-

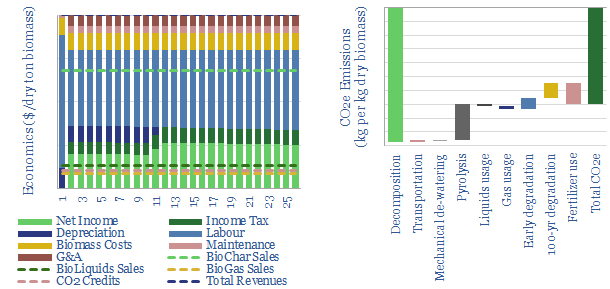

Biochar: burnt offerings?

Biochar is a miraculous material, improving soils, enhancing agricultural yields and avoiding 1.4kg of net CO2 emissions per kg of waste biomass. IRRs surpass 20% without CO2 prices or policy support. Hence this 18-page note outlines the opportunity.

-

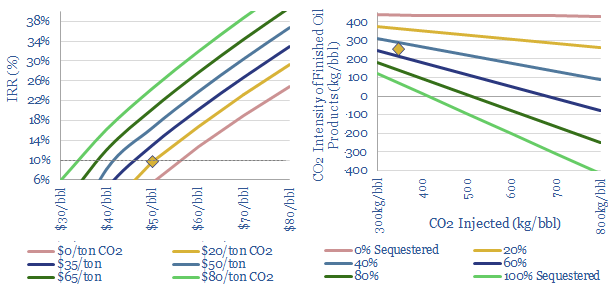

CO2-EOR: well disposed?

CO2-EOR is the most attractive option for large-scale CO2 disposal. Unlike CCS, which costs over $70/ton, additional oil revenues cover the costs of sequestration. And the resultant oil is 50-100% lower carbon than usual. The technology is mature. Potential exceeds 2GTpa. This 23-page report outlines the opportunity.

-

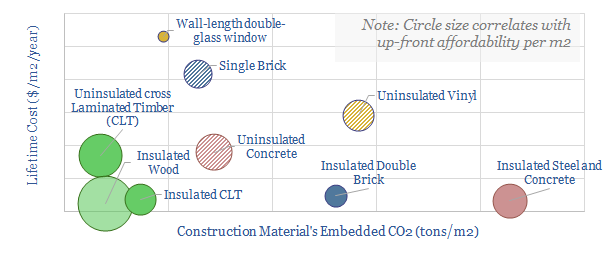

Carbon negative construction: the case for mass timber?

Construction accounts for 10% of global CO2, mainly due to cement and steel. But mass timber could become a dominant new material for the 21st century, lowering emissions 15-80% at no incremental cost. Debatably mass timber is carbon negative if combined with sustainable forestry. We outline the opportunity.

-

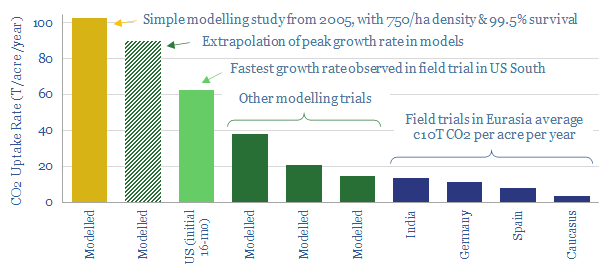

Paulownia tomentosa: the miracle tree?

The ‘Empress Tree’ has been highlighted as a miracle solution to climate change, with potential to absorb 10x more CO2 than other tree species; while its strong, light-weight timber is prized as the “aluminium of woods”. This note investigates the potential. There is clear room to optimise nature based solutions. But there may be downside…

-

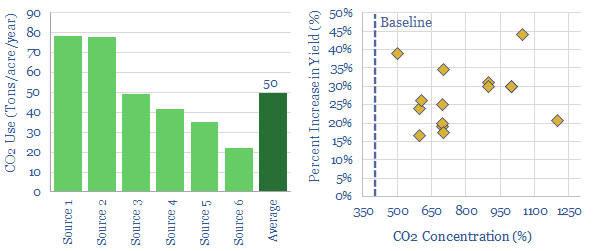

Greenhouse gas: use CO2 in agriculture?

