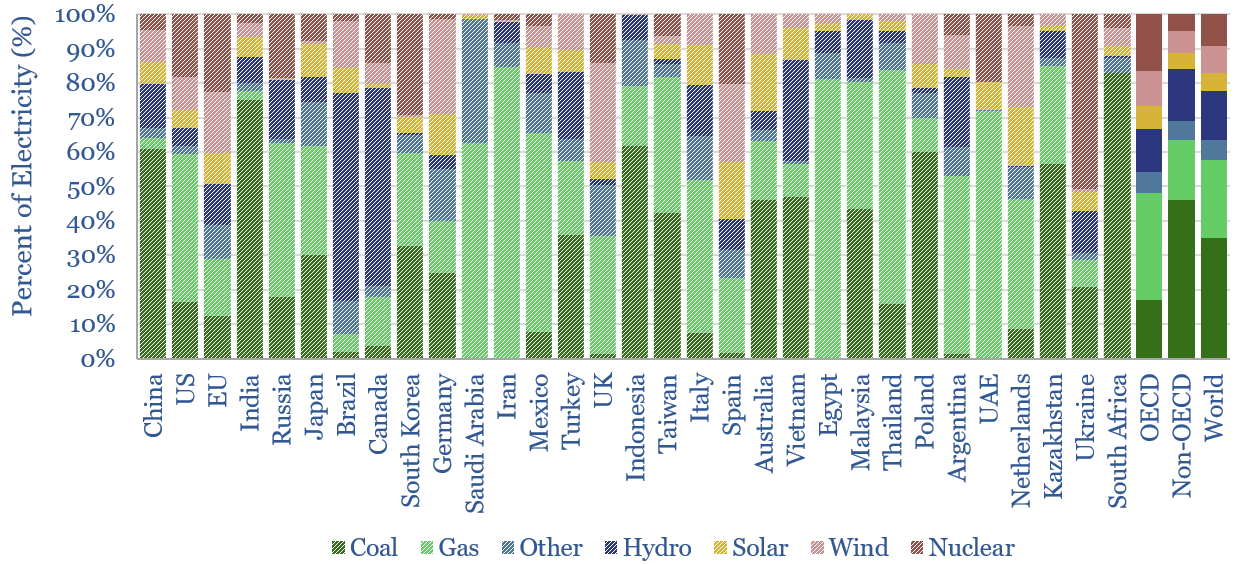

Renewables: share of global energy and electricity by country?

This data-file is an Excel “visualizer” for some of the key headline metrics in global energy: such as total global energy use, electricity generation by source and growing renewables penetration; broken down country-by-country, and showing how these metrics have changed over time.

-

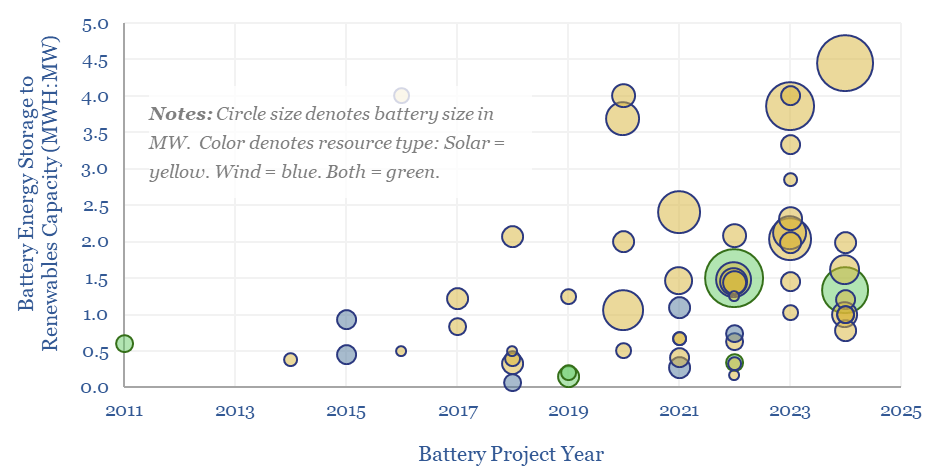

Renewables plus batteries: co-deployments over time?

