-

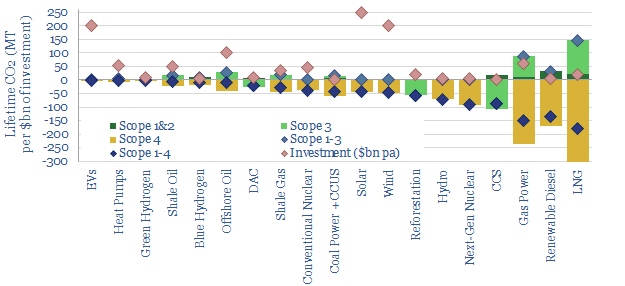

Scope 4 emissions: avoided CO2 has value?

Scope 4 CO2 emissions reflect the CO2 avoided by an activity. This 11-page note argues the metric warrants more attention. It yields an ‘all of the above’ approach to energy transition, shows where each investment dollar achieves most decarbonization and maximizes the impact of renewables.

-

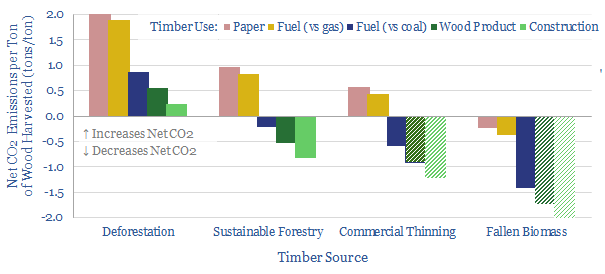

Wood use: what CO2 credentials?

The carbon credentials of wood are not black-and-white. They depend on context. So this 13-page note draws out the numbers and five key conclusions. They highlight climate negatives for deforestation, climate positives for using waste wood and wood materials (with some debate around paper), and very strong climate positives for natural gas.

-

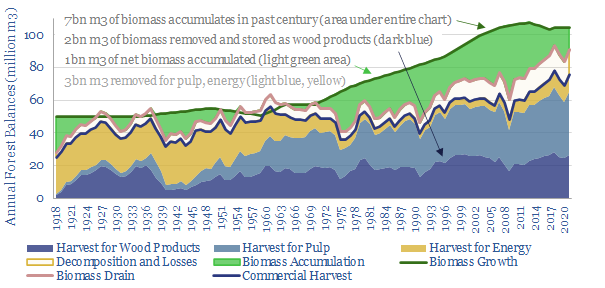

Finnish forests: a two billion ton CO2 case-study?

Can forests absorb CO2 at multi-GTpa scale? This 19-page note is a case study from Finland, where detailed data goes back a century. 70% of the country is forest. It is managed sustainably, equitably, economically. And forests have sequestered 2GT of CO2 in the past century, offsetting two-thirds of the country’s fossil emissions.

-

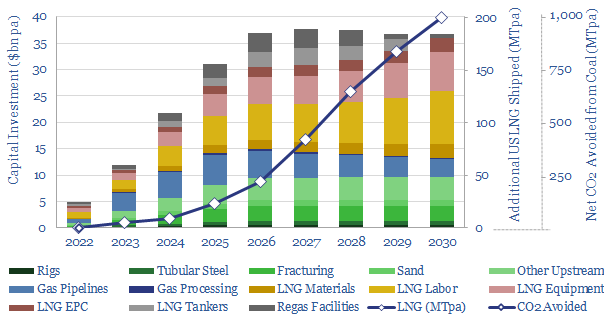

US LNG: new perceptions?

Perceptions in the energy transition are likely to change in 2022, amidst energy shortages, inflation and geopolitical discord. The biggest change will be a re-prioritization of US LNG. At $7.5/mcf, there is 200MTpa of upside by 2030, which could also abate 1GTpa of CO2. This 15 page note outlines our conclusions.

-

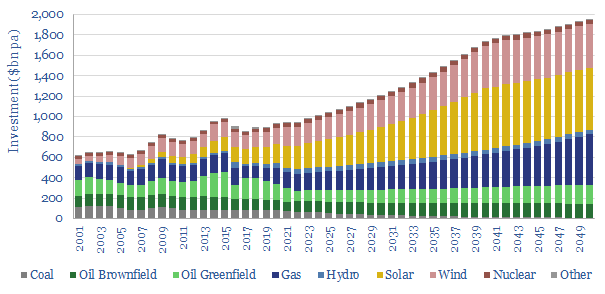

Is the world investing enough in energy?

Global energy investment in 2020-21 has been running 10% below the level needed on our roadmap to net zero. Under-investment is steepest for solar, wind and gas. Under-appreciated is that each $1 dis-invested from fossil fuels must be replaced with $25 in renewables. Future capex needs are vast.