Enhancing CO2 in greenhouses can improve yields by c30%. It costs $4-60/ton to supply this CO2, while $100-500/ton of value is unlocked. The challenge is scale, limited to 50MTpa globally. Around 50Tpa of CO2 is supplied to each acre of greenhouses. But only c10% is sequestered.

-

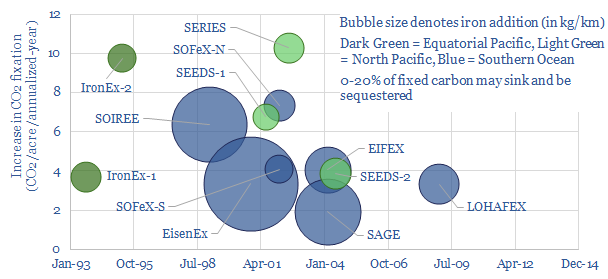

Carbon offsets: ocean iron fertilization?

Nature based solutions to climate change could extend beyond the world’s land (37bn acres) and into the world’s oceans (85 bn acres). This short article explores one option, ocean iron fertilization, based on technical papers. While the best studies indicate a vast opportunity, uncertainty remains high: on CO2 absorption, sequestration, scale, cost and side-effects. Unhelpfully,…

-

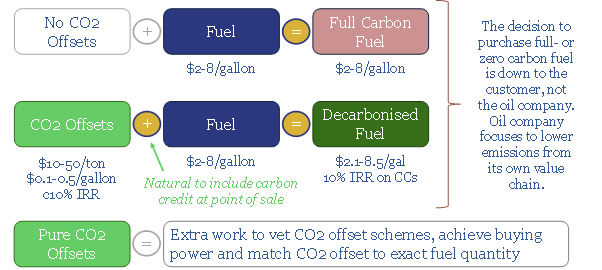

Can carbon-neutral fuels re-shape the oil industry?

Fuel retailers have a game-changing opportunity seeding new forests, outlined in our 26-page note. They could offset c15bn tons of CO2 per year at a competitive cost, well below c$50/ton. We 15-25% uplifts in the value of fuel retail stations, allaying fears over CO2, and benefitting as road fuel demand surges after COVID.

-

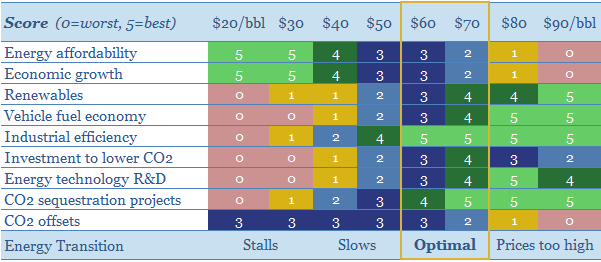

What oil price is best for energy transition?

$30/bbl oil prices stall the energy transition. They kill the relative economics of electric vehicles, renewables, industrial efficiency, flaring reductions, CO2 sequestration and new energy R&D. This 15-page note finds $60/bbl oil is ‘best’ for decarbonization. Policymakers should target $60 oil.

-

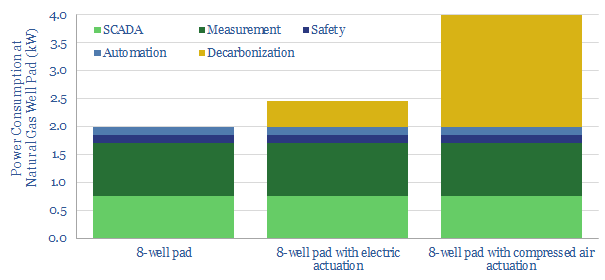

Qnergy: reliable remote power to mitigate methane?

This short note profiles Qnergy, the leading manufacturer of Stirling-design engines, which generate 1-10 kW of power, in remote areas, where a grid connection is not available. The units are particularly economical for mitigating methane emissions, with a potential abatement cost of $20/ton.

-

Ten Themes for Energy in the 2020s

We presented our ‘Top Ten Themes for Energy in the 2020s’ to an audience at Yale SOM, in February-2020. The audio recording is available below. The slides are available to TSE clients.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (90)

- Data Models (816)

- Decarbonization (159)

- Demand (108)

- Digital (56)

- Downstream (44)

- Economic Model (197)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (273)

- LNG (48)

- Materials (79)

- Metals (71)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (345)