More and more renewables plus batteries projects are being developed as grids face bottlenecks? On average, projects in 2022-24 supplemented each MW of renewables capacity with 0.5MW of battery capacity, which in turn offered 3.5 hours of energy storage per MW of battery capacity, for 1.7 MWH of energy storage per MW of renewables.

-

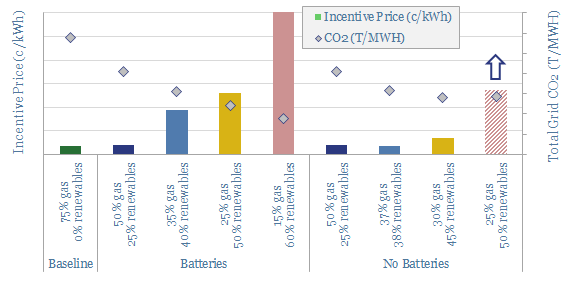

Scaling Up Renewables and Batteries

Renewables would cap out at 40-50% of inflexible electricity grids, based on Monte Carlo analysis of wind, solar and batteries. Beyond 50%, new renewables’ curtailment rates surpass 70%, trebling their marginal cost. Batteries also increase incentive prices by 5-25x. Natural gas and demand-shifting are the best backstops.

-

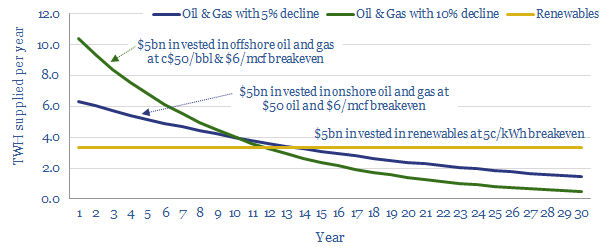

Production profiles: renewables vs oil and gas?

Further deflation of c50-70% is required before the world can truly “re-allocate” capital from fossil fuels to renewables, without causing near-term shortages. This is because fossil fuels’ production profiles are 2-3x more front-end loaded; despite comparable costs, breakevens and resource sizes. It is still necessary to attract adequate capital for both supply sources.

-

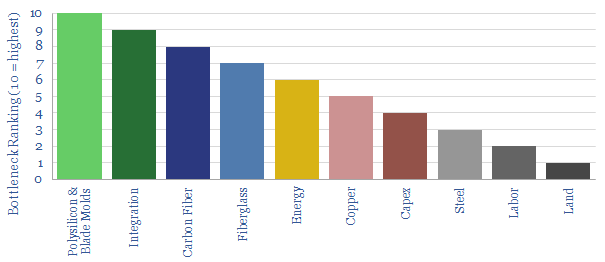

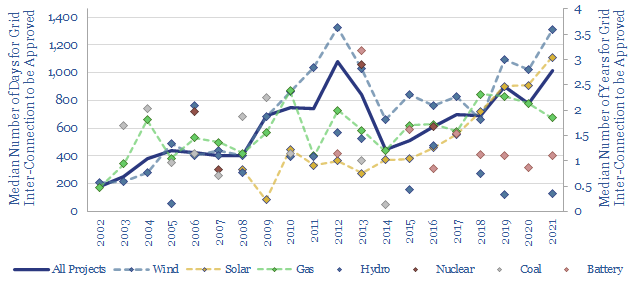

Renewables: how much time to connect to the grid?

Is the power grid becoming a bottleneck for the continued acceleration of renewables? The median approval time to tie a new US power project into the grid has climbed by 30-days/year since 2001, and doubled since 2015, to over 1,000 days (almost 3-years) in 2021. Wind and solar projects are now taking longest. This data-file…