-

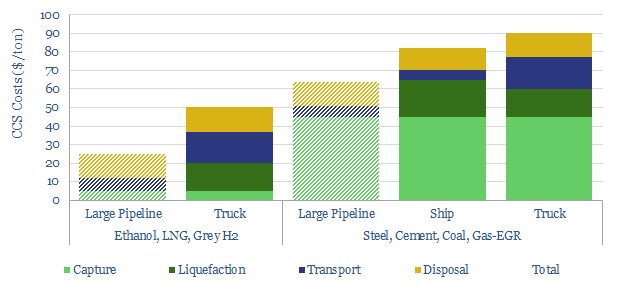

Small-scale CCS: transport liquid CO2?

CO2 has unusual physical properties, which make small-scale liquefaction and transport much more viable than we had expected. The energy burden is 70% less than other industrial gases. Total CCS costs are $50-90/ton for leading examples. This 15-page note outlines the opportunity.

-

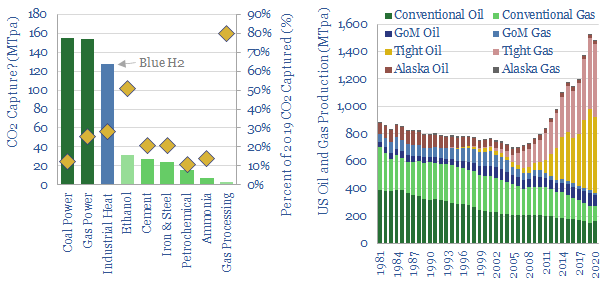

Carbon capture: how big is the opportunity?

This 13-page note quantifies the upside case for CCS in the United States, using top-down and bottom-up calculations. Our conclusion is that a clear, $100/ton incentive could help CCS scale by c25x, accelerating over 500MTpa of projects in the next decade, cutting US CO2 by 10%.

-

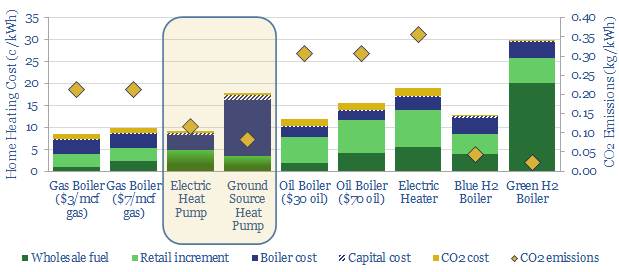

Heat pumps: hot and cold?

Some policymakers now aspire to ban gas boilers and ramp heat pumps 10x by 2050. In theory, the heat pump technology is superior. But in practice, there are ten challenges. It could become a political disaster. The most likely outcome is a 0-2% pullback in European gas by 2030.

-

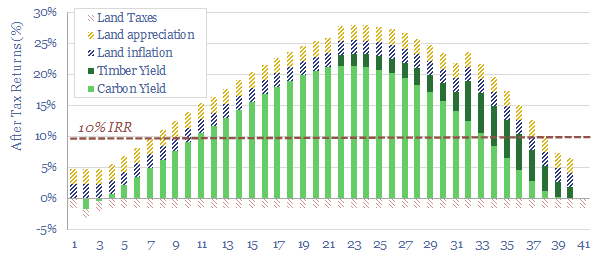

Reforestation: a real-life roadmap?

This 12-page note sets out an early-stage ambition for Thunder Said Energy to reforest former farmland in Estonia, producing high-quality CO2 credits in a biodiverse forest. The primary purpose would be to stress-test nature-based carbon removals in our roadmap to net zero, and understand the bottlenecks.

-

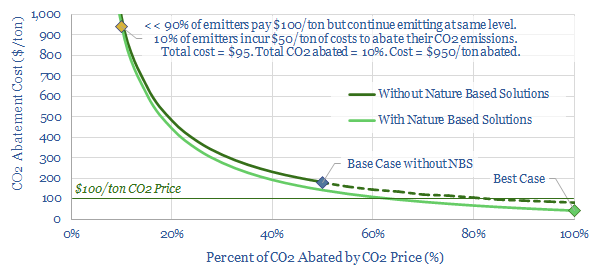

CO2 prices: re-thinking the costs?

CO2 prices and CO2 abatement costs are very different numbers. The CO2 prices are incurred by remaining emitters. But the abatement costs depend on how much CO2 is reduced. These abatement costs can actually be astronomical if CO2 does not fall much. We argue CO2 prices are only effective if nature-based offsets are incorporated.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)