-

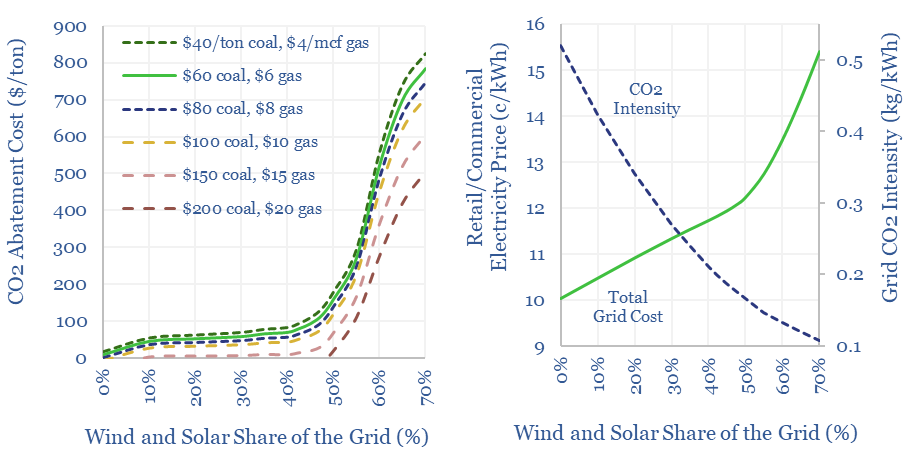

Wind and solar: what CO2 abatement costs of renewables?

The costs of decarbonizing by ramping up solar and wind are highly dependent on context. The purpose of this data-file is to enable stress-testing of the CO2 abatement costs of renewables, in different contexts and at different grid penetrations. Our own estimate is that solar and wind can reach 40% of the global grid for…

-

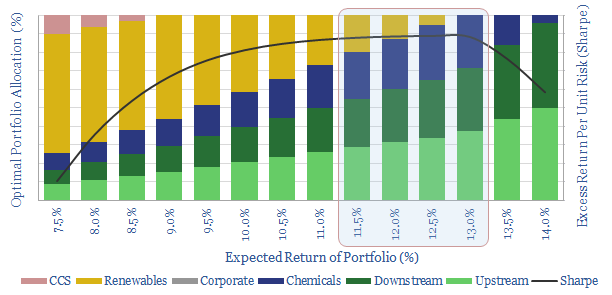

Ramping Renewables: Portfolio Perspectives?

It is often said that Oil Majors should transition to renewables and become Energy Majors. But what is the best balance based on modern portfolio theory? Our 7-page paper answers this question by constructing a mean-variance optimisation model. We find a c0-20% weighting to renewables can maximise risk-adjusted returns. 5-13% is ideal. But beyond a…

-

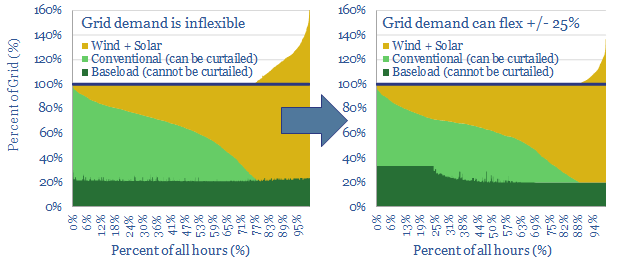

Shifting demand: can renewables reach 50% of grids?

25% of the power grid could realistically become ‘flexible’, shifting its demand across days, even weeks. This is the lowest cost and most thermodynamically efficient route to fit more wind and solar into power grids. We are upgrading our renewables ceilings from 40% to 50%. This 22-page note outlines the opportunity.

-

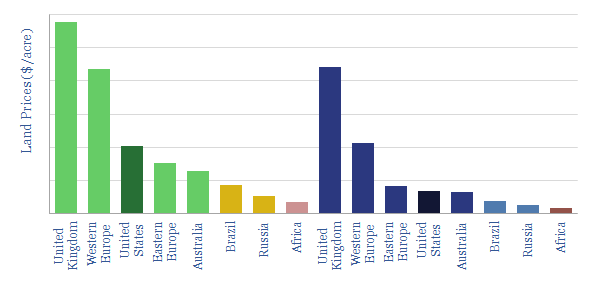

Land prices: an overview for renewables and reforestation?

The purpose of this data-file is to estimate the cost of land, which matters for renewables and reforestation projects, but also amidst rising inflation. Prices can be opaque and variable. For example, arable land in Europe ranges 100x from $700 to $70,000 per acre. Nevertheless, the data-file shows vast quantities of low cost land available…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)